Bhutan has taken a significant step into digital finance by launching a sovereign gold-backed token developed on the Solana blockchain. The initiative blends traditional asset security with modern blockchain efficiency, positioning the Himalayan kingdom at the forefront of state-led digital asset innovation. Backed by physical gold reserves, the token is designed to offer price stability,… Continue reading Bhutan Introduces Sovereign Gold-Backed Digital Token Built on Solana Blockchain

Author: Jimmy Peterson

Market Commentator Jim Cramer Adopts Fully Bearish Stance on Bitcoin

Prominent market commentator Jim Cramer has declared a fully bearish outlook on Bitcoin, marking a notable shift in sentiment toward the world’s largest cryptocurrency. His stance reflects growing concerns over regulatory pressure, macroeconomic uncertainty, and declining speculative appetite across digital asset markets. As central banks maintain tight monetary conditions and risk assets face renewed scrutiny,… Continue reading Market Commentator Jim Cramer Adopts Fully Bearish Stance on Bitcoin

Federal Reserve’s Q1 2026 Outlook Could Reshape Bitcoin and Crypto Market Dynamics

The U.S. Federal Reserve’s outlook for the first quarter of 2026 is emerging as a key variable for Bitcoin and the broader cryptocurrency market. Expectations around interest rates, liquidity conditions, and inflation management are influencing investor sentiment across digital assets. With monetary policy likely to remain data-dependent, crypto markets are preparing for a period of… Continue reading Federal Reserve’s Q1 2026 Outlook Could Reshape Bitcoin and Crypto Market Dynamics

Crypto ETF Flows Diverge as Bitcoin and Ether Funds See Rs. 228 Million in Outflows

Investor sentiment across cryptocurrency exchange-traded funds showed a clear split as Bitcoin and Ether ETFs recorded combined net outflows of Rs. 228 million, while XRP-linked funds remained largely stable. The contrasting performance reflects a cautious market environment shaped by macroeconomic uncertainty, profit-taking, and selective risk appetite. While flagship crypto assets faced withdrawal pressure, the relative… Continue reading Crypto ETF Flows Diverge as Bitcoin and Ether Funds See Rs. 228 Million in Outflows

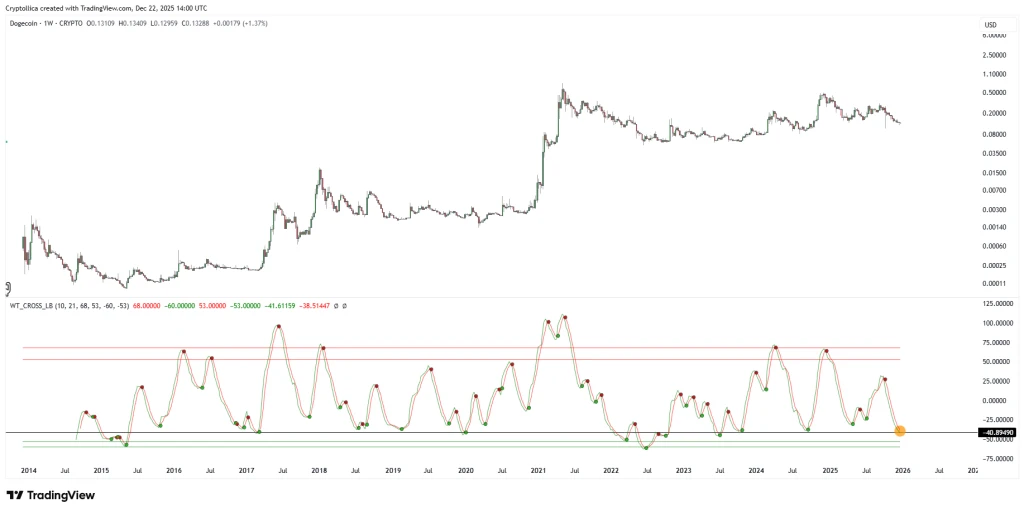

Analysts See Echoes of Dogecoin’s 2020 Accumulation Phase in Current Market Patterns

Dogecoin may be entering a familiar phase, according to market analysts who argue that current price behavior mirrors the accumulation cycle observed in 2020. The pattern is characterized by extended periods of consolidation, subdued volatility, and gradual capital buildup ahead of potential momentum shifts. While no outcome is guaranteed, the comparison has renewed debate around… Continue reading Analysts See Echoes of Dogecoin’s 2020 Accumulation Phase in Current Market Patterns

Trump Media Moves $174 Million in Bitcoin Across Multiple Wallets

Trump Media has reportedly transferred approximately $174 million in Bitcoin across multiple cryptocurrency wallets, signaling strategic portfolio adjustments or security-oriented diversification. Analysts note that such large-scale movements can reflect risk management practices, liquidity planning, or preparation for corporate initiatives involving digital assets. The transfers also underscore the growing mainstream adoption of cryptocurrency by high-profile corporate… Continue reading Trump Media Moves $174 Million in Bitcoin Across Multiple Wallets

Binance Founder CZ Exposes the Realities Behind Every ‘Perfect’ Bitcoin Purchase

Binance CEO Changpeng Zhao (CZ) has shed light on the misconceptions surrounding seemingly “perfect” Bitcoin buys, emphasizing that timing the market flawlessly is largely a myth. According to CZ, even experienced investors face volatility, sudden regulatory shifts, and unpredictable market sentiment, which can dramatically impact outcomes. While Bitcoin remains a high-potential digital asset, success often… Continue reading Binance Founder CZ Exposes the Realities Behind Every ‘Perfect’ Bitcoin Purchase

Rising Investor Risk as Crypto and Private Credit Enter Mainstream Finance

The convergence of cryptocurrencies and private credit into mainstream investment portfolios is intensifying risk exposure for global investors. As these alternative assets gain broader acceptance, the potential for volatility, illiquidity, and systemic shocks has increased. Cryptocurrencies, with their inherent price swings, and private credit, often characterized by opaque structures and limited secondary markets, present complex… Continue reading Rising Investor Risk as Crypto and Private Credit Enter Mainstream Finance

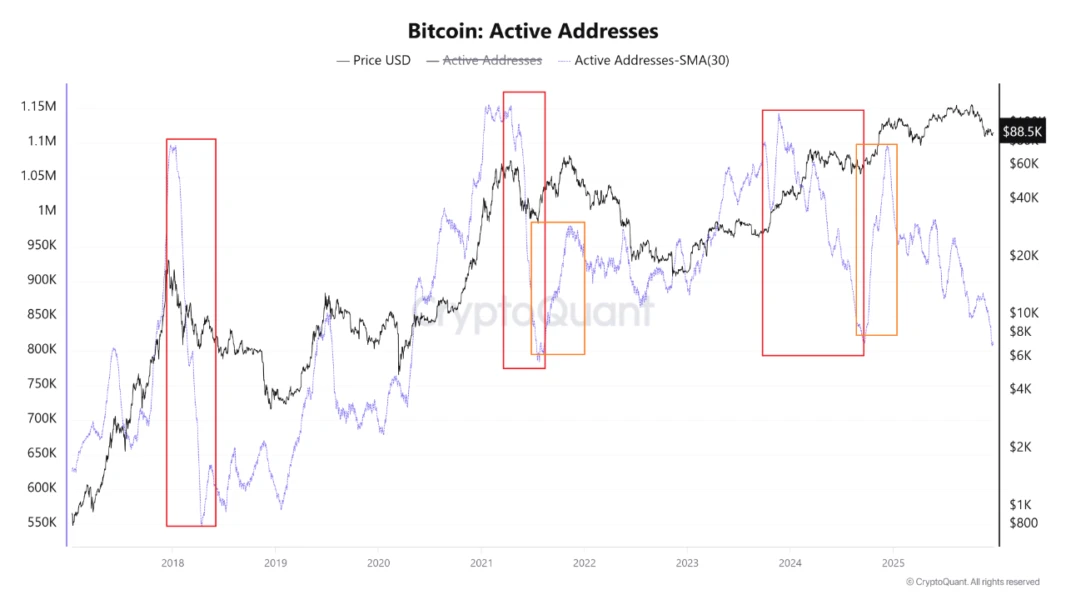

Bitcoin Volatility Surges Amid 100% Two-Year Rally and Dominant Short Positions

Bitcoin’s market dynamics have captured investor attention as volatility spikes alongside a 100% price increase over the past two years. Despite the rally, short positions have surged, indicating heightened caution and hedging activity among traders. Analysts note that extreme price swings, coupled with concentrated speculative bets, are amplifying market uncertainty. The current environment underscores the… Continue reading Bitcoin Volatility Surges Amid 100% Two-Year Rally and Dominant Short Positions

Bitcoin Remains Range-Bound Below 90,000 as Market Signals Await a Clear Turn

Bitcoin continues to trade below the psychologically critical 90,000 level, reflecting a market caught between long-term optimism and short-term uncertainty. Despite sustained institutional interest and improving infrastructure, key macroeconomic and market-specific conditions have yet to align for a decisive breakout. Analysts point to tightening liquidity, cautious investor sentiment, and the absence of a strong catalyst… Continue reading Bitcoin Remains Range-Bound Below 90,000 as Market Signals Await a Clear Turn