Kraken, one of the world’s leading cryptocurrency exchanges, is openly challenging recent UK regulatory measures that the company claims could stifle innovation and limit market access. The CEO argues that overly restrictive frameworks threaten the growth of digital asset markets and discourage international investment. This confrontation highlights ongoing tensions between regulators seeking investor protection and industry leaders advocating for innovation-friendly policies. With the UK aiming to establish itself as a global fintech hub, Kraken’s criticisms underscore broader concerns about balancing compliance, market growth, and technological advancement in the rapidly evolving crypto landscape.

Kraken’s Stance on UK Regulations

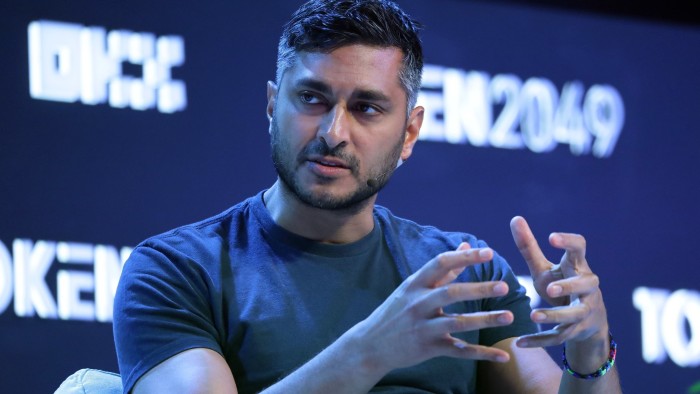

Kraken’s CEO has publicly voiced strong opposition to recent UK crypto regulations, arguing that they impose unnecessary restrictions on digital asset exchanges. The company contends that these measures could reduce operational flexibility, limit product offerings, and make the UK less attractive to international investors. The criticism reflects broader industry concerns that regulatory frameworks, while aimed at protecting consumers, may inadvertently hinder innovation and market competitiveness.

Impact on the Cryptocurrency Market

The UK’s regulatory environment has evolved to increase investor safeguards, requiring exchanges to adhere to strict compliance protocols, including anti-money laundering (AML) and know-your-customer (KYC) standards. While these measures aim to mitigate risk, Kraken warns that excessive bureaucracy could push businesses and investors toward more permissive jurisdictions. Market observers note that balancing regulatory oversight with industry growth is critical to maintain the UK’s position as a global crypto hub.

Global Regulatory Tensions

Kraken’s criticisms highlight a larger global debate: how to regulate cryptocurrencies without stifling innovation. Exchanges worldwide are navigating a patchwork of rules, with differing standards in the US, Europe, and Asia. Industry leaders emphasize the need for flexible, innovation-friendly frameworks that allow market expansion while safeguarding investor interests.

Potential Implications for Investors

For UK-based investors, stricter rules could mean fewer product offerings and limited access to emerging digital assets. Conversely, international exchanges may find regulatory arbitrage opportunities in jurisdictions with lighter oversight. Analysts suggest that companies like Kraken may increasingly prioritize markets that balance security, compliance, and growth potential, potentially affecting liquidity and adoption within the UK market.

Conclusion

Kraken’s CEO critique underscores the delicate tension between innovation and regulation in the cryptocurrency sector. While the UK seeks to protect investors, industry leaders warn that overly restrictive policies may drive businesses and capital abroad. The coming months will be pivotal in shaping the UK’s crypto landscape, testing whether policymakers can harmonize consumer protection with sustainable market growth.