In a landmark ruling that could redefine India’s digital financial ecosystem, the Madras High Court has formally recognized cryptocurrency as a legitimate form of property under Indian law. The decision, delivered by Justice N. Anand Venkatesh, establishes that cryptocurrencies possess all attributes of property—capable of being owned, enjoyed, and held in trust. This judgment, which emerged from a dispute involving frozen XRP tokens, represents a significant legal turning point, offering investors newfound protection while compelling regulators to address the growing complexities of digital asset governance in the country.

Court Ruling and Context

The Madras High Court’s decision comes as part of a legal dispute concerning 3,532.30 XRP tokens allegedly transferred without authorization through the WazirX exchange. The petitioner had purchased the cryptocurrency via a Chennai-based bank account, prompting the court to affirm its jurisdiction over the matter despite WazirX’s ongoing restructuring under Singaporean administration.

Justice Venkatesh, in his ruling, declared that cryptocurrency qualifies as “property” under Section 2(47A) of the Income Tax Act, 1961. The court emphasized that digital assets, though intangible, exhibit characteristics of ownership and value akin to traditional property. Consequently, the court ruled that crypto assets are subject to the same protections, rights, and obligations that govern other property forms in India.

This judgment marks the first time an Indian court has explicitly categorized cryptocurrency as property, creating a legal foundation for ownership rights, taxation, and fiduciary responsibility within the digital asset market.

A Turning Point for Indian Cryptocurrency Law

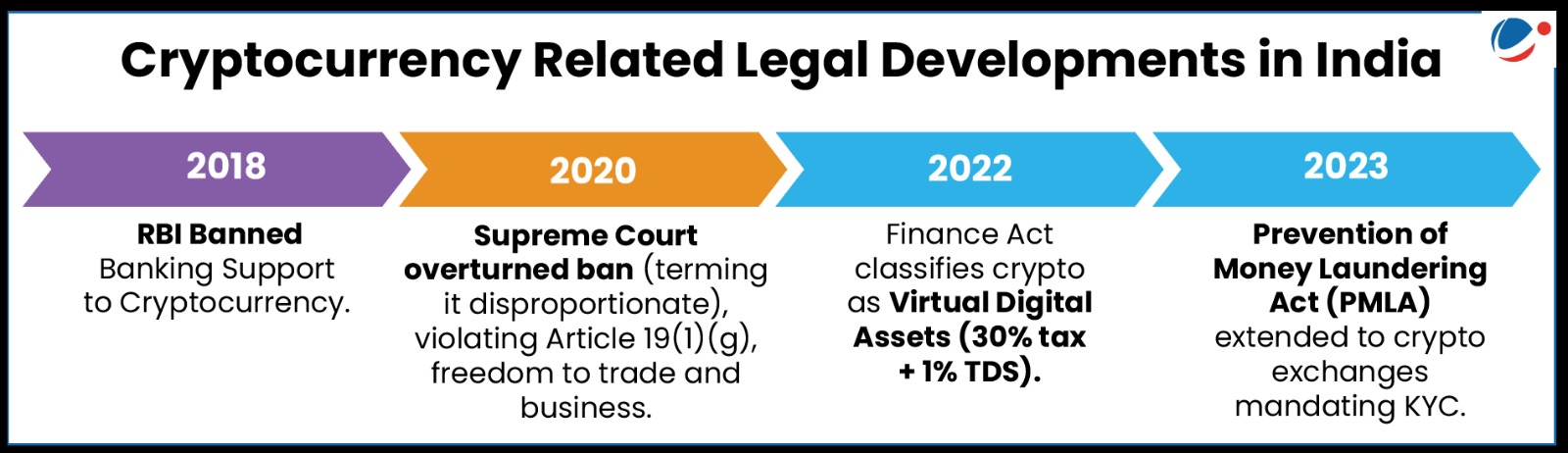

For years, India’s regulatory stance on cryptocurrency has been characterized by ambiguity. While the Reserve Bank of India (RBI) does not consider digital tokens as legal tender, neither has it declared them unlawful to own or trade. The absence of a clear classification framework has often left investors vulnerable and exchanges uncertain about compliance requirements.

The Madras High Court’s declaration provides long-awaited judicial clarity. By treating cryptocurrencies as property, the court effectively integrates them into the country’s existing legal infrastructure—bridging the gap between traditional asset ownership and emerging digital finance. Legal experts suggest that this recognition could form the basis for future tax guidelines, anti-fraud measures, and asset recovery procedures involving cryptocurrencies.

Implications for Investors and Crypto Platforms

The ruling carries significant implications for both retail investors and crypto platforms operating in India.

For investors, the decision offers enhanced legal protection over their holdings. In the event of hacking, fraud, or exchange insolvency, crypto assets will now enjoy the same level of legal recourse available to holders of other forms of property. This may also improve investor confidence and encourage wider participation in the digital asset market.

For exchanges and custodial entities, however, the judgment introduces greater fiduciary responsibility. Platforms that hold users’ crypto assets may now be viewed as trustees, legally obligated to safeguard those holdings and ensure transparency in their management. This could lead to stricter compliance standards and internal audits to protect customer funds.

Economic and Regulatory Repercussions

The High Court’s decision arrives at a critical juncture in India’s financial policy landscape. The government has already imposed a 30% tax on crypto income and a 1% TDS on transactions, signaling its intent to monitor the sector closely. Recognizing cryptocurrencies as property could now influence how taxation, valuation, and reporting frameworks evolve in the coming years.

From a macroeconomic standpoint, this ruling could pave the way for institutional adoption. Asset management firms, venture investors, and fintech enterprises may now explore crypto-linked products or investment vehicles within a clearer legal structure. It also places pressure on policymakers to finalize a comprehensive regulatory bill that aligns with this judicial interpretation.

Challenges Ahead

Despite its progressiveness, the ruling leaves several questions unanswered. The lack of a uniform regulatory framework continues to pose challenges regarding cross-border transactions, exchange compliance, and taxation consistency. Additionally, enforcement in cases involving foreign-based platforms remains complex, as crypto assets can move across jurisdictions with minimal traceability.

Another emerging challenge is valuation. Determining the fair market value of volatile digital assets for legal or tax purposes will require the government and financial regulators to establish standardized mechanisms. Furthermore, while this ruling recognizes crypto as property, it does not equate it to legal tender—meaning it cannot yet be used for mainstream transactions or settlement of debts.

Conclusion

The Madras High Court’s recognition of cryptocurrency as property represents a historic leap forward for India’s digital finance jurisprudence. It provides clarity to investors, accountability to exchanges, and direction to policymakers navigating the complexities of the virtual asset economy.

While challenges around taxation, regulation, and enforcement persist, this decision lays the groundwork for India’s evolution toward a more structured and secure digital asset market. As the global crypto landscape matures, India’s judiciary has now set a precedent that blends innovation with legal legitimacy—signaling that the country is prepared to engage with the future of finance on its own terms.