A US-led reconstruction authority overseeing postwar Gaza is examining the creation of a dollar-pegged stablecoin aimed at restoring liquidity and stabilizing economic activity in the enclave. The proposed cryptocurrency would function as a digital payment instrument tied to the US dollar, offering price stability in a region grappling with cash shortages and financial disruption. The… Continue reading US-Backed Body Explores Dollar-Pegged Stablecoin to Revive Gaza’s Postwar Economy

Tag: Economy

Iran Embraces Digital Assets as Rial Weakness Deepens Economic Pressures

Facing sustained pressure on its national currency, Iran is increasingly turning toward cryptocurrencies and digital assets as a financial buffer against the prolonged depreciation of the rial. As inflation erodes purchasing power and access to global financial systems remains constrained, digital currencies are emerging as an alternative channel for trade, value storage, and cross-border transactions.… Continue reading Iran Embraces Digital Assets as Rial Weakness Deepens Economic Pressures

India’s Crypto Sector Seeks Tax Overhaul as Budget 2026 Approaches

With the Union Budget 2026 on the horizon, India’s cryptocurrency industry is mounting a coordinated push for meaningful tax reform. Market participants are urging the government to reconsider the existing 30% tax on virtual digital asset gains and reduce the 1% tax deducted at source on transactions. They argue that the current framework has constrained… Continue reading India’s Crypto Sector Seeks Tax Overhaul as Budget 2026 Approaches

From Ambition to Authority: How the UK Is Redefining Its Role in the Global Crypto Economy

The United Kingdom is recalibrating its approach to digital assets, shifting from aspirations of becoming a global crypto hub to establishing itself as a leading rule-maker in the sector. Rather than competing on lax regulation or rapid experimentation, policymakers are prioritizing legal clarity, consumer protection, and market integrity. This strategic pivot reflects lessons learned from… Continue reading From Ambition to Authority: How the UK Is Redefining Its Role in the Global Crypto Economy

Crypto in 2026: Regulation, Real-World Utility, and the Maturing of the Blockchain Economy

By 2026, the global cryptocurrency ecosystem is expected to look markedly different from its speculative beginnings. The industry is moving toward maturity, shaped by tighter regulation, deeper institutional participation, and a stronger focus on real-world applications. Volatility will remain, but markets are likely to reward utility, compliance, and technological resilience over hype. Blockchain infrastructure is… Continue reading Crypto in 2026: Regulation, Real-World Utility, and the Maturing of the Blockchain Economy

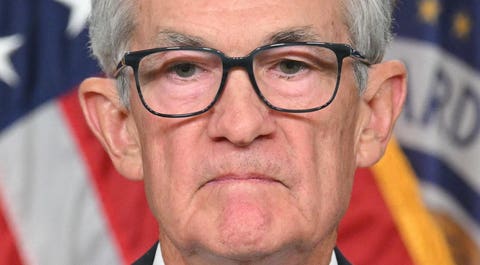

2026 Fed Policy Alarm Raises Fresh Questions Over the Dollar and Fuels Crypto Market Optimism

As the U.S. Federal Reserve approaches a critical policy juncture in 2026, growing warnings about long-term dollar stability are reshaping investor sentiment across global markets. Rising fiscal deficits, heavy debt-servicing costs, and the limits of prolonged tight monetary policy are prompting concerns about the future purchasing power of the greenback. Against this backdrop, Bitcoin and… Continue reading 2026 Fed Policy Alarm Raises Fresh Questions Over the Dollar and Fuels Crypto Market Optimism

Dollar Stability Under Scrutiny as Analysts Weigh 2026 Outlook for Gold, Silver, and Bitcoin

Renewed warnings about a potential crisis in the U.S. dollar have intensified debate across global financial markets, with analysts increasingly focusing on the implications for gold, silver, and digital assets. While predictions of a dollar “collapse” remain contentious, concerns over rising debt, persistent deficits, and shifting monetary policy expectations are reshaping investor behavior. Precious metals… Continue reading Dollar Stability Under Scrutiny as Analysts Weigh 2026 Outlook for Gold, Silver, and Bitcoin

Economist Warns of Historic Market Collapse in 2026 as Global Financial Risks Converge

A prominent economist has issued a stark warning that global financial markets could face an unprecedented crash in 2026, driven by a convergence of structural imbalances, excessive debt, and prolonged policy distortions. According to the analysis, years of loose monetary conditions, inflated asset valuations, and rising geopolitical and fiscal pressures have created a fragile economic… Continue reading Economist Warns of Historic Market Collapse in 2026 as Global Financial Risks Converge

Mapping the Rise of Blockchain, Crypto, and Web3: How a Decentralized Digital Economy Is Taking Shape

The global shift toward decentralized technologies has accelerated the evolution of blockchain, cryptocurrency, and Web3 ecosystems, reshaping how value is created, exchanged, and governed. What began as an experimental peer-to-peer payment network has expanded into a multifaceted digital economy powered by trustless protocols, tokenized assets, and community-driven governance. As industries explore new applications—from finance and… Continue reading Mapping the Rise of Blockchain, Crypto, and Web3: How a Decentralized Digital Economy Is Taking Shape

Understanding the Divide: What Sets Major Stablecoins Apart in a Rapidly Evolving Digital Economy

Stablecoins have become essential pillars of the digital asset market, offering price stability in an environment defined by volatility. Yet, not all stablecoins are built alike. Assets such as USDT, USDC and DAI differ significantly in their collateral structures, governance models, transparency standards and risk profiles. These distinctions influence how investors, institutions and developers utilize… Continue reading Understanding the Divide: What Sets Major Stablecoins Apart in a Rapidly Evolving Digital Economy