The cryptocurrency market faced a sharp and unexpected sell-off on October 10, with Bitcoin and Ethereum experiencing steep declines that unsettled investors worldwide. Triggered by a combination of macroeconomic uncertainty, geopolitical risks, and aggressive liquidations in leveraged positions, the downturn reflected the digital asset market’s continued sensitivity to global financial shifts. As traders rushed to… Continue reading Crypto Markets Rattle as Bitcoin and Ethereum Tumble — Examining the Trigger Behind the October 10 Crash

Author: Ron Klauss

A New Pathway for Digital Asset Distribution: Token Sale Framework Emerges on Coinbase

Coinbase has introduced a structured token-sale mechanism designed to support emerging blockchain projects in bringing their assets to market in a more transparent and compliant manner. The initiative reflects growing demand for regulated distribution channels as Web3 innovation accelerates and investor interest broadens beyond established cryptocurrencies. By offering a curated launch environment, Coinbase aims to… Continue reading A New Pathway for Digital Asset Distribution: Token Sale Framework Emerges on Coinbase

The Strategic Advantages of Bitcoin in Modern Finance

Bitcoin, the pioneering cryptocurrency, offers unique advantages that differentiate it from traditional financial instruments. Its decentralized nature eliminates reliance on intermediaries, providing users with greater control over their assets. Scarcity, with a capped supply of 21 million coins, positions Bitcoin as a potential hedge against inflation and currency devaluation. The digital currency’s global accessibility enables… Continue reading The Strategic Advantages of Bitcoin in Modern Finance

U.K. Court Decision Establishes XRP as Recognizable Property Asset in Landmark Ruling

In a significant development for the digital-asset ecosystem, XRP has been formally recognized as “property” under U.K. law, marking a milestone in regulatory clarity for crypto markets. The ruling affirms that XRP, similar to other digital tokens previously acknowledged by courts, qualifies as a property class capable of ownership, custody, and transfer under legal frameworks.… Continue reading U.K. Court Decision Establishes XRP as Recognizable Property Asset in Landmark Ruling

Cardsmiths Unveils Physical Currency Cards Loaded With Rs. 4.16 Crore in Bitcoin, Ethereum and Dogecoin

A new fusion of physical collectibles and digital finance has entered the spotlight as Cardsmiths launches cryptocurrency-backed currency cards featuring Bitcoin, Ethereum and Dogecoin. With reserves exceeding Rs. 4.16 crore (approximately USD 500,000) embedded across the limited-edition collection, the initiative blends blockchain utility with the collectible trading-card market, appealing to crypto enthusiasts and hobby investors… Continue reading Cardsmiths Unveils Physical Currency Cards Loaded With Rs. 4.16 Crore in Bitcoin, Ethereum and Dogecoin

Benchmark’s Bold Crypto Bet: Inside the $17 Million Series A for Trading App Fomo

In a rare move for a traditionally cautious venture capital firm, Benchmark has invested $17 million in Series A funding for Fomo, a new-generation crypto trading platform designed to simplify digital asset investing. This marks Benchmark’s first major crypto-focused bet in years, signaling renewed confidence in blockchain innovation amid a volatile market. Fomo aims to… Continue reading Benchmark’s Bold Crypto Bet: Inside the $17 Million Series A for Trading App Fomo

Polygon and Anq Reportedly Collaborating on India’s First Sovereign-Backed Stablecoin Framework

Polygon and Anq are reportedly developing a pioneering stablecoin model for India, designed to be backed by sovereign government securities. According to sources familiar with the matter, the initiative aims to establish a regulated and transparent digital asset ecosystem aligned with India’s financial and policy objectives. The proposed framework would bridge the gap between traditional… Continue reading Polygon and Anq Reportedly Collaborating on India’s First Sovereign-Backed Stablecoin Framework

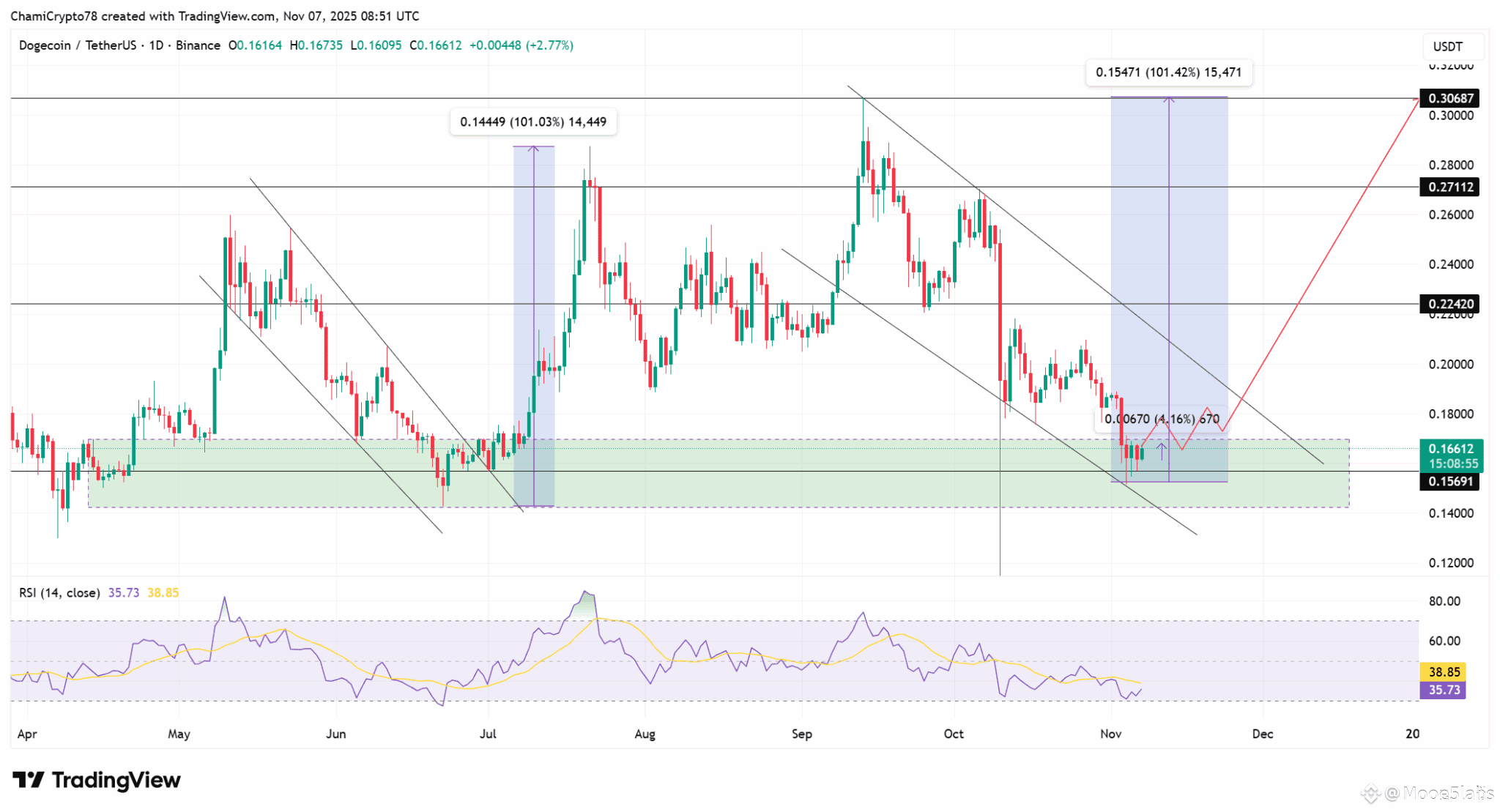

Dogecoin ETF Nears Possible U.S. Launch Amid Bearish Technical Outlook

Dogecoin (DOGE), the cryptocurrency long popularized by Elon Musk, could soon see a U.S.-listed exchange-traded fund (ETF) dedicated to it—a move that might elevate the meme coin’s legitimacy in mainstream finance. However, despite growing optimism around potential regulatory approval, Dogecoin’s near-term technical indicators remain bearish. Market data shows declining momentum, fading trading volumes, and key… Continue reading Dogecoin ETF Nears Possible U.S. Launch Amid Bearish Technical Outlook

Ray Dalio Cautions on Fed-Fueled Bubble, Predicts Surge and Collapse in Gold and Bitcoin

Billionaire investor Ray Dalio, founder of Bridgewater Associates, has issued a stark warning about the U.S. Federal Reserve’s policies, suggesting that an unsustainable financial bubble could propel assets like gold and Bitcoin to record highs—before an eventual market correction sends them crashing. Dalio believes that excessive liquidity, rising fiscal deficits, and mounting debt levels are… Continue reading Ray Dalio Cautions on Fed-Fueled Bubble, Predicts Surge and Collapse in Gold and Bitcoin

Ethereum Stablecoin Transactions Hit Record Rs. 233 Trillion in October, Underscoring Network’s Expanding Role in Global Finance

Ethereum’s dominance in the digital payments ecosystem reached a new milestone in October, with stablecoin transaction volume hitting a record US $2.8 trillion (around Rs. 233 trillion). This unprecedented figure reflects Ethereum’s growing role as the primary settlement layer for dollar-pegged digital assets such as USDT and USDC. Analysts attribute this surge to increased adoption… Continue reading Ethereum Stablecoin Transactions Hit Record Rs. 233 Trillion in October, Underscoring Network’s Expanding Role in Global Finance