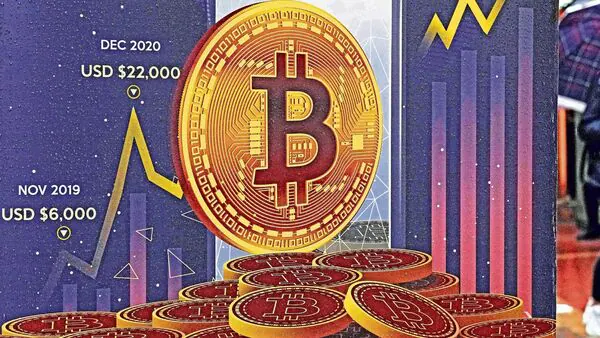

Cryptocurrency markets recorded a sharp upswing, led by Bitcoin, as investors increasingly priced in the possibility of interest rate cuts by major central banks. The rally reflects renewed risk appetite amid signs of easing inflation and slowing global growth. Traders pointed to improving liquidity conditions, stronger technical indicators, and rising institutional participation as key drivers behind the move. Bitcoin’s momentum has also lifted broader digital assets, reinforcing confidence in the sector. The surge highlights how macroeconomic expectations are now playing a decisive role in shaping crypto market dynamics.

Macro Environment Fuels Crypto Rally

Bitcoin’s latest advance underscores its growing sensitivity to global monetary conditions. As expectations of tighter financial policy recede, capital has begun rotating toward assets perceived as growth-oriented and inflation-hedged. Digital currencies, particularly Bitcoin, have benefited from this shift as investors reassess portfolio allocations in anticipation of easier credit conditions.

Rate-Cut Expectations Strengthen Risk Appetite

Recent economic data suggesting moderating inflation and softer demand have strengthened the case for potential rate reductions. Lower interest rates typically reduce the opportunity cost of holding non-yielding assets such as Bitcoin. As a result, traders and long-term investors alike have increased exposure, betting that improved liquidity will support higher valuations.

Technical Indicators Signal Momentum

Market participants noted that Bitcoin has moved decisively above key resistance levels, a development often interpreted as confirmation of a breakout phase. Rising trading volumes and sustained price support have added credibility to bullish forecasts. Technical strength has also attracted momentum-driven investors, amplifying the upward trend.

Institutional Participation Adds Depth

The rally has been supported by steady institutional inflows through regulated investment channels. Increased participation from large investors has enhanced market depth and reduced volatility compared with earlier cycles. This structural shift has contributed to stronger confidence in Bitcoin’s medium-term outlook.

Cautious Optimism Ahead

Despite the upbeat sentiment, analysts caution that crypto markets remain highly responsive to macroeconomic signals. Any reversal in rate expectations or renewed policy tightening could trigger sharp corrections. Nonetheless, the current rally reinforces Bitcoin’s position as a macro-linked asset increasingly influenced by global financial conditions rather than isolated sector developments.