A disturbing new risk is emerging alongside the growth of digital assets: a sharp rise in physical assaults targeting cryptocurrency holders. Known as “wrench attacks,” these crimes involve the use of force or intimidation to extract private keys, passwords, or wallet access from victims. Unlike cyber hacks, these attacks shift the threat from screens to real-world violence. As crypto wealth becomes more visible and concentrated, criminals are increasingly bypassing digital defenses and exploiting human vulnerability. The trend highlights a critical gap in the current crypto security framework and raises urgent questions about personal safety in an increasingly digitized financial system.

A New Face of Crypto Crime

Cryptocurrency was built on the promise of decentralization and cryptographic security. Yet recent incidents show that even the strongest encryption can be rendered useless when physical coercion is involved. Wrench attacks—so named because attackers may use tools or brute force rather than code—are becoming more frequent and more brutal. Victims are often ambushed at home, followed from public places, or targeted through social engineering before being assaulted.

Why Crypto Holders Are Being Targeted

Unlike traditional bank accounts, crypto wallets are controlled directly by individuals. There is no helpline to freeze funds once private keys are surrendered. This makes holders particularly attractive targets, especially those perceived to have substantial digital wealth. Public bragging, social media disclosures, and even participation in crypto events can unintentionally expose individuals to risk, turning anonymity into a critical but often overlooked asset.

Rising Severity and Organized Crime Involvement

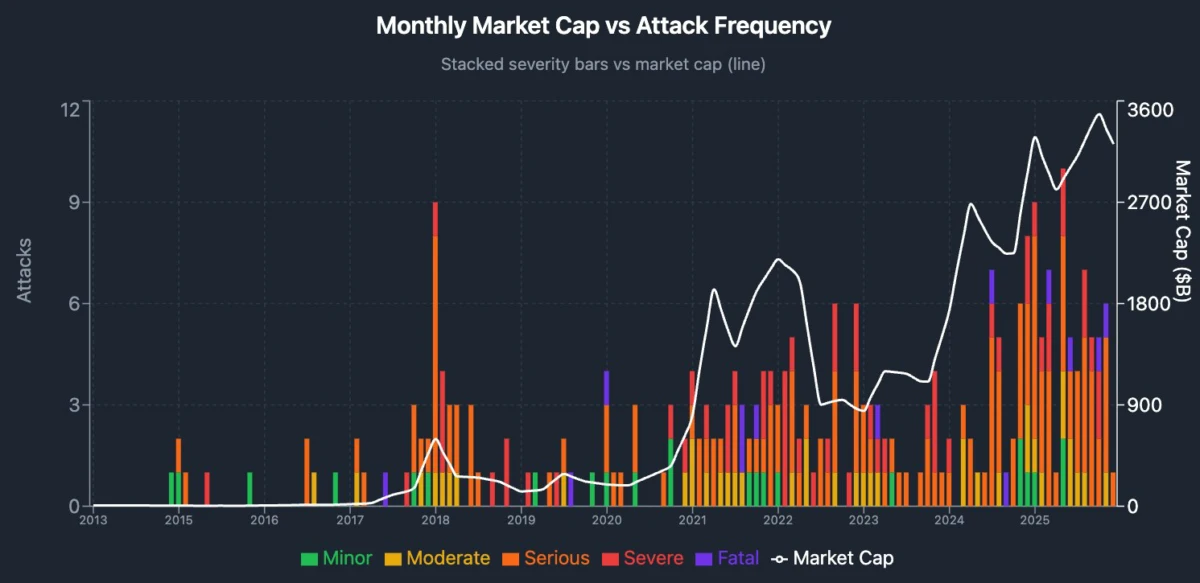

Law enforcement agencies and security analysts note that these attacks are not only increasing in number but also in severity. What began as opportunistic crimes are now showing signs of planning and coordination. In some cases, attackers operate in organized groups, conducting surveillance before striking. The escalation in violence suggests that criminals view these attacks as high-reward operations with relatively low traceability compared to digital theft.

Security Beyond the Blockchain

The surge in physical attacks underscores a hard truth: crypto security cannot rely solely on technology. Cold wallets, multisignature setups, and encrypted devices offer protection only up to a point. Personal security practices—such as discretion about holdings, secure living arrangements, and contingency plans—are becoming just as important as digital safeguards.

Implications for the Crypto Ecosystem

As digital assets move closer to mainstream finance, these incidents pose reputational and regulatory challenges for the industry. Investors, institutions, and policymakers are being forced to confront risks that fall outside traditional cybersecurity models. Without addressing the human and physical dimensions of security, confidence in the broader crypto ecosystem could erode.

A Wake-Up Call for Investors

The rise of wrench attacks is a stark reminder that financial innovation often brings unintended consequences. For crypto holders, safeguarding wealth now extends beyond passwords and protocols. In an era where digital fortunes can be unlocked under duress, true security lies in combining technological resilience with personal vigilance.