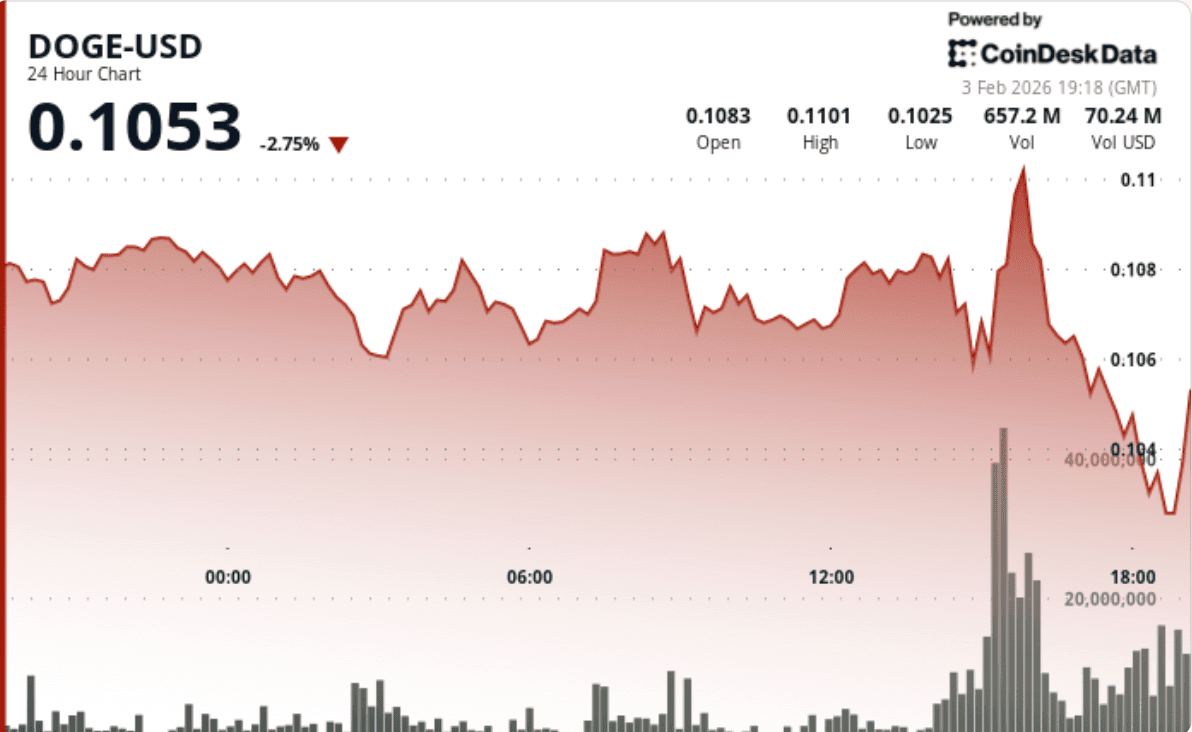

Dogecoin declined about 7 percent as investors pulled back from higher-risk digital assets, reflecting broader caution across cryptocurrency markets. The sell-off also affected tokens linked to the Ethereum ecosystem, highlighting how interconnected sentiment has become within the crypto sector. Analysts attribute the downturn to a global shift toward safer assets amid macroeconomic uncertainty and profit-taking after recent rallies. While meme-based and alternative tokens tend to amplify market moves, the episode underscores persistent volatility across digital assets. Despite the pullback, long-term supporters argue that market corrections are typical in crypto cycles and often precede periods of renewed consolidation and growth.

Dogecoin Retreats Amid Broader Market Caution

Dogecoin, one of the most widely recognized meme-inspired cryptocurrencies, fell roughly 7 percent as investors reduced exposure to speculative assets. The decline coincided with a broader shift in market sentiment, where traders favored defensive positioning over high-volatility holdings.

Such risk-off phases typically affect digital assets more sharply than traditional financial instruments. Tokens that are driven heavily by social momentum and retail participation often experience amplified price swings when sentiment turns negative.

Ethereum-Linked Tokens Also Under Pressure

The downturn extended beyond Dogecoin, affecting several tokens associated with the Ethereum ecosystem. These assets, often tied to decentralized finance platforms, gaming projects and blockchain-based applications, tend to move in tandem with broader crypto market trends.

When investor confidence wanes, liquidity can thin quickly in these segments, intensifying price declines. The synchronized movement reflects how closely digital asset markets are interconnected, with sentiment often spreading rapidly from major cryptocurrencies to smaller, ecosystem-driven tokens.

Risk-Off Mood Drives Short-Term Selling

Market participants point to a combination of macroeconomic concerns and recent profit-taking as key drivers behind the pullback. Uncertainty around global growth, interest rate expectations and regulatory developments has prompted investors to reassess risk-heavy positions.

In such environments, cryptocurrencies frequently experience outsized reactions compared with traditional equities or commodities. Traders seeking to preserve capital often rotate into less volatile assets, triggering swift declines across speculative markets.

Volatility Remains a Defining Feature

The latest drop serves as another reminder that volatility remains intrinsic to the cryptocurrency sector. Assets like Dogecoin, which originally gained prominence through online communities and viral enthusiasm, can see sharp moves in both directions within short periods.

While these swings can unsettle short-term traders, long-term participants note that periodic corrections are a recurring part of digital asset cycles. Historically, market pullbacks have been followed by phases of consolidation that lay the groundwork for future growth.

Outlook for the Crypto Market

Whether the current downturn proves temporary or evolves into a longer correction will likely depend on broader economic conditions and shifts in investor confidence. Stabilizing macro signals and clearer regulatory frameworks could help restore appetite for digital assets.

For now, the slide in Dogecoin and Ethereum-linked tokens illustrates the sensitivity of crypto markets to changing risk perceptions. As the sector matures, such episodes continue to test both investor conviction and the resilience of the broader digital asset ecosystem.