Bitcoin’s recent recovery attempt lost momentum midweek, underscoring the persistent volatility gripping the world’s largest cryptocurrency. After briefly climbing above key technical levels, the digital asset retreated to around $66,166 by late morning trading, marking a decline of roughly 4% on the day. The pullback comes amid a broader downtrend that began after Bitcoin surged… Continue reading Bitcoin Volatility Persists as Rally Fizzles, Prices Hover Nearly 47% Below Record High

Category: Crypto Exchanges

Cryptocurrency Exchanges

Crypto Ransom Threat Against French Magistrate Sparks Massive Police Operation

A chilling cryptocurrency ransom demand targeting a 35-year-old French magistrate has triggered a sweeping, multi-agency law enforcement response in France. The victim’s partner received a threatening message containing her photograph and a demand for payment in digital assets, accompanied by a warning of mutilation if the ransom was not paid. Authorities were alerted promptly, leading… Continue reading Crypto Ransom Threat Against French Magistrate Sparks Massive Police Operation

Crypto Markets Retreat as Bitcoin Slips Below $70,000; Investors Await U.S. Economic Signals

Cryptocurrency markets are under renewed pressure as Bitcoin has fallen below the critical $70,000 threshold, erasing gains made during a recent rebound from levels near $60,000. The broader digital asset ecosystem, including Ethereum and XRP, has mirrored the decline amid cautious investor sentiment. Market participants are closely watching upcoming U.S. employment and inflation data, which… Continue reading Crypto Markets Retreat as Bitcoin Slips Below $70,000; Investors Await U.S. Economic Signals

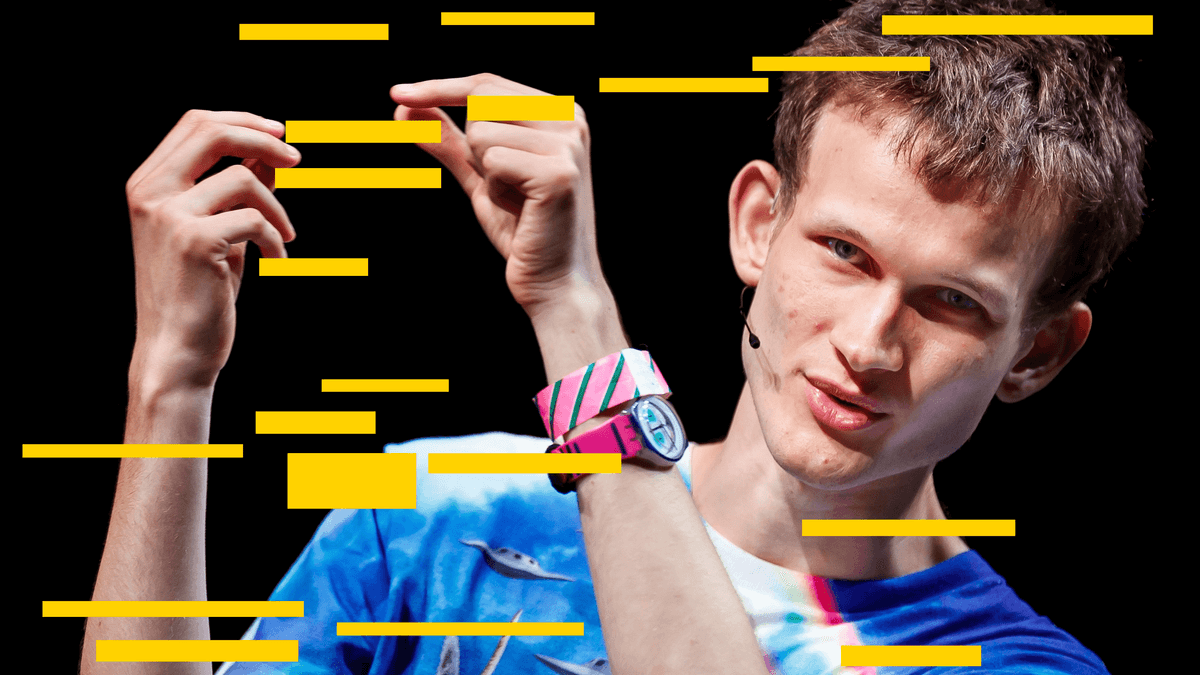

Ethereum and the AI Frontier: Vitalik Buterin’s Blueprint for Decentralized Intelligence

Ethereum co-founder Vitalik Buterin has renewed his call for a more decentralized approach to artificial intelligence, arguing that blockchain infrastructure could play a critical role in shaping the governance and safety of advanced AI systems. Revisiting arguments he first articulated two years ago, Buterin cautioned that the rapid, centralized pursuit of artificial general intelligence mirrors… Continue reading Ethereum and the AI Frontier: Vitalik Buterin’s Blueprint for Decentralized Intelligence

Solana Network Faces Structural Strain as Validator Numbers Decline and Vote Transactions Drop 40%

Solana’s blockchain ecosystem is confronting renewed scrutiny after a sustained decline in validator participation and a sharp 40 percent fall in vote transactions, a key metric of network consensus activity. The contraction raises questions about decentralization, economic incentives and long-term sustainability. Validators, who secure the network and confirm transactions, appear to be reassessing operational viability… Continue reading Solana Network Faces Structural Strain as Validator Numbers Decline and Vote Transactions Drop 40%

Corporate Solana Bet Backfires as Treasury Holdings Face Rs. 12,000 Crore in Unrealized Losses

A group of publicly traded companies that adopted Solana as a treasury reserve asset are now grappling with substantial mark-to-market losses as the cryptocurrency’s price has declined sharply from its 2025 highs. Based on disclosed acquisition costs, corporate holders are collectively sitting on more than $1.5 billion in unrealized losses, equivalent to roughly Rs. 12,000… Continue reading Corporate Solana Bet Backfires as Treasury Holdings Face Rs. 12,000 Crore in Unrealized Losses

Is Bitcoin Still ‘Digital Gold’? Market Strategists Question the Safe-Haven Narrative

Bitcoin has long been branded as “digital gold,” a decentralized and scarce asset positioned as a hedge against inflation and currency debasement. With its supply capped at 21 million coins, the cryptocurrency gained prominence during the 2013 rally and especially after the 2020 global macroeconomic crisis, when institutional investors increasingly embraced it as a store… Continue reading Is Bitcoin Still ‘Digital Gold’? Market Strategists Question the Safe-Haven Narrative

UK Regulator Takes Legal Action Against HTX Over Alleged Unlawful Crypto Promotions

The United Kingdom’s Financial Conduct Authority has initiated legal proceedings against cryptocurrency exchange HTX, alleging that the platform illegally promoted cryptoasset services to UK consumers despite prior regulatory warnings. According to the regulator, HTX continued advertising across its website and major social media platforms, including TikTok, X, Facebook, Instagram and YouTube. The watchdog further claims… Continue reading UK Regulator Takes Legal Action Against HTX Over Alleged Unlawful Crypto Promotions

EU Moves to Prohibit Russian Crypto Transactions in Escalation of Financial Sanctions

The European Union is preparing to tighten its sanctions regime against Moscow by seeking a comprehensive prohibition on cryptocurrency transactions linked to Russian entities and individuals. The proposed measures aim to prevent the use of digital assets as a tool to bypass existing financial restrictions imposed after the escalation of geopolitical tensions. Policymakers argue that… Continue reading EU Moves to Prohibit Russian Crypto Transactions in Escalation of Financial Sanctions

Crypto Markets Stabilize After Sharp Sell-Off as Bitcoin Tests Recovery Near $60,000

Bitcoin, Ethereum and XRP declined sharply in recent trading sessions, reflecting renewed volatility across digital asset markets. Bitcoin briefly fell toward the $60,000 level before staging a modest rebound, signaling tentative stabilization after heavy liquidation pressure. Ethereum and XRP mirrored the broader downturn, though market participants now see early signs of consolidation. Analysts point to… Continue reading Crypto Markets Stabilize After Sharp Sell-Off as Bitcoin Tests Recovery Near $60,000