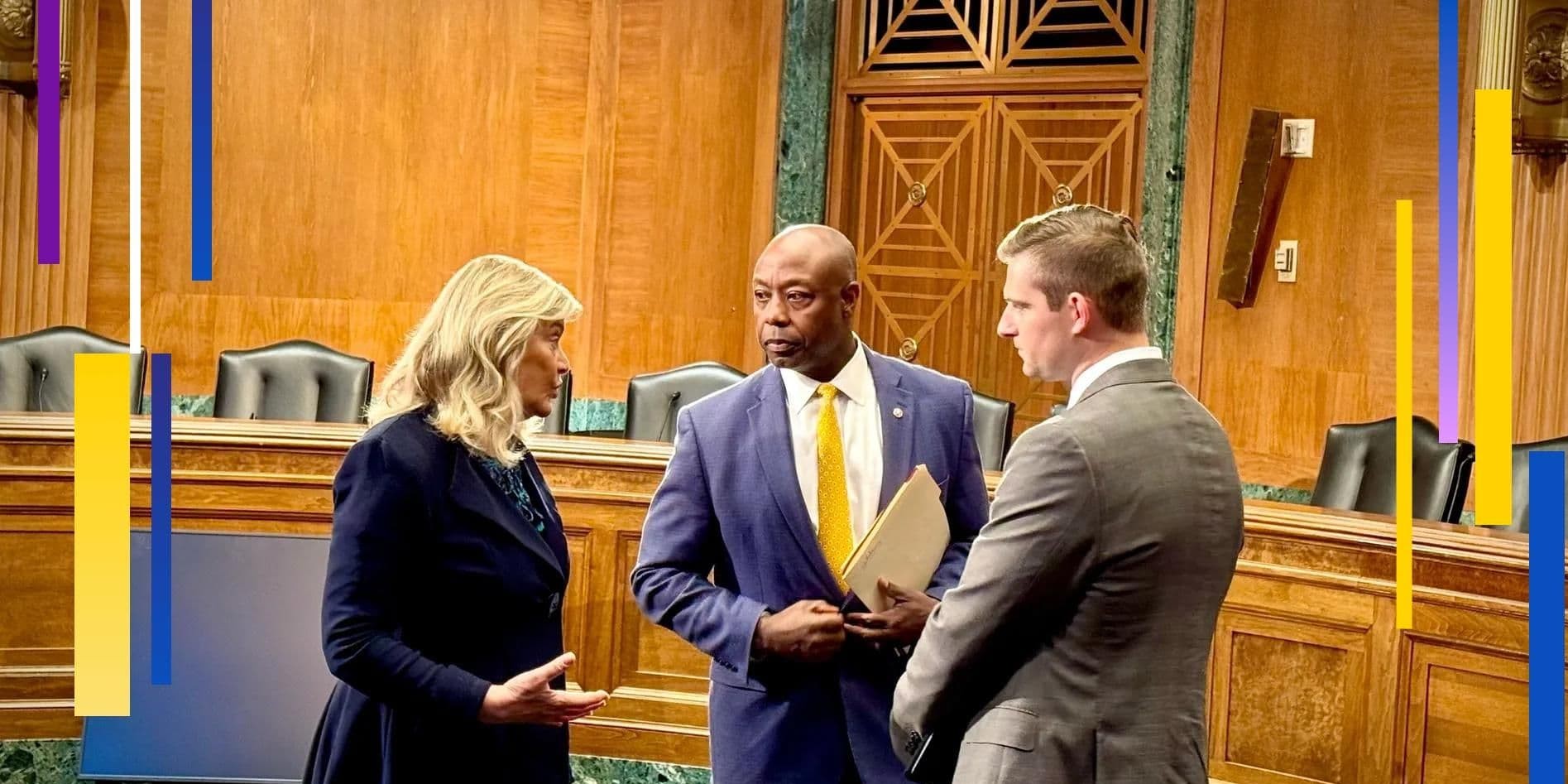

A bipartisan group of U.S. senators has introduced a long-anticipated bill aimed at bringing regulatory clarity to the cryptocurrency market. The proposed legislation seeks to define how digital assets should be classified and which federal agencies should oversee various segments of the industry. By addressing long-standing ambiguity around jurisdiction, consumer protection, and market integrity, the bill marks a significant step toward formalizing crypto regulation in the United States. While passage is far from guaranteed, the initiative signals growing political recognition that clear rules are essential to support innovation, protect investors, and strengthen the country’s position in the global digital asset economy.

A Push Toward Regulatory Clarity

The newly introduced legislation represents one of the most comprehensive attempts to date to establish a clear framework for cryptocurrency markets in the United States. Senators backing the bill argue that the absence of defined rules has created confusion for businesses and investors alike, exposing consumers to risk while discouraging responsible innovation.

The proposal outlines how different types of digital assets should be categorized, drawing clearer lines between securities, commodities, and other blockchain-based instruments.

Defining Agency Responsibilities

A central feature of the bill is its effort to resolve jurisdictional disputes among federal regulators. By specifying oversight responsibilities, the legislation aims to reduce regulatory overlap and enforcement uncertainty. Market participants have long complained that inconsistent interpretations have made compliance costly and unpredictable, particularly for startups and mid-sized firms.

Supporters say clearer boundaries would allow regulators to focus on supervision rather than legal battles.

Investor Protection and Market Integrity

The bill also places emphasis on safeguarding investors by introducing disclosure standards, registration requirements, and transparency measures tailored to digital assets. Lawmakers argue that these provisions are critical to preventing fraud and market manipulation while preserving trust in emerging financial technologies.

At the same time, the framework seeks to avoid overregulation that could stifle innovation or push activity offshore.

Implications for the Crypto Industry

If enacted, the legislation could reshape how crypto businesses operate in the United States. Clearer rules may encourage greater institutional participation, improve access to capital, and reduce legal risks for compliant firms. Analysts note that regulatory certainty is often a prerequisite for long-term investment, particularly from traditional financial institutions.

The bill could also serve as a benchmark for future policy development.

Challenges Ahead

Despite its significance, the bill faces a complex legislative path. Political divisions, competing priorities, and differing views on the role of government in financial markets could slow progress. Industry stakeholders are expected to lobby actively as debates unfold, seeking amendments that balance innovation with oversight.

Looking Forward

The introduction of the bill marks a pivotal moment in the evolution of U.S. crypto policy. Whether or not it becomes law, the move reflects a growing consensus that digital assets can no longer operate in a regulatory vacuum. As discussions continue, the outcome will play a crucial role in shaping the future of crypto markets and the United States’ role in the global financial system.