In a development stirring significant interest within the cryptocurrency community, Ripple’s Chief Technology Officer (CTO) has made comments interpreted by many as a subtle indication that XRP could one day evolve into the world’s reserve currency. While not an explicit declaration, the CTO’s remarks have fueled discussions about Ripple’s strategic vision, the future of cross-border finance, and the broader debate over whether digital assets could eventually challenge traditional reserve currencies like the U.S. dollar. This article examines the implications of the statement, Ripple’s positioning in global finance, and the feasibility of XRP serving such a monumental role.

The CTO’s Subtle Statement and Its Interpretation

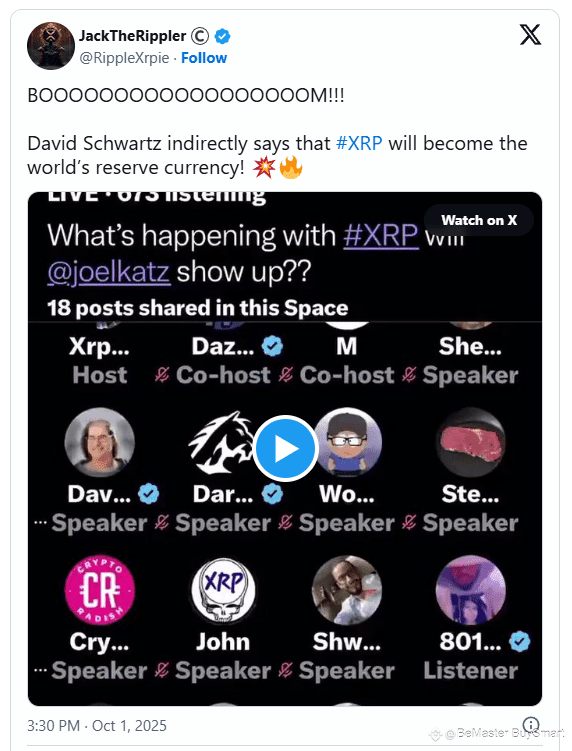

The remarks, though indirect, have been received by the XRP community as a strong affirmation of Ripple’s long-term ambition. By suggesting that XRP possesses the infrastructure and scalability to operate on a global scale, the CTO sparked speculation about its potential as a reserve asset in international markets. The statement reflects Ripple’s ongoing strategy of positioning XRP not merely as a digital token for transactions but as a critical instrument in modernizing cross-border settlement systems.

Ripple’s Position in Global Financial Infrastructure

Ripple has long pursued partnerships with financial institutions, central banks, and payment providers to integrate XRP into global payment systems. Its blockchain-based technology is designed to enhance transaction speed, reduce costs, and improve liquidity for cross-border transfers. Unlike speculative cryptocurrencies, Ripple has consistently emphasized utility, focusing on creating solutions for institutional adoption. This sets XRP apart as a contender in discussions about reserve assets, though the leap from widespread utility to official reserve status remains vast.

The Reserve Currency Question

Becoming a reserve currency requires more than technological efficiency; it demands geopolitical trust, stability, regulatory clarity, and widespread institutional acceptance. Historically, the U.S. dollar achieved this role through its dominance in global trade, its integration into international debt markets, and the credibility of the American financial system. For XRP to occupy a similar position, it would require not only central bank adoption but also a framework of global governance and coordination that currently does not exist for any digital asset.

Challenges and Opportunities Ahead

While the CTO’s comment has ignited optimism, the path to XRP achieving reserve status is filled with challenges. Regulatory uncertainty, particularly in major economies, remains the most significant hurdle. Additionally, the entrenched dominance of the U.S. dollar, euro, and other fiat currencies makes displacement unlikely in the near term. On the other hand, XRP’s technical design, which enables fast and low-cost settlements, offers unique advantages that could support its role in bridging fiat currencies, even if full reserve status remains aspirational.

Conclusion

Ripple’s CTO may not have explicitly declared XRP the future reserve currency, but his carefully worded suggestion reflects the company’s vision of transforming the financial system. Whether XRP can achieve such prominence depends on regulatory developments, institutional trust, and broader shifts in global monetary policy. For now, XRP’s journey continues to straddle ambition and practicality, offering both a vision of financial disruption and a reminder of the immense challenges ahead.