Market strategist Tom Lee has forecast a new all-time high for Bitcoin as early as January, citing improving liquidity conditions, renewed institutional interest, and growing acceptance of digital assets within mainstream finance. However, he has simultaneously cautioned investors to brace for sharper swings and elevated risk as the market moves toward 2026. Lee’s outlook reflects a dual narrative shaping crypto markets: strong near-term momentum driven by capital inflows and sentiment, contrasted with longer-term uncertainty tied to regulation, macroeconomic cycles, and leverage. His comments highlight both the opportunity and instability inherent in Bitcoin’s evolving market structure.

A Bullish Start to the Year

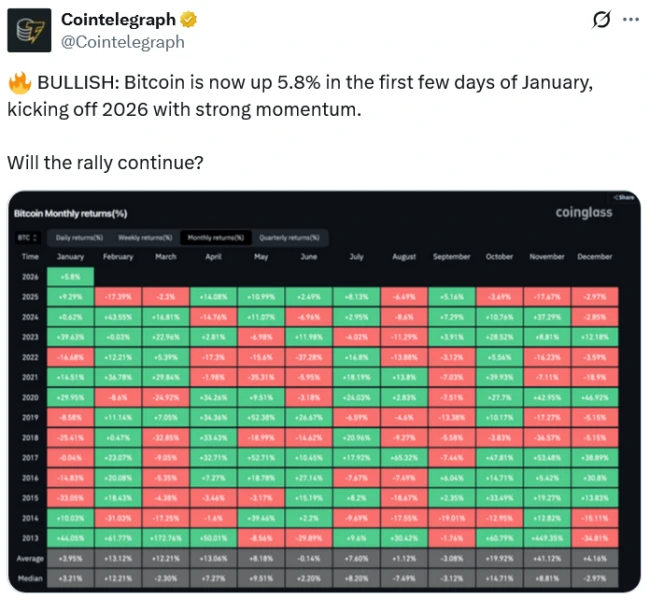

Tom Lee’s optimism for January rests on historical patterns and current market dynamics. He argues that Bitcoin often benefits from early-year positioning by institutional investors reallocating capital after year-end adjustments. Improved liquidity, easing financial conditions, and sustained demand from long-term holders are expected to support upward price movement in the near term.

Drivers Behind the Optimism

According to Lee, Bitcoin’s supply constraints continue to play a central role in shaping price action. With a fixed issuance schedule and growing global adoption, even modest increases in demand can have an outsized impact on valuations. He also points to increasing participation from asset managers and high-net-worth investors seeking diversification beyond traditional equities and bonds.

A Cautious Outlook for 2026

Despite his short-term confidence, Lee has warned that 2026 could bring pronounced volatility. As Bitcoin matures as an asset class, it is becoming more sensitive to macroeconomic shifts, regulatory developments, and changes in global risk appetite. Higher leverage, more complex financial products, and greater retail participation could amplify price swings during periods of stress.

Implications for Investors

Lee’s assessment underscores the importance of disciplined risk management. While the potential for new highs may attract fresh capital, investors are advised to prepare for abrupt corrections and prolonged drawdowns. Portfolio sizing, diversification, and a long-term perspective remain critical in navigating Bitcoin’s evolving market cycle.

The Bigger Picture

The contrasting outlook—near-term strength paired with longer-term turbulence—reflects Bitcoin’s transition from a niche digital experiment to a globally traded financial asset. As adoption deepens, volatility may remain a defining feature rather than a temporary anomaly.

Looking Ahead

If Bitcoin achieves a new record in January, it would reinforce confidence in the current cycle. Yet, as Lee cautions, sustained success will depend on how the market adapts to greater scale, scrutiny, and complexity in the years leading up to 2026.