Global asset management giant BlackRock has moved cryptocurrency holdings worth approximately Rs. 3,550 crore, spanning Bitcoin and Ethereum, in a transaction that has drawn close attention across financial markets. The large-scale digital asset movement underscores the growing institutional sophistication in crypto portfolio management rather than a retreat from the sector. Market analysts view the transfer… Continue reading BlackRock Executes Rs. 3,550-Crore Crypto Transfer, Signaling Strategic Portfolio Rebalancing

Author: Jimmy Peterson

Crypto Market Outlook: Which Tokens Could Lead in 2026 Amid Potential Altseason?

As 2026 approaches, cryptocurrency investors are closely monitoring conditions that could trigger a new altseason, potentially reshaping market leadership beyond Bitcoin. Analysts are evaluating Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), Solana (SOL), and Dogecoin (DOGE) for their adoption, network activity, and historical performance during bullish cycles. While Bitcoin often sets overall market sentiment, altcoins… Continue reading Crypto Market Outlook: Which Tokens Could Lead in 2026 Amid Potential Altseason?

U.S. Crypto Regulation Heads for a Defining Year in 2026 as Federal Policy and State Innovation Converge

The United States is moving toward a pivotal moment in cryptocurrency regulation, with 2026 shaping up as a year of structural clarity and political decision-making. Proposed Senate legislation, emerging stablecoin frameworks, and state-level Bitcoin initiatives are collectively redefining how digital assets are governed. After years of regulatory ambiguity, policymakers are shifting from enforcement-driven responses toward… Continue reading U.S. Crypto Regulation Heads for a Defining Year in 2026 as Federal Policy and State Innovation Converge

Precious Metals Poised for Strength: Gold’s Rally Seen Extending Into 2026 as Silver Gains From Crypto Fatigue

Gold’s prolonged rally is expected to maintain momentum through 2026, supported by macroeconomic uncertainty, persistent inflation risks, and shifting investor preferences, according to market analysis. At the same time, weakness across major cryptocurrencies could redirect speculative and defensive capital toward silver, reviving interest in the metal as both an industrial asset and a monetary hedge.… Continue reading Precious Metals Poised for Strength: Gold’s Rally Seen Extending Into 2026 as Silver Gains From Crypto Fatigue

Economist Warns of Historic Market Collapse in 2026 as Global Financial Risks Converge

A prominent economist has issued a stark warning that global financial markets could face an unprecedented crash in 2026, driven by a convergence of structural imbalances, excessive debt, and prolonged policy distortions. According to the analysis, years of loose monetary conditions, inflated asset valuations, and rising geopolitical and fiscal pressures have created a fragile economic… Continue reading Economist Warns of Historic Market Collapse in 2026 as Global Financial Risks Converge

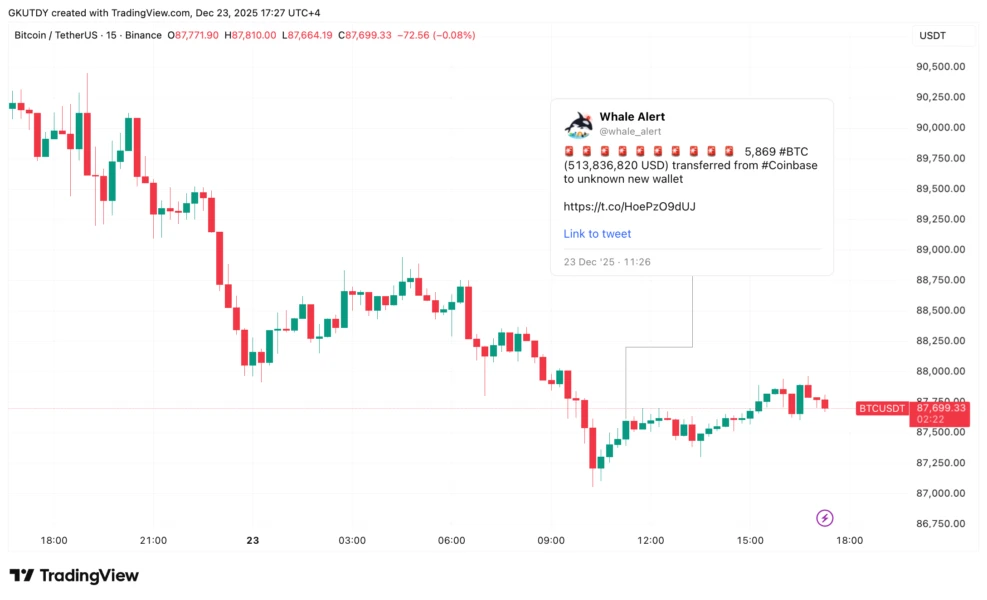

Inflation Reality Check: Why Bitcoin’s $100,000 Milestone Remains Elusive in Real Terms

Bitcoin may have approached the psychologically significant $100,000 mark in nominal terms, but when adjusted for inflation, the milestone has yet to be truly achieved, according to industry analysis. The argument reframes one of the most celebrated narratives in crypto markets, highlighting the difference between headline prices and real purchasing power. As inflation reshapes global… Continue reading Inflation Reality Check: Why Bitcoin’s $100,000 Milestone Remains Elusive in Real Terms

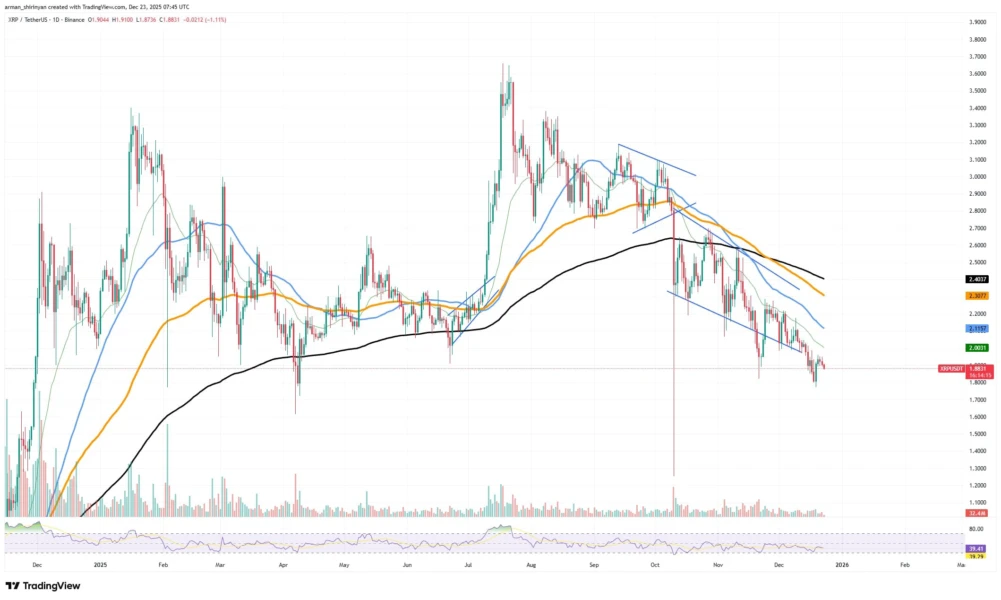

XRP Displays Its Most Resilient Market Structure Since 2022, Data Signals

XRP has reached its most favorable technical and on-chain position since 2022, according to recent market indicators tracking price structure, liquidity flows, and investor behavior. The improvement reflects a combination of renewed trading interest, tighter supply dynamics, and growing confidence among long-term holders. While broader digital asset markets remain sensitive to macroeconomic cues, XRP’s underlying… Continue reading XRP Displays Its Most Resilient Market Structure Since 2022, Data Signals

Binance Introduces Time-Bound Alpha Rewards Initiative to Boost Platform Engagement

Binance has announced a limited-period Alpha initiative designed to increase user engagement through a task-based rewards mechanism. Under the program, participants can earn Alpha Points by completing specified on-platform activities within a defined timeframe. The move reflects a broader industry trend of incentivizing participation as digital asset platforms compete for user attention amid fluctuating market… Continue reading Binance Introduces Time-Bound Alpha Rewards Initiative to Boost Platform Engagement

Ghana Embraces Digital Assets With Crypto Legalization and Gold-Backed Stablecoin Plans

Ghana has formally legalized cryptocurrency trading through new legislation, marking a significant shift in its financial and regulatory landscape. The move aims to bring oversight, consumer protection, and transparency to a sector that has operated largely outside formal regulation. Alongside legalization, authorities have signaled plans to explore gold-backed stablecoins, leveraging the country’s mineral resources to… Continue reading Ghana Embraces Digital Assets With Crypto Legalization and Gold-Backed Stablecoin Plans

XRP Shows Strongest Market Signals Since 2022, On-Chain Indicators Suggest

XRP has reached its most favorable technical and on-chain position since 2022, according to recent market indicators tracking price structure, liquidity flows, and investor behavior. The improvement reflects a combination of renewed trading interest, tighter supply dynamics, and growing confidence among long-term holders. While broader digital asset markets remain sensitive to macroeconomic cues, XRP’s underlying… Continue reading XRP Shows Strongest Market Signals Since 2022, On-Chain Indicators Suggest