A sophisticated social-engineering attack has resulted in the theft of $282 million in cryptocurrency from a single victim, marking one of the largest known personal losses in the digital asset ecosystem. Unlike traditional hacks that exploit software vulnerabilities, this incident relied on psychological manipulation to gain control over private credentials. The breach underscores the growing… Continue reading Rs-Freefall Trust: Social Engineering Scam Drains $282 Million in One of Crypto’s Largest Personal Heists

BitGo’s IPO Move Rekindles Debate as Crypto Public Listings Deliver Mixed Results in 2025

Crypto custody firm BitGo has filed for an initial public offering, reigniting attention on how cryptocurrency-linked companies have performed in public markets. The filing comes after a year in which digital-asset firms delivered uneven results post-listing, reflecting both renewed investor interest and persistent volatility in the sector. While regulatory clarity and institutional adoption improved sentiment… Continue reading BitGo’s IPO Move Rekindles Debate as Crypto Public Listings Deliver Mixed Results in 2025

Budget 2026 Puts Spotlight on Crypto as Industry Seeks Tax Relief and Regulatory Clarity

As preparations for Budget 2026 gather pace, India’s cryptocurrency industry is intensifying calls for clearer regulations and a more balanced tax framework. Market participants argue that current policies, particularly the 1% tax deducted at source (TDS) on crypto transactions, have constrained liquidity and driven trading activity offshore. Industry stakeholders are urging the government to rationalise… Continue reading Budget 2026 Puts Spotlight on Crypto as Industry Seeks Tax Relief and Regulatory Clarity

Inside India’s Crypto KYC Framework: How Exchanges Screen Users in a Regulated Digital Market

As India tightens oversight of digital assets, Know Your Customer (KYC) compliance has become central to how crypto exchanges operate. Platforms are now required to follow stringent identity verification and anti-money laundering norms, reshaping the user onboarding process. From document verification to transaction monitoring, exchanges are deploying layered checks to align with regulatory expectations while… Continue reading Inside India’s Crypto KYC Framework: How Exchanges Screen Users in a Regulated Digital Market

GainBitcoin Probe Takes Dramatic Turn as Auditor Arrested Over Rs 30 Crore Crypto Asset Diversion

The long-running GainBitcoin cryptocurrency fraud investigation has taken a startling turn with the arrest of a forensic audit firm official accused of siphoning off digital assets seized during the probe. Mumbai Police allege that the accused acted in collusion with certain law enforcement personnel to divert cryptocurrency worth nearly Rs 30 crore. The case, which… Continue reading GainBitcoin Probe Takes Dramatic Turn as Auditor Arrested Over Rs 30 Crore Crypto Asset Diversion

Solana Shows Resilience as Meme Coins Swing Wildly in a Fragmented Crypto Market

Solana has maintained relative price stability even as meme-based cryptocurrencies experience sharp and unpredictable fluctuations, highlighting a growing divide within digital asset markets. The divergence reflects shifting investor priorities, with capital increasingly favoring networks supported by strong fundamentals, real-world use cases, and active developer ecosystems. While meme coins continue to attract speculative interest driven by… Continue reading Solana Shows Resilience as Meme Coins Swing Wildly in a Fragmented Crypto Market

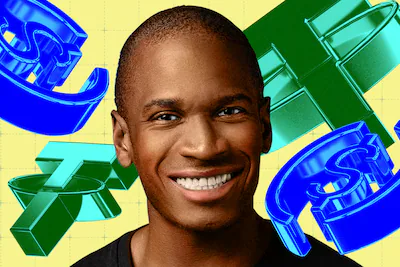

Arthur Hayes Doubles Down on Crypto as Startups Secure Rs. 4,880 Crore in Fresh Capital

A renewed wave of optimism is sweeping through the digital asset industry as prominent crypto investor Arthur Hayes increases his exposure to the sector, coinciding with a strong rebound in venture funding. Crypto startups collectively raised $588 million, or roughly Rs. 4,880 crore, signaling renewed institutional confidence after a prolonged period of caution. The fundraising… Continue reading Arthur Hayes Doubles Down on Crypto as Startups Secure Rs. 4,880 Crore in Fresh Capital

Choosing a Crypto Trading App in India: Key Factors Investors Must Weigh Carefully

As cryptocurrency adoption continues to rise in India, the choice of a trading app has become a critical decision for retail and professional investors alike. With dozens of platforms offering access to digital assets, differences in security standards, regulatory compliance, fees, liquidity, and user experience can significantly affect outcomes. Investors must look beyond flashy features… Continue reading Choosing a Crypto Trading App in India: Key Factors Investors Must Weigh Carefully

X Tightens Crypto Rules as Musk-Led Platform Moves Against ‘InfoFi’ Spam

X, the social media platform owned by Elon Musk, has intensified its moderation of crypto-related content by banning several so-called “InfoFi” projects accused of flooding the platform with low-quality, automated posts and reply spam. The action reflects growing concern over the misuse of artificial intelligence to manipulate engagement and promote speculative tokens under the guise… Continue reading X Tightens Crypto Rules as Musk-Led Platform Moves Against ‘InfoFi’ Spam

A Practical Guide to Depositing Cryptocurrency on Stake

As cryptocurrency adoption continues to expand across digital platforms, understanding how to securely deposit crypto has become essential for users. Stake, a popular crypto-based entertainment platform, allows users to fund their accounts using multiple digital assets through a streamlined process. Depositing cryptocurrency involves selecting the desired token, generating a unique wallet address, and transferring funds… Continue reading A Practical Guide to Depositing Cryptocurrency on Stake