Zcash has emerged as one of the strongest-performing digital assets of the year, delivering a year-to-date gain of 652% and sharply outperforming the broader cryptocurrency market. The rally reflects renewed investor interest in privacy-focused blockchain protocols amid evolving regulatory debates, technological upgrades, and shifting capital flows within the digital asset ecosystem. Once considered a niche… Continue reading Zcash Emerges as a Standout Performer After Surging 652% Year-to-Date

Year: 2025

Security Breach Hits Binance-Linked Crypto Wallet Extension, Losses Estimated at Rs. 58 Crore

A security breach involving a browser extension linked to a cryptocurrency wallet owned by a Binance-affiliated entity has resulted in user losses estimated at nearly Rs. 58 crore. The incident, which targeted a Google Chrome extension, has reignited concerns over the safety of browser-based crypto tools amid rising adoption of digital assets. Company executives have… Continue reading Security Breach Hits Binance-Linked Crypto Wallet Extension, Losses Estimated at Rs. 58 Crore

Trump’s Wealth Reshaped by Tech and Crypto as Conflict-of-Interest Questions Intensify

Donald Trump’s financial profile has undergone a dramatic transformation during his second presidency, with technology and cryptocurrency ventures overtaking traditional real estate as primary drivers of wealth. His net worth surged sharply in 2025, fueled by investor enthusiasm for a social media company he founded and new crypto-related initiatives launched shortly before returning to office.… Continue reading Trump’s Wealth Reshaped by Tech and Crypto as Conflict-of-Interest Questions Intensify

Crypto Markets Retreat as 2025 Gains Fade and Political Euphoria Cools

The cryptocurrency market has entered a sharp corrective phase, wiping out much of the gains accumulated earlier in 2025 and dampening optimism that had followed renewed political signaling from the United States. Digital assets that had rallied on expectations of a more crypto-friendly policy environment have retreated amid profit-taking, regulatory uncertainty, and tighter global financial… Continue reading Crypto Markets Retreat as 2025 Gains Fade and Political Euphoria Cools

Rajkot Crypto Investment Fraud Allegation Highlights Rising Risks in Informal Digital Asset Deals

A Rajkot-based businessman has approached the police alleging that he was cheated of Rs. 13.71 lakh after being lured by promises of unusually high returns on a cryptocurrency investment. The complaint names three individuals, accusing them of fraud, criminal intimidation, and caste-based abuse. According to the police filing, the transaction involved the purchase of USDT… Continue reading Rajkot Crypto Investment Fraud Allegation Highlights Rising Risks in Informal Digital Asset Deals

Cantor Fitzgerald Sees Institutional Crypto Adoption Accelerating Into 2026

Cantor Fitzgerald expects institutional adoption of cryptocurrencies to continue gaining momentum through 2026, driven by improving market infrastructure, clearer regulatory frameworks, and growing demand for diversified digital exposure. The firm’s outlook reflects a broader reassessment of crypto assets among banks, asset managers, and hedge funds that previously remained cautious. As volatility moderates and custody, compliance,… Continue reading Cantor Fitzgerald Sees Institutional Crypto Adoption Accelerating Into 2026

XRP’s Vanishing Exchange Supply Raises a Bigger Question: Is a 2026 Supply Shock on the Horizon?

XRP’s circulating supply on cryptocurrency exchanges has been steadily declining, a trend that is drawing close attention from market analysts and long-term investors. Fewer tokens available for immediate trading often signal reduced selling pressure and growing conviction among holders. As XRP continues to move off exchanges into private wallets, questions are emerging about whether a… Continue reading XRP’s Vanishing Exchange Supply Raises a Bigger Question: Is a 2026 Supply Shock on the Horizon?

XRP’s Long-Term Wealth Potential: Can a Rs.4 Lakh Investment Turn Into Rs.40 Lakh by 2030?

The prospect of turning a modest investment into a tenfold return continues to attract attention in the cryptocurrency market, with XRP once again under the spotlight. Investors are increasingly asking whether an investment of $5,000—approximately Rs.4 lakh—could realistically grow to $50,000, or about Rs.40 lakh, by 2030. The answer depends on a complex mix of… Continue reading XRP’s Long-Term Wealth Potential: Can a Rs.4 Lakh Investment Turn Into Rs.40 Lakh by 2030?

Hoskinson Pushes Back as ADA Slumps: Inside Cardano’s Sharp Correction and Market Fallout

Cardano founder Charles Hoskinson has rejected allegations that he sold large quantities of ADA near its peak, as the cryptocurrency reels from a steep correction of nearly 88 percent from its all-time high. The claims surfaced amid renewed volatility in the digital asset market, with ADA’s price sliding far below its former highs of around… Continue reading Hoskinson Pushes Back as ADA Slumps: Inside Cardano’s Sharp Correction and Market Fallout

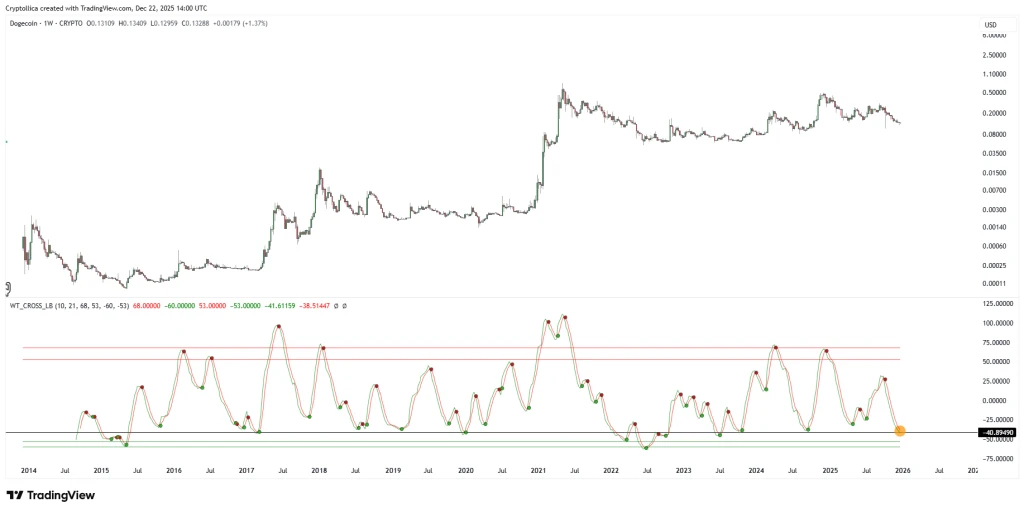

Dogecoin Mirrors 2020 Accumulation Cycle: Analysts Highlight Potential Upside

Dogecoin (DOGE) appears to be echoing its 2020 accumulation cycle, according to leading cryptocurrency analysts. Observing trading patterns, on-chain metrics, and market sentiment, experts suggest that the meme-based cryptocurrency may be entering a phase of strategic accumulation by retail and institutional investors. This phase is characterized by relatively stable price movements, reduced volatility, and growing… Continue reading Dogecoin Mirrors 2020 Accumulation Cycle: Analysts Highlight Potential Upside