Major cryptocurrencies retreated sharply as investors pared exposure to risk assets amid renewed macroeconomic uncertainty and profit-taking after recent rallies. Dogecoin and Cardano were among the steepest decliners, underscoring the vulnerability of altcoins during periods of tightening liquidity and shifting sentiment. Bitcoin and Ethereum also moved lower, dragging overall market capitalization down and triggering liquidations… Continue reading Crypto Markets Slide as Risk Appetite Fades; Dogecoin and Cardano Lead Losses

Category: Uncategorized

How Blockchain Technology Is Reshaping the Future of Real Estate App Development

Blockchain technology is rapidly transforming the real estate sector, introducing transparency, efficiency and trust into an industry long dominated by complex paperwork and slow transactional processes. Its integration into real estate app development enables secure property records, automated contract execution and more efficient verification of ownership. By decentralising data and eliminating many intermediaries, blockchain lowers… Continue reading How Blockchain Technology Is Reshaping the Future of Real Estate App Development

Japan’s Cash-Loving Culture Meets Its First Fully Convertible Yen Stablecoin: A Financial Revolution in the Making

Japan, a nation renowned for its deep-rooted affinity for cash, is entering a new era of digital finance with the launch of the world’s first fully convertible yen-backed stablecoin. This development bridges the gap between traditional currency and blockchain innovation, allowing users to exchange digital yen for physical yen seamlessly. In a country where nearly… Continue reading Japan’s Cash-Loving Culture Meets Its First Fully Convertible Yen Stablecoin: A Financial Revolution in the Making

Hidden Complexities: What U.S. Expats Need to Know About Crypto Taxes

For U.S. citizens living abroad, cryptocurrency taxation remains one of the most misunderstood areas of financial compliance. Despite residing overseas, American expats are still subject to U.S. tax laws on their global income, including profits derived from digital assets. Many mistakenly believe that relocating abroad exempts them from reporting crypto transactions to the Internal Revenue… Continue reading Hidden Complexities: What U.S. Expats Need to Know About Crypto Taxes

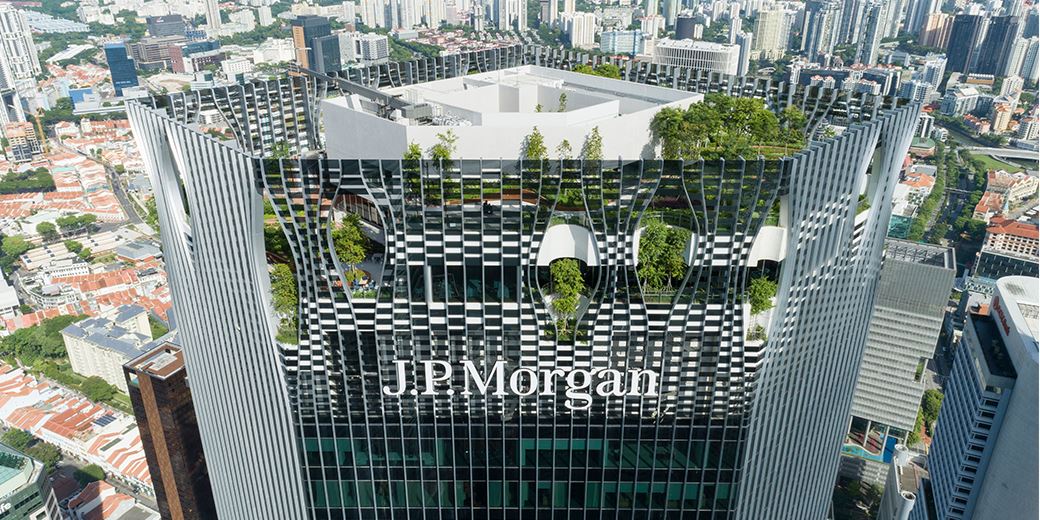

JPMorgan Slashes Fees on Four Mutual Funds and One ETF Covering Rs. 5.8 Trillion in Assets

JPMorgan Asset Management has announced fee reductions across four of its mutual funds and one exchange-traded fund (ETF), collectively managing assets worth nearly Rs. 5.8 trillion ($70 billion). The move, aimed at enhancing competitiveness in a rapidly evolving investment landscape, underscores the industry-wide trend of large asset managers trimming costs to retain investors amid intensifying… Continue reading JPMorgan Slashes Fees on Four Mutual Funds and One ETF Covering Rs. 5.8 Trillion in Assets

Tether Charts U.S. Strategy With Launch of USAT Stablecoin

Tether, the world’s largest stablecoin issuer, is preparing to expand its portfolio with the introduction of a U.S.-focused token dubbed USAT. The initiative signals a deliberate effort to align closer with American regulatory frameworks and to strengthen its foothold in a market where policymakers are tightening their grip on digital assets. By pivoting from its… Continue reading Tether Charts U.S. Strategy With Launch of USAT Stablecoin

Tether Appoints Former Trump Advisor Bo Hines to Spearhead New Stablecoin Initiative

Tether, the world’s largest stablecoin issuer, has announced the appointment of Bo Hines, a former advisor to Donald Trump, to lead its new stablecoin project. The move signals Tether’s intent to expand its influence in the evolving digital asset ecosystem by leveraging political expertise and leadership with regulatory insight. Hines’ appointment comes at a time… Continue reading Tether Appoints Former Trump Advisor Bo Hines to Spearhead New Stablecoin Initiative

South Korea Mandates KRW Stablecoins to Trade Exclusively on Binance

Title: South Korea Mandates KRW Stablecoins to Trade Exclusively on Binance SummarySouth Korea has introduced a landmark regulatory requirement stipulating that KRW-backed stablecoins must now be traded exclusively on Binance, the global cryptocurrency exchange. This move signals the country’s effort to streamline stablecoin markets, enhance regulatory oversight, and ensure investor protection amid growing digital asset… Continue reading South Korea Mandates KRW Stablecoins to Trade Exclusively on Binance

Hong Kong’s HashKey Plans $500 Million Digital Treasury Fund Launch

HashKey, a prominent Hong Kong-based blockchain and digital asset firm, has announced plans to launch a $500 million digital treasury fund. The initiative aims to consolidate crypto and blockchain-based investments under a diversified fund structure, targeting institutional and high-net-worth investors. The fund will focus on digital assets, tokenized securities, and decentralized finance (DeFi) projects, reflecting… Continue reading Hong Kong’s HashKey Plans $500 Million Digital Treasury Fund Launch

Nasdaq Seeks SEC Approval to Enable Tokenized and Blockchain-Based Stock Listings

Nasdaq has filed a formal proposal with the U.S. Securities and Exchange Commission (SEC) to allow the tokenization and blockchain-based listing of stocks. The initiative aims to modernize capital markets by leveraging distributed ledger technology, providing enhanced transparency, settlement efficiency, and accessibility for investors. If approved, the move could transform traditional equity markets by integrating… Continue reading Nasdaq Seeks SEC Approval to Enable Tokenized and Blockchain-Based Stock Listings