The global cryptocurrency sector is expected to enter a more stable and growth-oriented phase in 2026 as regulatory clarity improves and market infrastructure matures, according to analysts tracking digital asset trends. After years marked by extreme volatility and uneven oversight, the industry appears to be transitioning toward a more disciplined environment shaped by clearer rules,… Continue reading Crypto Markets Eye Maturity in 2026 as Regulation and Stability Take Center Stage

Author: Aaron Ross

Aaron has been with TopNews since 2014. He covers Technology, Business and Stock Markets. He is passionate about Apple products and can be biased in his stories about Apple's new launches.

Can XRP Climb to Rs. 8 by 2026? Examining the Case Behind the Bold Forecast

A recent projection suggesting that XRP could rise to Rs. 8 by 2026 has reignited debate across financial and crypto circles. The forecast, attributed to a major global banking institution, rests on expectations of regulatory clarity, growing institutional adoption, and XRP’s potential role in cross-border payments. While supporters argue that structural shifts in global finance… Continue reading Can XRP Climb to Rs. 8 by 2026? Examining the Case Behind the Bold Forecast

Mirae Asset Moves to Acquire Korbit, Signaling Deeper Institutional Entry Into Crypto Markets

Mirae Asset has unveiled plans to acquire Korbit, a prominent South Korean cryptocurrency exchange, marking a notable step in the convergence of traditional asset management and digital finance. The proposed acquisition reflects a strategic bet on regulated crypto infrastructure as institutions seek durable exposure beyond price speculation. For Mirae Asset, the move broadens its footprint… Continue reading Mirae Asset Moves to Acquire Korbit, Signaling Deeper Institutional Entry Into Crypto Markets

Rajkot Crypto Investment Fraud Allegation Highlights Rising Risks in Informal Digital Asset Deals

A Rajkot-based businessman has approached the police alleging that he was cheated of Rs. 13.71 lakh after being lured by promises of unusually high returns on a cryptocurrency investment. The complaint names three individuals, accusing them of fraud, criminal intimidation, and caste-based abuse. According to the police filing, the transaction involved the purchase of USDT… Continue reading Rajkot Crypto Investment Fraud Allegation Highlights Rising Risks in Informal Digital Asset Deals

XRP’s Long-Term Wealth Potential: Can a Rs.4 Lakh Investment Turn Into Rs.40 Lakh by 2030?

The prospect of turning a modest investment into a tenfold return continues to attract attention in the cryptocurrency market, with XRP once again under the spotlight. Investors are increasingly asking whether an investment of $5,000—approximately Rs.4 lakh—could realistically grow to $50,000, or about Rs.40 lakh, by 2030. The answer depends on a complex mix of… Continue reading XRP’s Long-Term Wealth Potential: Can a Rs.4 Lakh Investment Turn Into Rs.40 Lakh by 2030?

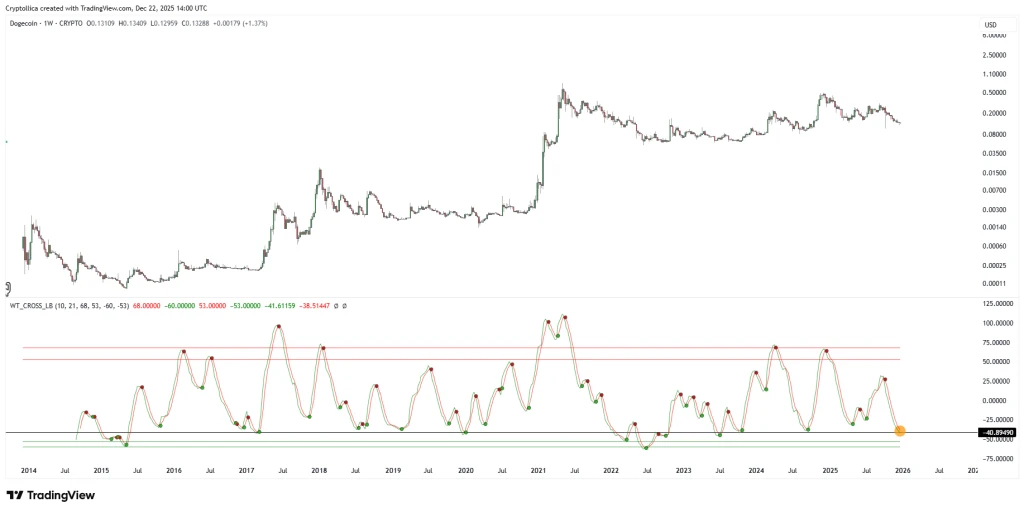

Dogecoin Mirrors 2020 Accumulation Cycle: Analysts Highlight Potential Upside

Dogecoin (DOGE) appears to be echoing its 2020 accumulation cycle, according to leading cryptocurrency analysts. Observing trading patterns, on-chain metrics, and market sentiment, experts suggest that the meme-based cryptocurrency may be entering a phase of strategic accumulation by retail and institutional investors. This phase is characterized by relatively stable price movements, reduced volatility, and growing… Continue reading Dogecoin Mirrors 2020 Accumulation Cycle: Analysts Highlight Potential Upside

Cardano’s Long-Term Price Outlook: Can ADA Realistically Reach $2 Between 2026 and 2030?

Cardano’s native token, ADA, remains a closely watched asset as investors assess its long-term potential amid a maturing cryptocurrency market. With prices well below previous cycle highs, attention is shifting from short-term speculation to realistic projections for the years 2026 through 2030. Analysts suggest that ADA reaching the $2 mark is not impossible, but it… Continue reading Cardano’s Long-Term Price Outlook: Can ADA Realistically Reach $2 Between 2026 and 2030?

Bitcoin Pulls Back 30% From Record High, Prompting Fresh Debate on the Crypto Market’s 2026 Trajectory

Bitcoin has retreated roughly 30 percent from its recent all-time high, triggering renewed scrutiny of the broader cryptocurrency market and its long-term outlook. The pullback, while sharp, mirrors historical correction patterns seen after periods of rapid price appreciation. Market participants are now shifting focus from short-term volatility to structural questions about adoption, regulation, and capital… Continue reading Bitcoin Pulls Back 30% From Record High, Prompting Fresh Debate on the Crypto Market’s 2026 Trajectory

Cardano Founder Warns Big Banks Are Mimicking XRP on a Massive Scale

Charles Hoskinson, founder of Cardano, has highlighted a striking trend in the banking sector: major financial institutions are reportedly adopting strategies reminiscent of XRP, operating at scales far exceeding their original ambitions. Hoskinson’s observations point to a growing convergence between traditional finance and blockchain-driven solutions, particularly in cross-border payments and digital asset infrastructure. While XRP… Continue reading Cardano Founder Warns Big Banks Are Mimicking XRP on a Massive Scale

Dogecoin’s Defining Year: How 2025 Pushed DOGE Into Politics and Commerce

Dogecoin’s evolution in 2025 marked a turning point for the once-joke cryptocurrency as it gained visibility in both political discourse and commercial adoption. What began as a meme-driven digital asset increasingly found relevance in payment systems, brand partnerships, and public debate around digital finance. While price volatility remained a defining feature, Dogecoin’s cultural reach expanded… Continue reading Dogecoin’s Defining Year: How 2025 Pushed DOGE Into Politics and Commerce