Ethereum, the world’s second-largest cryptocurrency by market capitalization, faces a challenging path toward the $3,900 mark as investor sentiment wanes and market demand softens. After a period of strong price appreciation, the asset is encountering resistance, with trading volumes tapering and speculative interest declining. Analysts point to a combination of macroeconomic factors, regulatory uncertainty, and profit-taking behavior that is restraining upward momentum. While Ethereum’s underlying network and adoption remain robust, short-term price trajectories suggest cautious market conditions. Traders and investors are closely monitoring support levels, technical indicators, and liquidity flows to gauge whether a recovery or extended consolidation lies ahead.

Cooling Market Sentiment Weighs on Ethereum

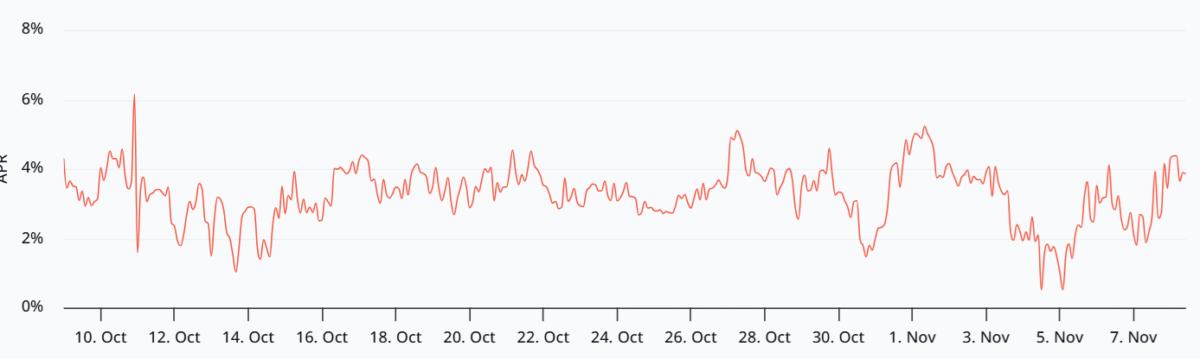

Ethereum’s recent price dynamics reflect a broader shift in investor psychology. As gains have accumulated, sentiment indicators such as trading volume, social media chatter, and derivative positioning suggest diminishing bullish conviction. Market participants appear increasingly selective, favoring quality exposure and risk management over aggressive speculation. Analysts warn that this sentiment slowdown could constrain short-term rallies, highlighting the importance of monitoring market mood alongside technical signals.

Demand Dynamics and Liquidity Pressures

Despite Ethereum’s widespread adoption and continued network growth, demand-side factors are exerting pressure. Reduced inflows from retail investors and cautious institutional participation have contributed to declining liquidity in key trading pairs. Profit-taking by early adopters and momentum traders further limits buying pressure at higher price points. Observers note that unless demand rebounds, Ethereum may experience a prolonged consolidation phase rather than a sustained move toward $3,900.

Macro and Regulatory Considerations

Ethereum’s price trajectory is also influenced by macroeconomic conditions and regulatory signals. Interest-rate expectations, global liquidity trends, and potential oversight from financial authorities can impact risk appetite and capital allocation in crypto markets. Analysts suggest that while Ethereum’s network fundamentals remain strong, external factors may delay breakout attempts, emphasizing the need for cautious positioning and adaptive strategies.

Technical Outlook and Support Levels

From a technical perspective, Ethereum faces critical resistance zones near $3,900, with immediate support levels offering potential stabilization around lower benchmarks. Short-term charts indicate that momentum oscillators and trading volume patterns could dictate the pace of recovery or consolidation. Traders are advised to track key indicators, including moving averages, relative strength indices, and on-chain activity, to anticipate potential trend reversals.

Conclusion: A Cautious Path Forward

Ethereum’s journey toward $3,900 is contingent on a combination of renewed buying interest, sentiment recovery, and supportive macro conditions. While the cryptocurrency’s long-term fundamentals remain compelling, short-term price movements underscore a cautious market environment. Investors and traders are likely to adopt disciplined risk management, balancing optimism about Ethereum’s growth with prudence in the face of market headwinds.