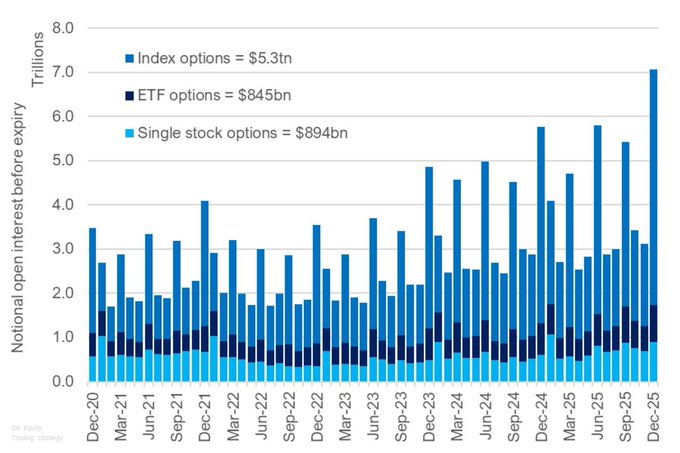

Digital asset markets are entering a critical juncture as options contracts with a notional value of approximately Rs.7.1 trillion expire today, raising expectations of heightened volatility across major cryptocurrencies. Bitcoin, Ethereum, and XRP are at the center of investor focus as traders reassess risk exposure, hedge positions, and recalibrate strategies ahead of settlement. Historically, large-scale expiries have acted as catalysts for short-term price swings, particularly when open interest is concentrated around key price levels. While long-term fundamentals remain intact, the immediate outlook points to increased market sensitivity and rapid intraday movements.

Why Options Expiry Matters

Options expiry represents a pivotal moment in derivatives markets, when contracts tied to future price expectations are either exercised or allowed to lapse. In crypto markets, where leverage and speculative positioning are more pronounced than in traditional finance, these events can amplify price movements.

The expiry of contracts worth Rs.7.1 trillion is significant by any measure. Such scale suggests substantial institutional and professional participation, increasing the likelihood of sharp moves as positions are unwound or rolled forward.

Bitcoin: Pressure Around Key Levels

Bitcoin, as the largest and most liquid digital asset, is expected to absorb the bulk of the impact. A high concentration of options near psychologically important price thresholds may intensify short-term volatility as traders attempt to defend or challenge those levels.

If spot prices drift toward areas with heavy options interest, hedging activity by market makers could exaggerate price swings. Conversely, a clean break away from these zones may reduce immediate pressure once expiry-related flows subside.

Ethereum: Sensitivity to Derivatives Flows

Ethereum’s expanding role in decentralized finance and staking has increased its exposure to derivatives trading. Options tied to Ethereum often reflect both directional bets and volatility strategies, making expiry days particularly influential.

As contracts settle, shifts in delta hedging could introduce abrupt price changes. However, Ethereum’s deepening liquidity may help absorb some of the shock, limiting extreme dislocations compared with smaller assets.

XRP: Volatility Risk Amplified

XRP, while smaller in market capitalization than Bitcoin and Ethereum, has historically shown outsized reactions during derivatives-driven events. Lower liquidity and concentrated positioning can magnify price movements when large options blocks expire.

Traders are watching closely for sudden spikes in volume, which could signal rapid repositioning. Even modest shifts in sentiment may translate into sharp percentage moves.

Investor Sentiment and Market Dynamics

Beyond individual assets, today’s expiry highlights the growing sophistication of crypto markets. Options are increasingly used for hedging rather than pure speculation, suggesting a maturing investor base. Still, short-term traders often exploit expiry-related volatility, adding another layer of complexity.

Market participants remain divided on direction, with implied volatility elevated across major tokens. This reflects uncertainty rather than conviction, a condition that often precedes sharp but short-lived moves.

What Happens After the Expiry

Once the contracts expire, markets often experience a normalization phase as temporary pressures ease. Volatility may decline, allowing prices to refocus on broader drivers such as macroeconomic conditions, regulatory signals, and network fundamentals.

However, if traders roll positions into new contracts at similar price levels, elevated volatility could persist beyond the immediate event.

Conclusion

The expiry of crypto options worth Rs.7.1 trillion places Bitcoin, Ethereum, and XRP at a moment of heightened risk and opportunity. While long-term trends remain shaped by adoption and macro forces, the short-term outlook is dominated by technical dynamics and trader behavior. For investors, today serves as a reminder that derivatives activity now plays a central role in shaping crypto market movements, making risk management as important as directional conviction.