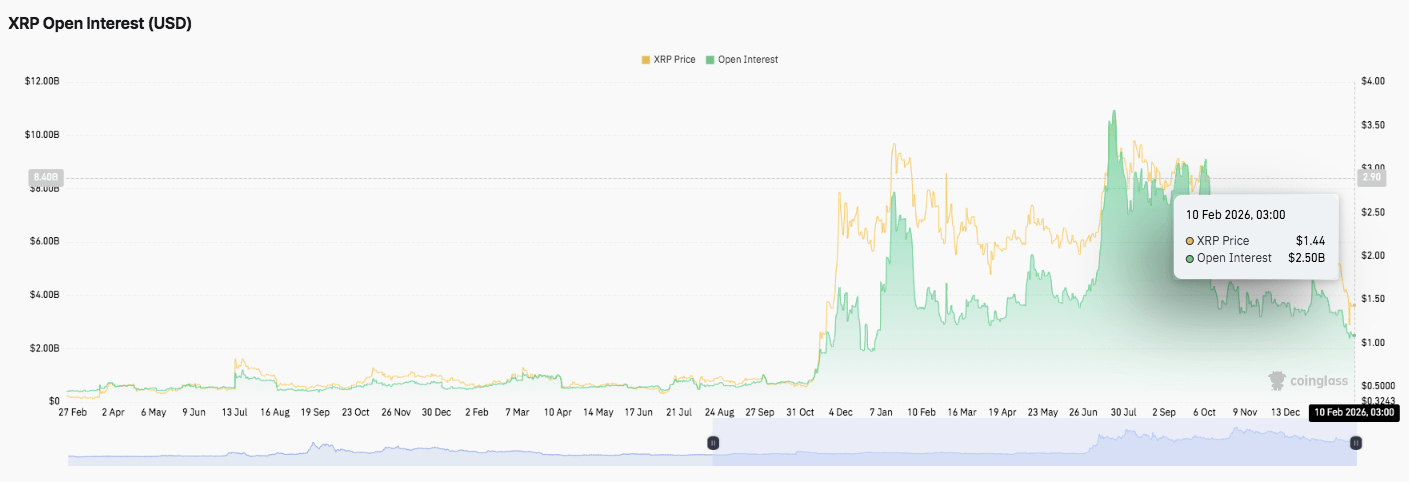

XRP remains one of the most closely monitored digital assets in the cryptocurrency market, driven by its institutional payment focus and evolving regulatory landscape. As investors assess forward-looking valuations, a central question emerges: what could 1,000 XRP be worth by the end of the first quarter of 2026? The answer depends on macroeconomic conditions, regulatory… Continue reading XRP Outlook 2026: What Could 1,000 Tokens Be Worth by the End of Q1?

Year: 2026

Solana’s High-Speed Blockchain Strategy: Scaling the Future of Decentralized Finance

Solana has emerged as one of the most technically ambitious blockchain platforms, offering high transaction throughput and minimal fees to support decentralized finance, non-fungible tokens and Web3 applications. As scalability constraints challenge legacy networks, Solana’s architecture positions it as a performance-driven alternative. Following earlier operational disruptions, network stability improvements have restored investor confidence. Venture capital… Continue reading Solana’s High-Speed Blockchain Strategy: Scaling the Future of Decentralized Finance

Digital Assets at an Inflection Point: Cryptocurrency Markets Shift From Speculation to Structural Finance

The global cryptocurrency market is undergoing a structural transformation as institutional capital, regulatory clarity and technological refinement redefine the industry’s trajectory. Once dominated by retail speculation and volatile trading cycles, digital assets are increasingly integrated into formal financial systems. Governments are advancing regulatory frameworks, asset managers are expanding crypto-linked investment products and blockchain infrastructure is… Continue reading Digital Assets at an Inflection Point: Cryptocurrency Markets Shift From Speculation to Structural Finance

XRP Navigates Regulatory Milestones as Cross-Border Payments Strategy Gains Traction

Solana Emerges as High-Performance Blockchain Challenger in Expanding DeFi Landscape

Solana has positioned itself as a high-performance blockchain network capable of supporting decentralized finance, non-fungible tokens and scalable Web3 applications. Known for low transaction fees and high throughput, the platform has attracted developers seeking efficiency and speed. Institutional interest has grown as network stability improves following earlier outages. As blockchain competition intensifies, Solana’s value proposition… Continue reading Solana Emerges as High-Performance Blockchain Challenger in Expanding DeFi Landscape

Bitcoin Strengthens Position as Digital Store of Value Amid Monetary Uncertainty

Bitcoin is reinforcing its status as a digital store of value as global monetary uncertainty intensifies. With fixed supply mechanics and decentralized governance, the asset continues to attract institutional and retail investors seeking hedges against inflation and currency debasement. Recent capital inflows into regulated investment vehicles have increased liquidity and broadened participation. While price volatility… Continue reading Bitcoin Strengthens Position as Digital Store of Value Amid Monetary Uncertainty

Global Cryptocurrency Market Enters Strategic Consolidation Phase Amid Regulatory Maturation

The global cryptocurrency market is transitioning from speculative expansion to strategic consolidation, shaped by regulatory advancements, institutional participation and evolving macroeconomic conditions. After years of volatility-driven cycles, digital assets are increasingly viewed through the lens of portfolio diversification, financial infrastructure innovation and cross-border settlement efficiency. Governments are refining oversight frameworks, while asset managers integrate crypto… Continue reading Global Cryptocurrency Market Enters Strategic Consolidation Phase Amid Regulatory Maturation

Ethereum’s Evolution: From Smart Contracts Pioneer to Institutional Blockchain Infrastructure

Ethereum continues to redefine its position within the digital asset ecosystem as it evolves from a pioneering smart contract platform into a foundational layer for decentralized finance, tokenization and enterprise blockchain integration. The network’s transition to a proof-of-stake consensus mechanism significantly reduced energy consumption while improving scalability potential. Institutional adoption is accelerating as tokenized assets,… Continue reading Ethereum’s Evolution: From Smart Contracts Pioneer to Institutional Blockchain Infrastructure

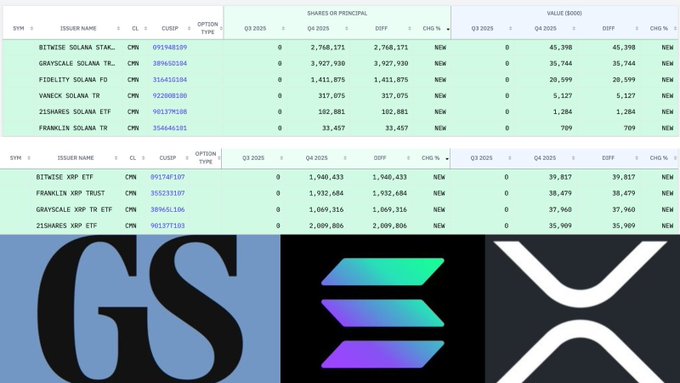

Goldman Sachs Expands Digital Asset Bet With Rs. 19,000 Crore Crypto Portfolio, Including Bitcoin and XRP

Goldman Sachs has disclosed a substantial cryptocurrency exposure valued at approximately Rs. 19,000 crore (about $2.3 billion), signaling a decisive shift in institutional engagement with digital assets. The portfolio reportedly includes significant allocations to Bitcoin and XRP, underscoring growing confidence in both established cryptocurrencies and alternative blockchain networks. The investment highlights the accelerating mainstream adoption… Continue reading Goldman Sachs Expands Digital Asset Bet With Rs. 19,000 Crore Crypto Portfolio, Including Bitcoin and XRP

Crypto Market Rout Erodes Coinbase CEO Brian Armstrong’s Fortune

Brian Armstrong, co-founder and chief executive of Coinbase, has seen his personal fortune shrink dramatically amid a sharp downturn in cryptocurrency markets and a Wall Street downgrade of Coinbase shares. Once ranked among the world’s 500 wealthiest individuals, Armstrong has fallen off a leading global rich list after his net worth declined from approximately $17.7bn… Continue reading Crypto Market Rout Erodes Coinbase CEO Brian Armstrong’s Fortune