The market turbulence of 2025 tested investors across asset classes, exposing the risks of speculation while reaffirming the value of discipline and long-term thinking. Sharp swings in equities, commodities, and digital assets were driven by shifting interest-rate expectations, geopolitical uncertainty, and uneven corporate earnings. Amid the noise, seasoned investors drew important lessons about risk management,… Continue reading Eight Investment Lessons From the Market Volatility of 2025

Author: Jimmy Peterson

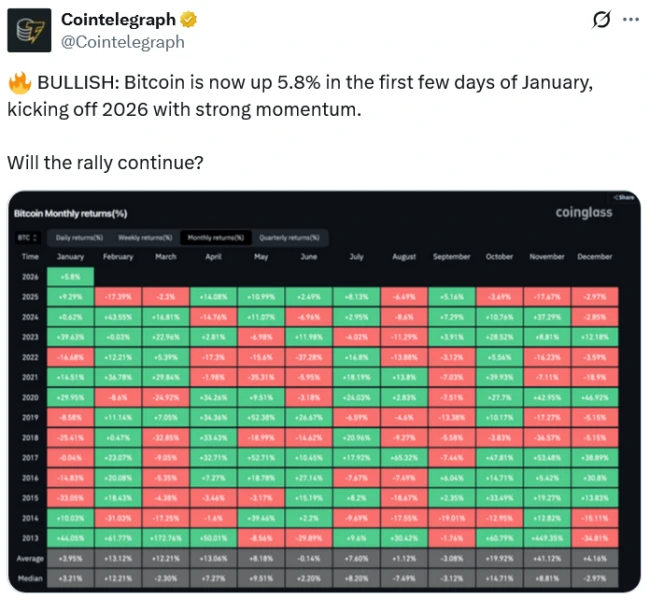

Tom Lee Predicts Fresh Bitcoin High in January, Flags Heightened Volatility Ahead in 2026

Market strategist Tom Lee has forecast a new all-time high for Bitcoin as early as January, citing improving liquidity conditions, renewed institutional interest, and growing acceptance of digital assets within mainstream finance. However, he has simultaneously cautioned investors to brace for sharper swings and elevated risk as the market moves toward 2026. Lee’s outlook reflects… Continue reading Tom Lee Predicts Fresh Bitcoin High in January, Flags Heightened Volatility Ahead in 2026

India’s Competition Watchdog Clears Coinbase’s Strategic Entry into DCX Global

India’s competition regulator has approved Coinbase’s acquisition of a minority stake in DCX Global, marking a notable development in the country’s evolving digital asset landscape. The clearance underscores regulatory openness to foreign participation in India’s crypto ecosystem, provided competition norms are respected. For Coinbase, the move offers a calibrated entry into a complex but high-potential… Continue reading India’s Competition Watchdog Clears Coinbase’s Strategic Entry into DCX Global

Why XRP’s Path to Four Digits Remains Distant: Analysts Reset Expectations for 2026

Speculation around XRP reaching the Rs. 1,000 mark by 2026 has resurfaced among retail investors, but market analysts are urging restraint. Based on current adoption trends, regulatory clarity, liquidity dynamics, and realistic valuation models, experts argue that such a price target is highly improbable within the next two years. Instead, analysts outline a more measured… Continue reading Why XRP’s Path to Four Digits Remains Distant: Analysts Reset Expectations for 2026

Bitcoin Mining Faces Record Profitability Squeeze in 2025 Despite All-Time High Prices

Bitcoin miners in 2025 are navigating the most severe profitability squeeze on record, even as the cryptocurrency reaches unprecedented price levels. Rising operational costs, including electricity and hardware expenditures, coupled with growing network difficulty, have sharply compressed profit margins for mining operations worldwide. Analysts note that while Bitcoin’s all-time highs present potential revenue opportunities, the… Continue reading Bitcoin Mining Faces Record Profitability Squeeze in 2025 Despite All-Time High Prices

Digital Assets in Focus: Evaluating the Top Cryptocurrencies for Investment in 2026

As cryptocurrencies mature into a recognised asset class, 2026 marks a decisive phase for digital finance, shaped by regulation, institutional participation, and real-world adoption. Bitcoin and Ethereum continue to anchor the market, while a new generation of blockchain projects is redefining utility, scalability, and decentralised finance. This article examines the ten most closely watched cryptocurrencies… Continue reading Digital Assets in Focus: Evaluating the Top Cryptocurrencies for Investment in 2026

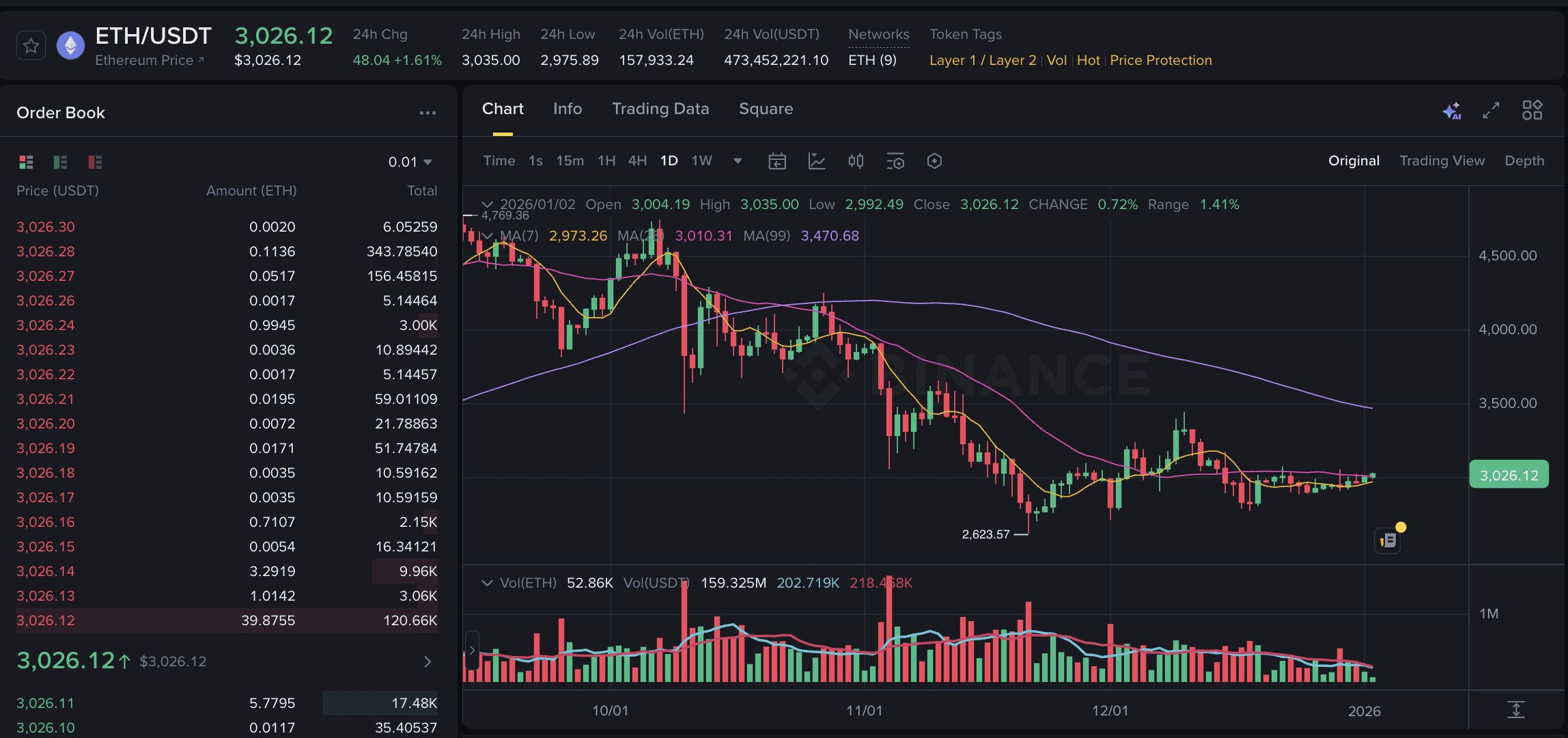

Ethereum Reclaims the 3,000 Mark as Options Expiry Triggers Market Rebound

Ethereum staged a strong recovery, climbing back above the 3,000 level as a major options expiry passed without significant market disruption. The rebound reflects renewed buying interest after weeks of consolidation, with traders reassessing near-term risk following the settlement of derivative contracts. Analysts say the move signals improving sentiment rather than a decisive trend reversal,… Continue reading Ethereum Reclaims the 3,000 Mark as Options Expiry Triggers Market Rebound

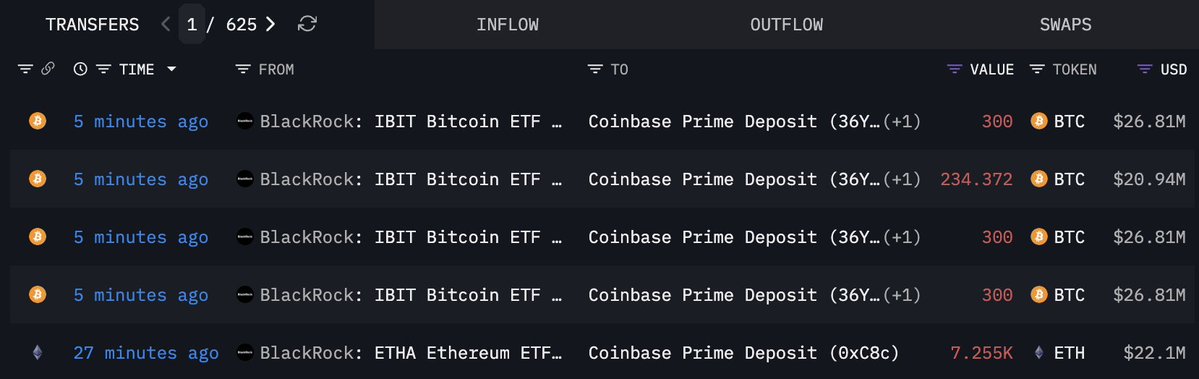

BlackRock Initiates 2026 With First-Ever Bitcoin and Ethereum Asset Sale

Global asset management giant BlackRock has made its first sale of Bitcoin and Ethereum holdings in 2026, marking a notable moment for institutional participation in digital assets. The transaction signals a shift from pure accumulation toward active portfolio management amid evolving market conditions. While the scale of the sale remains measured, it reflects a maturing… Continue reading BlackRock Initiates 2026 With First-Ever Bitcoin and Ethereum Asset Sale

Pi Network Token Under Scrutiny as Unclear 2026 Roadmap Fuels Investor Discontent

As the broader cryptocurrency market stages an altcoin-led recovery, the Pi Network token remains conspicuously absent from the rally. Once celebrated for its mobile-first mining model and expansive global community, Pi now faces growing criticism from users and market observers. The lack of a clearly defined 2026 roadmap has raised concerns about execution, transparency, and… Continue reading Pi Network Token Under Scrutiny as Unclear 2026 Roadmap Fuels Investor Discontent

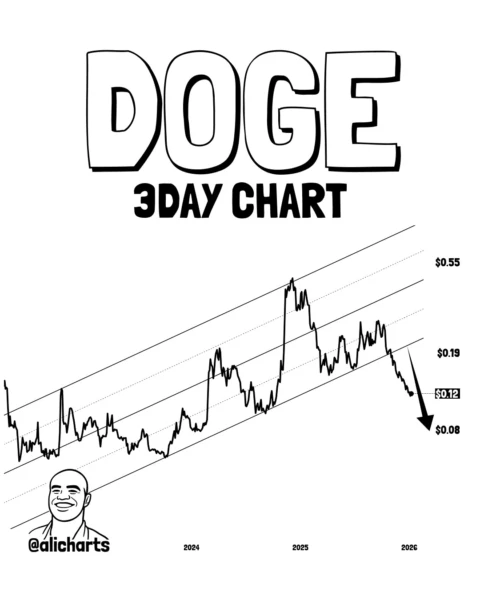

Dogecoin at a Crossroads: Why Analysts See a Potential Slide Toward $0.08

Dogecoin, the meme-inspired cryptocurrency that once captured global investor enthusiasm, is again under scrutiny as market analysts warn of a possible decline toward the $0.08 level. Weak price momentum, declining trading volumes, and broader risk-off sentiment across digital assets are weighing heavily on the token. Technical indicators suggest Dogecoin is struggling to hold key support… Continue reading Dogecoin at a Crossroads: Why Analysts See a Potential Slide Toward $0.08