Thai authorities have dismantled Bitcoin mining operations valued at Rs. 8.6 crore, reportedly linked to networks accused of orchestrating scams in China. The crackdown highlights the growing scrutiny of cryptocurrency activities and the associated risks of illicit funding across borders. Officials claim the seized operations were being used to generate digital assets that supported fraudulent schemes, underlining the intersection of crypto mining, financial crime, and international enforcement. The incident underscores the regulatory and compliance challenges faced by countries navigating the fast-evolving cryptocurrency ecosystem, while reinforcing the need for robust monitoring, cross-border cooperation, and investor vigilance in digital asset markets.

Thailand Targets Illicit Crypto Mining

Authorities in Thailand recently seized Bitcoin mining operations worth approximately Rs. 8.6 crore, marking one of the largest crackdowns on cryptocurrency activities linked to cross-border financial crime. Officials indicated that the operation was allegedly funding networks implicated in scams targeting Chinese citizens, illustrating the international dimension of illicit crypto activity.

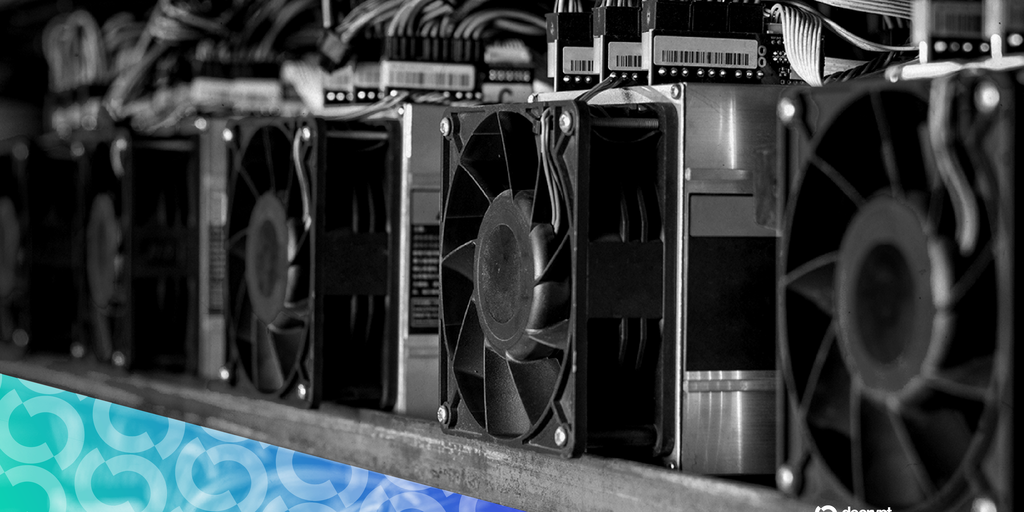

The raid involved the confiscation of mining equipment, servers, and related infrastructure, highlighting the significant resources required to operate large-scale crypto mining operations and the potential misuse of such assets for fraudulent purposes.

The Link Between Mining and Scam Networks

Investigators allege that the digital assets generated through these mining operations were diverted to support fraudulent schemes. By leveraging Bitcoin’s pseudonymous nature, operators can obscure financial flows, making detection and enforcement more challenging.

This case underscores the dual-use nature of cryptocurrency mining: while legitimate operations contribute to decentralized networks and innovation, misuse can facilitate illicit financial activities, including fraud, money laundering, and cross-border scams.

Regulatory Implications and Enforcement Challenges

Thailand’s intervention highlights the growing regulatory attention on cryptocurrency operations. Governments worldwide are increasingly balancing the promotion of blockchain innovation with the need to prevent criminal exploitation.

For regulators, large-scale mining operations present unique challenges, including energy consumption oversight, financial traceability, and compliance with anti-money laundering protocols. Cross-border cases, like this one involving alleged Chinese scam networks, further complicate enforcement, emphasizing the need for international collaboration among financial and law enforcement authorities.

Broader Impact on the Cryptocurrency Ecosystem

The seizure serves as a cautionary example for investors and operators in the digital asset space. While cryptocurrency offers legitimate investment and technological opportunities, incidents of misuse can undermine market confidence and prompt tighter regulatory scrutiny.

Experts note that increased enforcement actions may accelerate industry adoption of robust compliance frameworks, improved transaction monitoring, and transparent operational practices, thereby supporting sustainable growth while mitigating criminal exploitation.

Conclusion: Vigilance and Compliance Are Key

Thailand’s crackdown on Rs. 8.6 crore in Bitcoin mining assets linked to alleged scam networks highlights the dual realities of cryptocurrency: its potential for innovation and its susceptibility to misuse. As global adoption expands, regulatory vigilance, cross-border cooperation, and operational transparency will be critical in maintaining market integrity and safeguarding both investors and the broader financial ecosystem.