Elon Musk, CEO of Tesla and SpaceX, recently shared insights on XRP’s supply and demand dynamics through his Grok platform, drawing attention from cryptocurrency investors and analysts alike. Musk highlighted the importance of liquidity, token distribution, and long-term holding trends in shaping XRP’s market behavior. Market participants are closely examining his commentary for implications on price volatility and potential investment strategies. Analysts note that Musk’s observations may influence retail sentiment and trading activity, particularly in a market where social signals and prominent endorsements can trigger notable shifts in demand, impacting both short-term pricing and long-term adoption trajectories.

Musk’s Perspective on Supply and Demand

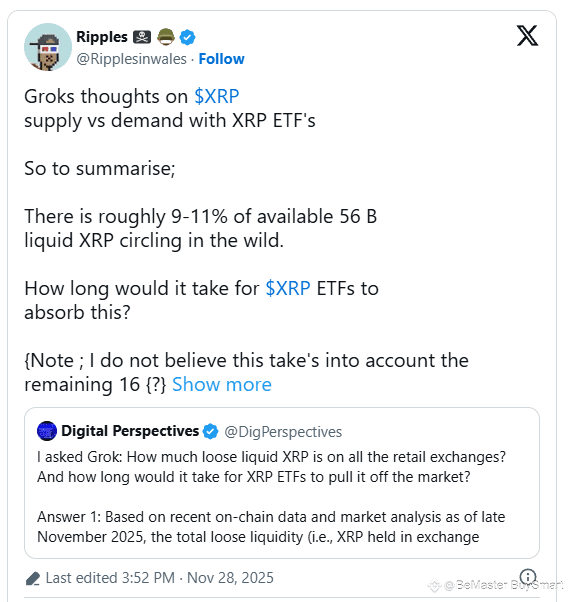

Elon Musk emphasized the critical role that circulating supply and token availability play in determining market stability. According to his analysis, the balance between XRP held in private wallets versus tokens available on exchanges directly affects liquidity and short-term volatility.

He suggested that concentrated holdings among large investors—or “whales”—can magnify price movements, making it crucial for traders to monitor wallet activity and off-exchange storage trends.

Implications for Price Movements

Musk’s insights underline how supply constraints, combined with demand from retail and institutional participants, can influence XRP price behavior. Reduced availability on exchanges may create scarcity-driven upward pressure, while increased sell-offs by major holders could prompt sharp declines.

Technical analysts argue that Musk’s commentary reinforces the importance of tracking support and resistance levels, order book depth, and trading volumes to anticipate potential market swings.

Investor Sentiment and Market Signals

Given Musk’s influence on cryptocurrency communities, his observations are likely to impact retail investor sentiment, potentially triggering speculative trading activity. Market observers note that social signals from high-profile figures often accelerate trends, especially in altcoins like XRP, which are sensitive to public perception and hype cycles.

Analysts recommend that traders interpret such commentary as a factor among many, balancing it with broader market fundamentals and regulatory considerations.

Broader Market Implications

Beyond immediate price effects, Musk’s discussion highlights structural factors affecting XRP’s long-term adoption, including:

- Token Distribution: Ensuring a balanced spread of holdings to prevent excessive market influence by a few entities.

- Liquidity Management: Adequate supply on exchanges to support efficient trading and reduce volatility.

- Strategic Holding Trends: Long-term investor behavior as a stabilizing force in the market.

These elements collectively shape XRP’s market resilience and investment appeal.

Conclusion

Elon Musk’s commentary on XRP supply and demand provides a nuanced lens for understanding market mechanics, emphasizing liquidity, token distribution, and investor behavior. While his insights may influence short-term sentiment and trading activity, long-term market stability will depend on a combination of adoption trends, regulatory clarity, and balanced token availability. Investors and analysts are advised to integrate such perspectives with technical and fundamental analysis to navigate XRP’s evolving landscape strategically.