XRP remains one of the most closely monitored digital assets in the cryptocurrency market, driven by its institutional payment focus and evolving regulatory landscape. As investors assess forward-looking valuations, a central question emerges: what could 1,000 XRP be worth by the end of the first quarter of 2026? The answer depends on macroeconomic conditions, regulatory clarity, cross-border payment adoption and broader crypto market cycles. While price forecasts vary widely, scenario-based analysis provides structured insight. This report examines valuation drivers, adoption trends and risk variables to estimate potential outcomes for XRP holders over the next year.

Market Context: XRP’s Position in the Digital Asset Ecosystem

XRP occupies a distinct niche within the cryptocurrency sector. Unlike purely decentralized payment tokens, its primary narrative revolves around facilitating cross-border settlements and liquidity provisioning for financial institutions. Its value proposition centers on transaction efficiency, low cost and rapid settlement finality.

In recent years, digital assets have transitioned from speculative instruments toward institutional experimentation. Central banks are studying digital currencies, and commercial banks are exploring blockchain settlement systems. XRP’s long-term valuation is closely tied to whether such institutional use cases scale meaningfully.

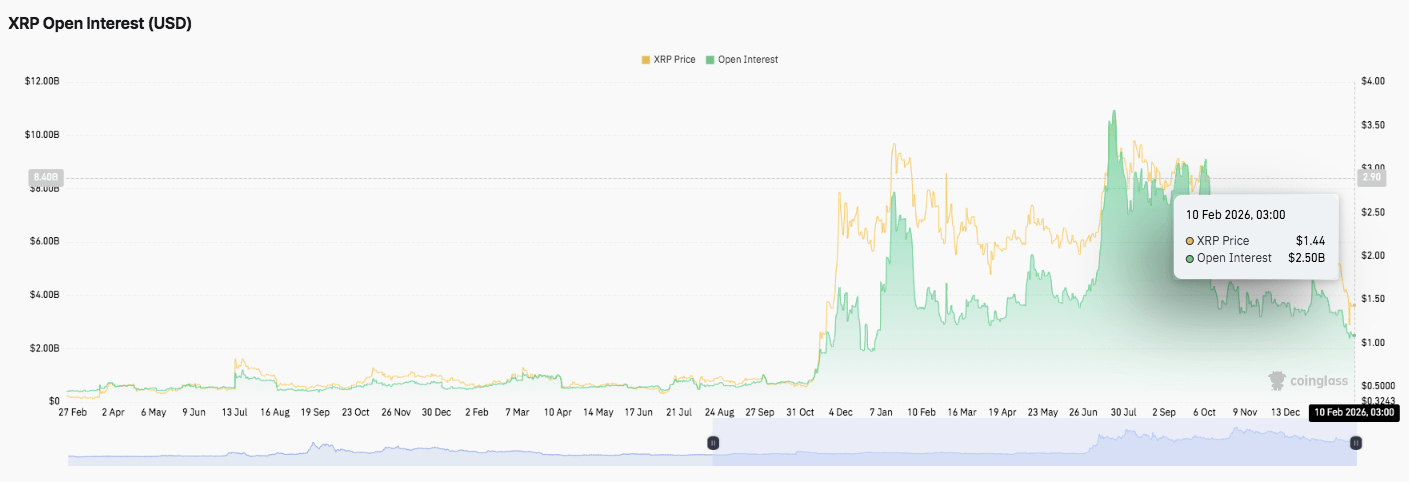

As of current market conditions, XRP trades within a range influenced by regulatory progress, liquidity flows and overall crypto sentiment. For investors holding 1,000 XRP, future value projections depend heavily on macro and sector-specific catalysts.

Key Drivers That Could Influence XRP by Q1 2026

- Regulatory Clarity

Regulatory developments remain the most critical determinant of XRP’s price trajectory. Clear classification within securities or payment frameworks could unlock broader exchange participation and institutional onboarding.

If compliance structures align with international financial standards, liquidity pools could deepen significantly. Conversely, prolonged legal uncertainty may suppress capital inflows. - Institutional Payment Adoption

XRP’s value proposition hinges on cross-border transaction utility. Should global remittance corridors adopt blockchain-based liquidity tools at scale, demand for settlement tokens may increase.

However, adoption depends on regulatory acceptance and competitive positioning against alternative digital settlement platforms. - Broader Crypto Market Cycle

Cryptocurrency markets historically move in cycles influenced by Bitcoin performance, global liquidity and investor risk appetite. If the broader market enters a bullish expansion phase by early 2026, altcoins including XRP may benefit from capital rotation dynamics.

On the other hand, tightening monetary conditions or economic slowdown could dampen speculative capital flows. - Supply and Market Liquidity

Circulating supply, escrow releases and exchange liquidity depth influence price stability. Transparent token distribution mechanisms reduce volatility risk, while sudden liquidity imbalances can amplify price swings.

Scenario-Based Valuation Analysis

Projecting the value of 1,000 XRP requires scenario modeling rather than deterministic prediction. Below are structured outlook ranges based on varying market conditions.

Conservative Scenario

If XRP trades within a moderate range of Rs. 45 to Rs. 65 by the end of Q1 2026 under stable but unremarkable growth conditions:

1,000 XRP could be worth between Rs. 45,000 and Rs. 65,000.

This scenario assumes regulatory stability but limited institutional acceleration.

Moderate Growth Scenario

If adoption improves and crypto markets enter expansion territory, XRP could trade in a range of Rs. 80 to Rs. 120:

1,000 XRP could be valued between Rs. 80,000 and Rs. 1,20,000.

This projection reflects broader bullish momentum and improved liquidity participation.

High Adoption Scenario

Under strong institutional integration, favorable regulation and a full-scale market rally, XRP could potentially trade in the range of Rs. 150 to Rs. 200:

1,000 XRP could be worth between Rs. 1,50,000 and Rs. 2,00,000.

This outcome would require sustained adoption and positive macroeconomic tailwinds.

Risk Factors Investors Must Consider

While upside scenarios attract attention, prudent analysis requires recognition of downside risks:

Regulatory setbacks or unfavorable classification rulings

Competitive displacement from alternative blockchain settlement networks

Broader crypto market corrections

Liquidity contraction during macroeconomic tightening

Cryptocurrency markets remain inherently volatile. Price swings of 20% to 40% within short timeframes are not uncommon.

Comparative Positioning Within the Crypto Market

XRP competes with other blockchain networks aiming to facilitate cross-border payments and decentralized financial services. However, its strategic differentiation lies in its early focus on enterprise use cases.

Investor perception often oscillates between speculative token and institutional infrastructure asset. Its long-term valuation will depend on which narrative prevails.

Investment Perspective and Strategic Outlook

For investors holding 1,000 XRP, the potential valuation by Q1 2026 spans a broad range depending on market dynamics. The realistic spectrum could fall between Rs. 45,000 and Rs. 2,00,000 based on adoption, regulation and macroeconomic trends.

However, digital asset investment requires risk tolerance and diversified capital allocation. Scenario-based forecasting should complement, not replace, disciplined financial planning.

XRP’s trajectory over the next year will likely be shaped less by speculation and more by measurable integration within financial systems. If blockchain-based settlement gains institutional legitimacy, valuation multiples could expand accordingly.

Until then, price projections remain probabilistic rather than certain — shaped by evolving regulation, capital flows and technological adoption across the global financial landscape.