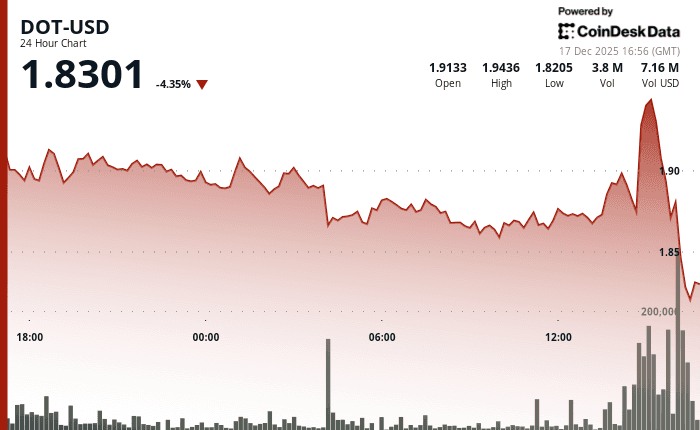

Polkadot’s native token, DOT, experienced a 3% drop to $1.83 as the broader cryptocurrency market faced a reversal after a period of upward momentum. Analysts cite a combination of profit-taking, regulatory uncertainty, and a cautious investor sentiment as contributing factors to the pullback. Despite the decline, Polkadot’s underlying ecosystem—known for its interoperability, parachain architecture, and cross-chain scalability—remains structurally sound, with ongoing network developments and partnerships supporting long-term prospects. The recent dip highlights the volatility inherent in digital assets, emphasizing the importance of both technical fundamentals and macro-level factors in shaping short-term market performance.

Market Dynamics Behind DOT’s Decline

DOT’s 3% drop reflects broader corrective pressure across major cryptocurrencies. Investors reportedly took profits after recent rallies, leading to temporary selling pressure. Additionally, regulatory developments in key jurisdictions have created uncertainty, influencing market sentiment.

The decline aligns with a wider trend in the crypto market, where altcoins often amplify movements driven by Bitcoin and Ethereum. DOT’s price movement underscores the sensitivity of interoperable blockchain projects to both sector-wide and macroeconomic cues.

Polkadot’s Ecosystem Fundamentals

Despite short-term volatility, Polkadot’s network fundamentals remain robust. Its unique parachain architecture facilitates interoperability between multiple blockchains, allowing developers to deploy decentralized applications (dApps) across interconnected networks.

Ongoing developments, such as new parachain auctions, network upgrades, and strategic partnerships, continue to strengthen the ecosystem. These initiatives suggest that long-term value creation may persist even during temporary market corrections.

Technical Analysis and Market Sentiment

Market analysts highlight that DOT’s current price sits near support levels observed in recent months. Technical indicators suggest potential consolidation before a resumption of upward momentum, provided broader market conditions stabilize.

Investor sentiment remains mixed, with cautious optimism regarding Polkadot’s scalability and governance model counterbalanced by general crypto market volatility.

Regulatory and Macro Considerations

Global regulatory discussions around digital assets continue to impact market behavior. Increased scrutiny of exchanges, stablecoins, and cross-border transactions can influence short-term pricing, even for well-established networks like Polkadot.

Macroeconomic factors, including interest rate policies and investor appetite for risk assets, also play a role in shaping crypto price dynamics.

Outlook for DOT

While short-term price fluctuations may persist, Polkadot’s long-term trajectory benefits from its technological innovations, growing developer ecosystem, and commitment to cross-chain interoperability. Investors are advised to weigh both technical and fundamental factors when assessing market movements.

Conclusion

DOT’s 3% pullback to $1.83 underscores the inherent volatility of crypto markets and the influence of regulatory and macroeconomic pressures. However, Polkadot’s strong network infrastructure and ongoing ecosystem development provide a foundation for long-term resilience. For investors, the correction offers both a reminder of short-term risks and a potential opportunity to engage with a blockchain project positioned for scalable, cross-chain growth.