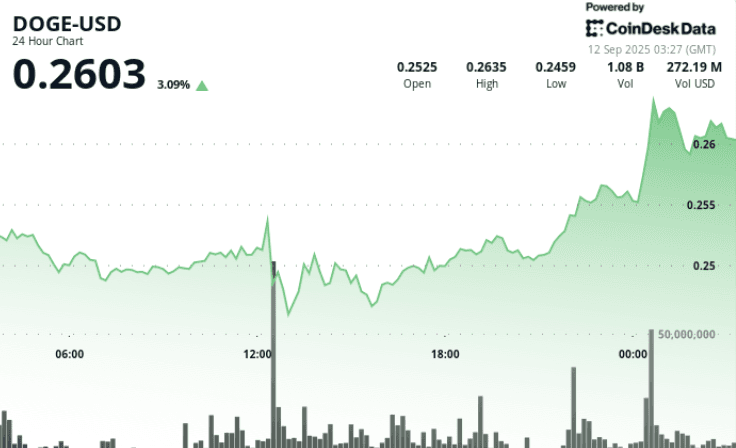

Dogecoin surged by nearly 6% in the latest trading session, buoyed by growing anticipation of a forthcoming exchange-traded fund (ETF) tied to the cryptocurrency. The prospect of an ETF has invigorated investor sentiment, with expectations that it could open the door to broader participation from retail and institutional players. Market observers note that such a product would represent a milestone for Dogecoin, long viewed as a speculative asset driven by community enthusiasm. As attention builds ahead of regulatory developments, the rally underscores the power of market expectations in shaping momentum within the volatile digital asset space.

ETF Expectations Ignite Optimism

The rally reflects mounting speculation that a Dogecoin-linked ETF could soon be introduced, following the success of similar products in the Bitcoin and Ethereum markets. An ETF would give investors a regulated, accessible channel to gain exposure to Dogecoin without the complexities of direct custody.

For many traders, this could transform Dogecoin’s profile, shifting it from a meme-inspired token toward an asset with more structured investment pathways. The potential development also raises questions about how much institutional capital could flow into the token once an ETF framework is in place.

Market Performance and Price Drivers

Dogecoin’s price advance highlights the market’s sensitivity to news of financial innovation. While a 6% jump may seem modest compared to past rallies, it signals renewed confidence after a period of subdued trading activity. Analysts suggest that the anticipation of regulatory approval, combined with Dogecoin’s enduring retail following, could create the conditions for further upside if momentum continues.

The rise also comes at a time when overall cryptocurrency markets are displaying heightened volatility, amplifying the impact of any positive news on asset prices.

Implications for Broader Crypto Adoption

The possibility of a Dogecoin ETF underscores the growing acceptance of cryptocurrencies within mainstream finance. Should approval be granted, it would mark another step in bridging digital assets with traditional investment vehicles, potentially broadening market depth and liquidity.

For institutions, an ETF could serve as a lower-risk entry point to engage with Dogecoin, while retail investors would benefit from the accessibility and oversight provided by regulated products. Beyond price movement, the event would symbolize the continued legitimization of meme-driven assets in the global financial system.

Outlook: Momentum Meets Uncertainty

While optimism remains strong, uncertainty lingers over the timing and scope of a potential ETF launch. Regulatory scrutiny, market conditions, and investor demand will determine whether Dogecoin’s latest surge can be sustained. Traders are advised to monitor both technical indicators and policy signals, as the token’s performance will likely remain tied to these developments.

Ultimately, Dogecoin’s 6% rally ahead of the anticipated ETF launch demonstrates the market’s readiness to embrace new investment structures. Whether this enthusiasm translates into lasting gains depends on the interplay between regulatory approval and the depth of investor commitment.