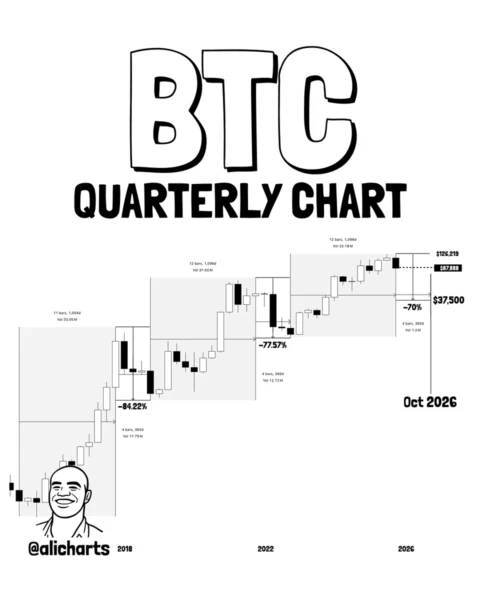

A leading cryptocurrency analyst has suggested that Bitcoin may reach its next market bottom around October 2026, citing historical price cycles and macroeconomic correlations. Analysis of previous bull and bear cycles indicates that Bitcoin often follows predictable patterns, with multiyear peaks followed by prolonged corrections. While past performance is not a guarantee of future outcomes,… Continue reading Analyst Predicts Bitcoin Bottom Around October 2026 Based on Historical Patterns

Category: Bitcoin

Crypto Market Outlook: Which Tokens Could Lead in 2026 Amid Potential Altseason?

As 2026 approaches, cryptocurrency investors are closely monitoring conditions that could trigger a new altseason, potentially reshaping market leadership beyond Bitcoin. Analysts are evaluating Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), Solana (SOL), and Dogecoin (DOGE) for their adoption, network activity, and historical performance during bullish cycles. While Bitcoin often sets overall market sentiment, altcoins… Continue reading Crypto Market Outlook: Which Tokens Could Lead in 2026 Amid Potential Altseason?

Shift in Crypto Exchange Flows Signals Changing Trader Behavior Across Major Platforms

Bitcoin and Ethereum inflows to major crypto exchanges have dropped sharply, signaling a notable shift in trader behavior and market structure. Recent data indicates a significant slowdown in deposits to one leading U.S.-based exchange, while activity on a major global rival has remained comparatively resilient. The divergence suggests evolving preferences among traders, influenced by liquidity… Continue reading Shift in Crypto Exchange Flows Signals Changing Trader Behavior Across Major Platforms

Precious Metals Poised for Strength: Gold’s Rally Seen Extending Into 2026 as Silver Gains From Crypto Fatigue

Gold’s prolonged rally is expected to maintain momentum through 2026, supported by macroeconomic uncertainty, persistent inflation risks, and shifting investor preferences, according to market analysis. At the same time, weakness across major cryptocurrencies could redirect speculative and defensive capital toward silver, reviving interest in the metal as both an industrial asset and a monetary hedge.… Continue reading Precious Metals Poised for Strength: Gold’s Rally Seen Extending Into 2026 as Silver Gains From Crypto Fatigue

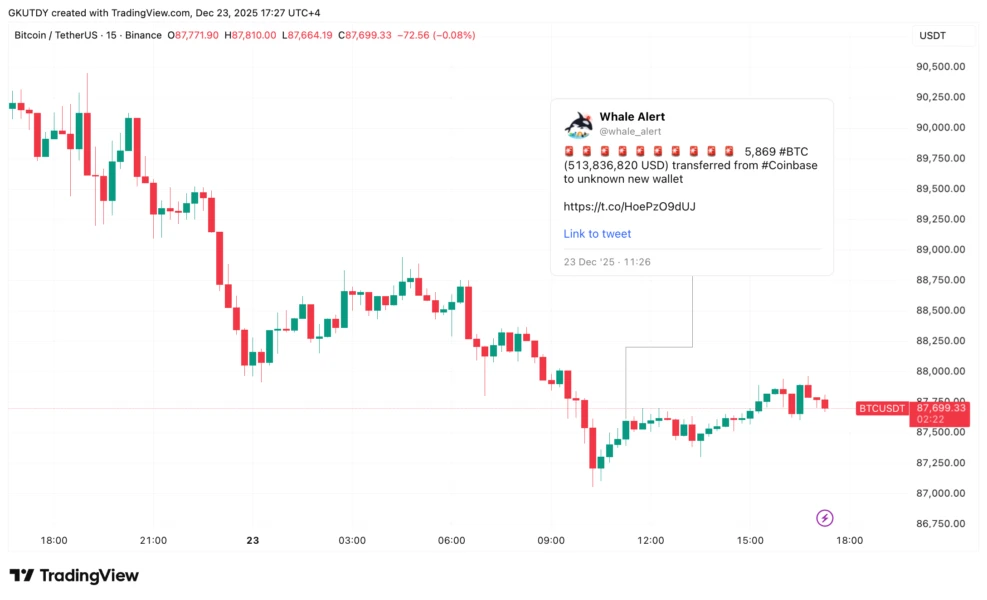

Rs. 513 Million Bitcoin Enigma Jolts U.S. Crypto Markets, Raises Questions on Exchange Transparency

A mysterious Bitcoin transaction valued at more than Rs. 513 million has sent ripples through the U.S. cryptocurrency market, drawing attention to one of the country’s largest digital asset exchanges. The unexpected movement of funds, executed without an immediately identifiable trigger, has fueled speculation among analysts and traders about its origin and intent. While large… Continue reading Rs. 513 Million Bitcoin Enigma Jolts U.S. Crypto Markets, Raises Questions on Exchange Transparency

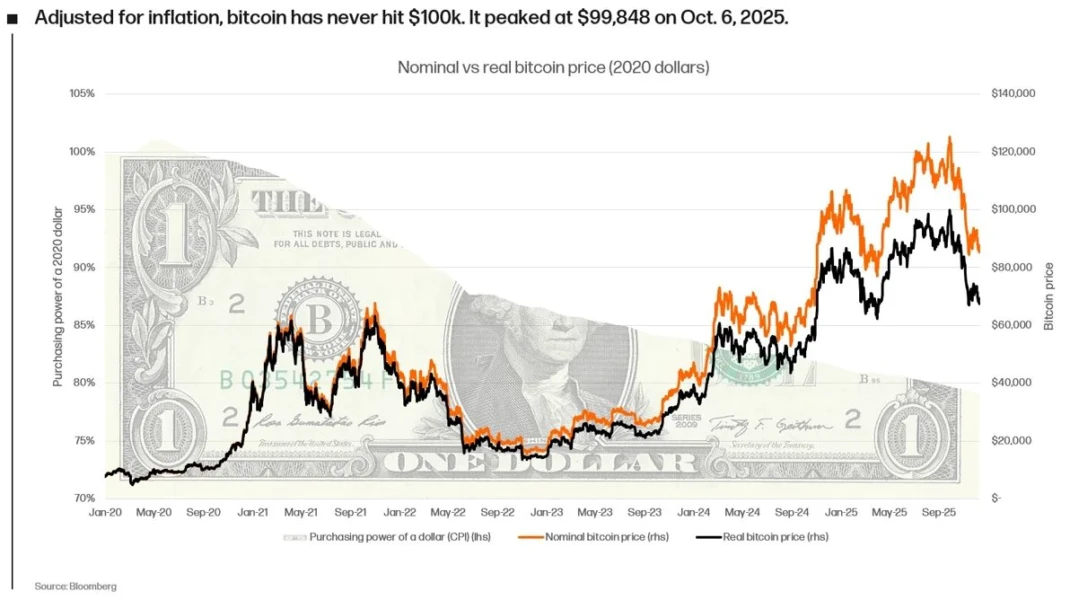

Inflation Reality Check: Why Bitcoin’s $100,000 Milestone Remains Elusive in Real Terms

Bitcoin may have approached the psychologically significant $100,000 mark in nominal terms, but when adjusted for inflation, the milestone has yet to be truly achieved, according to industry analysis. The argument reframes one of the most celebrated narratives in crypto markets, highlighting the difference between headline prices and real purchasing power. As inflation reshapes global… Continue reading Inflation Reality Check: Why Bitcoin’s $100,000 Milestone Remains Elusive in Real Terms

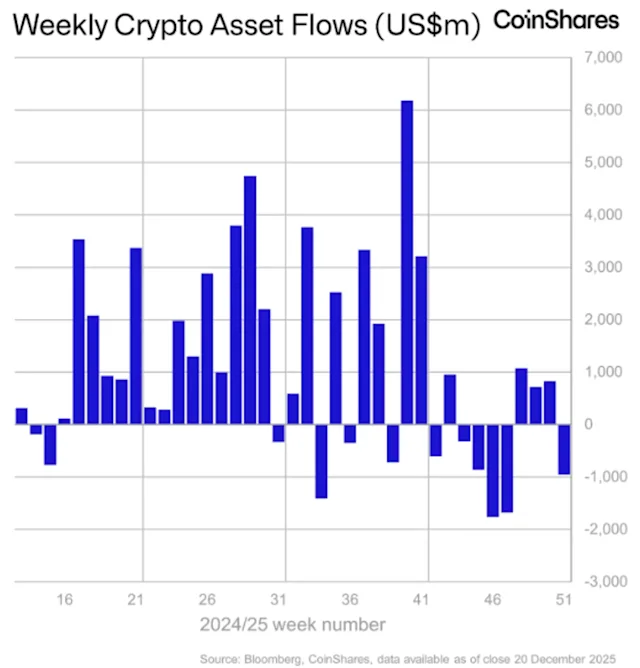

Congress Delay on Crypto Legislation Spurs $1 Billion Capital Outflow

A delay in crypto-related legislation in the U.S. Congress has triggered an estimated $1 billion outflow from digital asset markets, highlighting investor sensitivity to regulatory clarity. Market participants cite uncertainty over taxation, custody rules, and potential trading restrictions as key factors driving withdrawals. The pause has affected both institutional and retail investors, impacting liquidity and… Continue reading Congress Delay on Crypto Legislation Spurs $1 Billion Capital Outflow

VanEck’s Mid-December 2025 Bitcoin ChainCheck Signals Shifting On-Chain Dynamics

VanEck’s mid-December 2025 Bitcoin ChainCheck highlights notable changes in on-chain activity, offering insights into investor behavior and market structure as the digital asset matures. The assessment points to evolving holding patterns, measured network usage, and capital flows that suggest a transition from speculative trading toward longer-term positioning. While price volatility remains a defining feature, underlying… Continue reading VanEck’s Mid-December 2025 Bitcoin ChainCheck Signals Shifting On-Chain Dynamics

Fundstrat’s Bitcoin Playbook: Tom Lee Clarifies Strategy Amid Market Crosscurrents

Bitcoin’s evolving market narrative took center stage after Fundstrat co-founder Tom Lee outlined the firm’s outlook during a recent investor discussion, shedding light on how institutional strategists are positioning themselves amid heightened volatility. Lee’s commentary focused on long-term adoption trends, macroeconomic signals, and capital rotation within digital assets, rather than short-term price speculation. As Bitcoin… Continue reading Fundstrat’s Bitcoin Playbook: Tom Lee Clarifies Strategy Amid Market Crosscurrents

Litecoin Rides Bitcoin’s Rally, Faces Crucial Test Near Rs.79.60 Resistance

Litecoin has mirrored Bitcoin’s recent upward momentum, benefiting from renewed optimism across the broader cryptocurrency market. As capital flows back into large-cap digital assets, Litecoin has staged a steady recovery, supported by improving sentiment and higher trading volumes. However, technical indicators suggest the rally may be approaching a critical inflection point. Market participants are closely… Continue reading Litecoin Rides Bitcoin’s Rally, Faces Crucial Test Near Rs.79.60 Resistance