Dogecoin (DOGE) appears to be echoing its 2020 accumulation cycle, according to leading cryptocurrency analysts. Observing trading patterns, on-chain metrics, and market sentiment, experts suggest that the meme-based cryptocurrency may be entering a phase of strategic accumulation by retail and institutional investors. This phase is characterized by relatively stable price movements, reduced volatility, and growing investor confidence ahead of potential bullish momentum. Analysts caution that while historical patterns provide guidance, market conditions remain influenced by broader crypto trends, macroeconomic factors, and regulatory developments. Dogecoin’s renewed accumulation signals heightened investor interest and the potential for an upward trajectory in the coming months.

Current Accumulation Trends

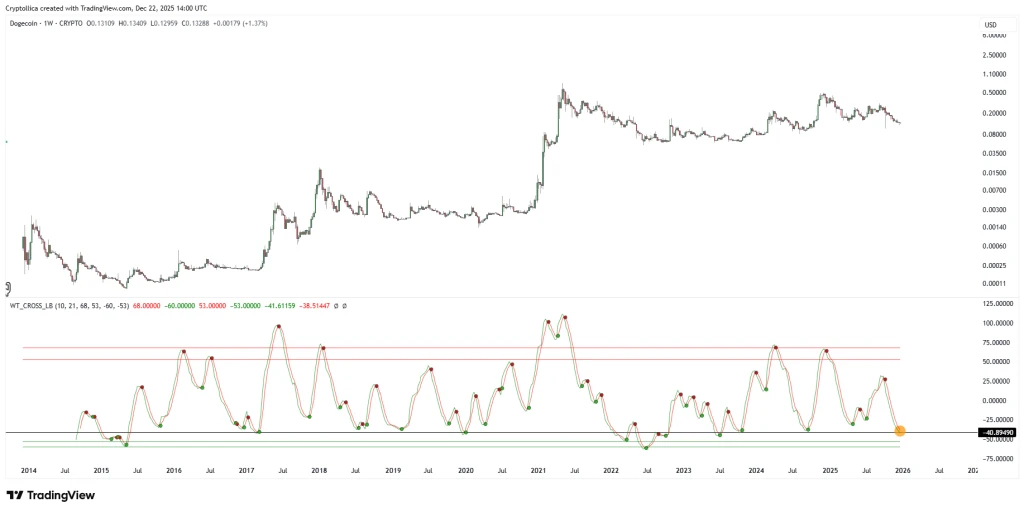

Data indicates that DOGE holders are increasingly adopting a long-term holding strategy. Wallet activity shows reduced selling pressure, while the average balance of holding addresses has risen. Analysts interpret this as a repeat of the 2020 cycle, when similar accumulation preceded significant price surges.

Investor Behavior and Market Sentiment

The accumulation phase is accompanied by growing optimism among retail investors and emerging interest from institutional participants. Social media activity, sentiment indices, and trading volume suggest that market participants are positioning for potential upward momentum. Historically, such accumulation phases have served as precursors to significant rallies in Dogecoin’s price trajectory.

Technical Indicators and Historical Context

Technical analysis highlights parallels with 2020, including relative strength patterns, support levels, and moving average convergence. Analysts note that while historical cycles provide context, DOGE’s future performance remains sensitive to overall cryptocurrency market dynamics, regulatory developments, and macroeconomic conditions.

Implications for Traders and Investors

For traders, the current accumulation phase may present opportunities for strategic entry points ahead of potential bullish trends. Long-term holders may view this period as an ideal time to strengthen positions. Analysts emphasize caution, advising investors to balance historical insights with real-time market signals.

Conclusion

Dogecoin’s current market behavior reflects a potential repeat of its 2020 accumulation cycle, suggesting renewed investor confidence and strategic positioning. While market volatility and external factors can influence outcomes, this phase underscores DOGE’s evolving role as both a cultural and financial asset in the cryptocurrency landscape.