Bitcoin is expected to rebound significantly by the end of 2025, according to Michael Saylor, prominent Bitcoin advocate and executive chairman of MicroStrategy. Saylor anticipates that market consolidation, increasing institutional adoption, and macroeconomic factors will contribute to a renewed upward trajectory for the cryptocurrency. Despite interim volatility, he underscores Bitcoin’s long-term potential as a store of value and hedge against inflation. Analysts suggest that growing regulatory clarity, corporate treasury adoption, and broader acceptance in financial markets could further support price appreciation, signaling a pivotal phase for both retail and institutional investors seeking exposure to digital assets.

Saylor’s Market Outlook

Michael Saylor projects a “smart” recovery for Bitcoin, emphasizing that the cryptocurrency is entering a phase of consolidation before resuming an upward trend. According to Saylor, institutional adoption, corporate treasury strategies, and macroeconomic conditions, including inflation hedging and currency diversification, will drive renewed investor confidence. He remains bullish on Bitcoin’s long-term value proposition despite periodic corrections.

Institutional Adoption and Corporate Strategies

Corporate interest in Bitcoin continues to grow, with companies incorporating the digital asset into their treasury reserves. Saylor highlights that such adoption not only legitimizes Bitcoin but also contributes to market stability and liquidity. Institutional investors are increasingly viewing Bitcoin as a strategic asset, enhancing its credibility and potential for substantial appreciation over time.

Macroeconomic Drivers

Factors such as global inflationary pressures, currency devaluation risks, and economic uncertainty are reinforcing Bitcoin’s appeal as a non-correlated asset. Analysts note that these macroeconomic trends, combined with growing regulatory clarity, could catalyze a surge in investor demand, positioning Bitcoin as a complementary tool for portfolio diversification.

Price Trajectory and Market Sentiment

While volatility remains inherent to cryptocurrency markets, Saylor emphasizes that strategic accumulation and long-term holding could yield significant returns. The anticipated recovery aligns with broader industry sentiment suggesting that Bitcoin’s next market cycle could see renewed upward momentum as investor confidence stabilizes.

Implications for Investors

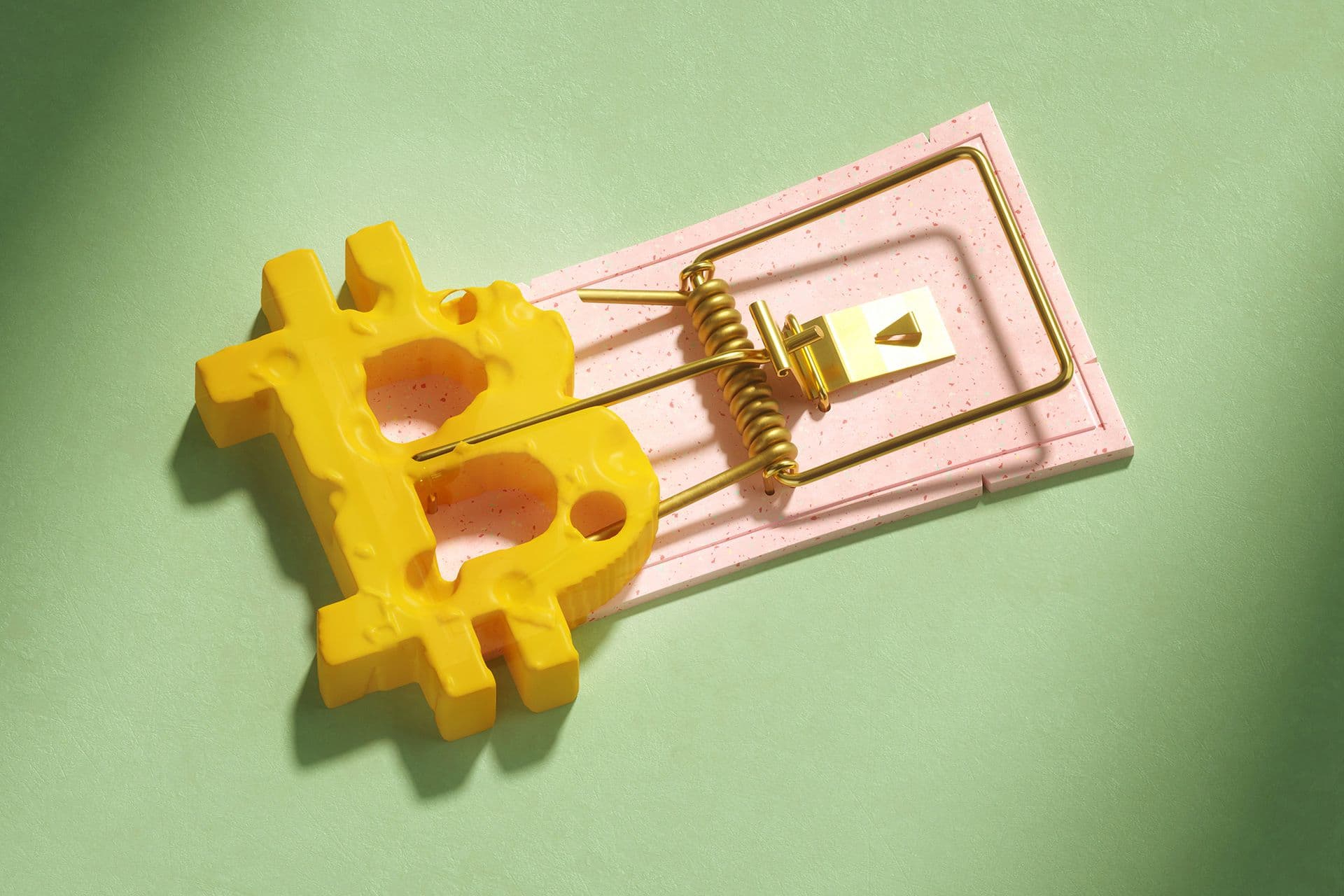

For retail and institutional investors, the outlook suggests an opportunity to consider measured exposure to Bitcoin while managing risk. Diversification, due diligence, and adherence to regulatory compliance are critical components for participation in a market poised for potential growth. Analysts recommend monitoring adoption trends, macroeconomic indicators, and market sentiment to inform investment strategies.

Conclusion

Michael Saylor’s forecast underscores optimism for Bitcoin’s trajectory toward the end of 2025. With institutional adoption, macroeconomic drivers, and growing legitimacy underpinning the market, the cryptocurrency may experience a strong recovery, offering potential opportunities for investors seeking both capital appreciation and a hedge against traditional market risks.