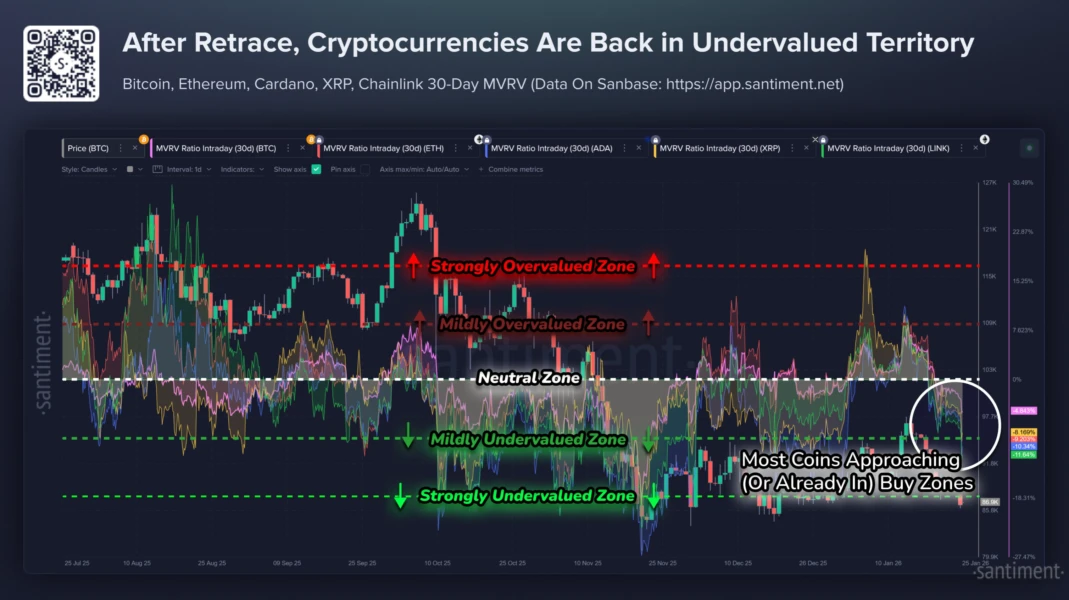

Fresh blockchain data indicates that XRP and Ethereum may be trading below their historical fair-value ranges, according to analysis of the Market Value to Realized Value (MVRV) metric. This on-chain indicator, widely used to gauge investor profitability and market sentiment, shows both assets hovering in zones that have previously preceded price recoveries. The development comes amid broader cryptocurrency market consolidation, with traders weighing macroeconomic uncertainty and regulatory signals. Analysts say subdued valuations could attract long-term investors seeking discounted entry points, though short-term volatility remains a risk as liquidity conditions and speculative appetite continue to shape digital asset performance worldwide.

Understanding the MVRV Indicator

The Market Value to Realized Value ratio compares a cryptocurrency’s current market capitalization with the value of coins at the price they last moved on-chain. When the ratio falls below historical norms, it often signals that many holders are at or near a loss, reducing selling pressure and creating conditions for potential accumulation.

For XRP and Ethereum, recent readings place both assets in what analysts describe as “undervalued zones,” levels historically associated with medium- to long-term recovery phases rather than late-stage bull market exuberance.

XRP: Discounted Amid Legal and Market Overhang

XRP’s valuation has faced persistent headwinds from regulatory uncertainty and fluctuating investor sentiment. Despite periods of strong price momentum, the asset has struggled to maintain sustained rallies.

On-chain data now suggests that a significant portion of XRP holders are holding at marginal profit or loss levels. Historically, such conditions have coincided with accumulation by longer-term investors who view depressed prices as opportunities. However, analysts caution that regulatory developments and broader market liquidity remain key variables that could influence recovery speed.

Ethereum: Cooling Momentum, Strong Fundamentals

Ethereum, the second-largest cryptocurrency by market capitalization, has also entered a lower MVRV range after months of uneven performance. Slower network activity growth and cautious investor positioning have weighed on price action despite continued development in decentralized finance and tokenization initiatives.

Lower profitability among holders may reduce the likelihood of aggressive selling, creating a more stable base for gradual recovery. Analysts note that Ethereum’s role as the backbone of multiple blockchain applications supports its long-term demand profile, even as short-term sentiment remains fragile.

Market Context Matters

While MVRV readings can highlight valuation extremes, they do not guarantee immediate price reversals. Broader macroeconomic forces, including interest rate expectations and global risk appetite, continue to influence capital flows into digital assets.

Periods of undervaluation can persist if external pressures outweigh internal network strength. As a result, investors are increasingly combining on-chain indicators with macro and technical analysis to build a more comprehensive market outlook.

Investor Sentiment and Accumulation Trends

Historically, undervaluation signals have drawn the attention of patient investors seeking asymmetric risk-reward opportunities.

Accumulation phases often occur quietly, marked by reduced volatility and gradual increases in long-term holdings rather than sharp price spikes.

If accumulation strengthens, XRP and Ethereum could see improving price stability before any sustained upward movement develops. Market participants will be watching trading volumes and wallet activity for confirmation of renewed demand.

Outlook for the Months Ahead

The shift of XRP and Ethereum into historically undervalued territory adds a notable dimension to the current market cycle. While near-term uncertainty persists, on-chain data suggests the downside may be increasingly limited compared with earlier periods of elevated profitability.

Whether these signals translate into recovery will depend on investor confidence, regulatory clarity, and broader economic conditions. For now, the data points to a market environment where caution and opportunity coexist, offering selective entry points for long-term-focused participants.