Title:

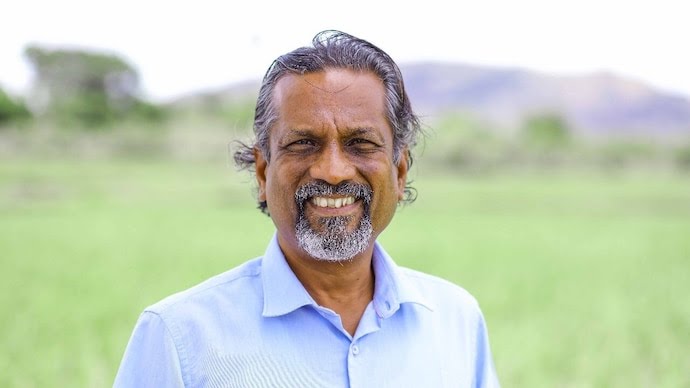

Zoho’s Sridhar Vembu Says Gold Still Outshines Crypto — A Pragmatic View on Wealth and Trust

Summary (100 words):

Zoho Corporation’s founder and CEO, Sridhar Vembu, has expressed a firm preference for gold over cryptocurrencies, calling the precious metal a time-tested store of value. His statement comes at a time when global markets remain volatile and digital currencies continue to face regulatory and trust-related challenges. Vembu’s stance reflects a traditional, risk-conscious investment philosophy rooted in tangible assets, contrasting sharply with the speculative nature of crypto markets. As investors worldwide debate the long-term sustainability of decentralized currencies, his remarks highlight an enduring truth—trust, not technology alone, determines what people ultimately consider real wealth.

A Conservative Voice in a Speculative Age

In an era dominated by digital disruption and decentralized finance, Sridhar Vembu’s faith in gold stands out as a voice of restraint. The Zoho founder, known for his disciplined, values-driven approach to business, emphasized that gold has served humanity as a store of value for millennia—long before algorithms and blockchains promised to revolutionize money.

Vembu’s comments reflect his broader economic philosophy: wealth should be built on productive assets and sustainable value creation, not speculation. For him, gold’s appeal lies not in its potential for rapid gains but in its stability, scarcity, and universal acceptance—qualities that cryptocurrencies, even after a decade of innovation, have yet to fully earn.

Gold: The Enduring Store of Value

Gold has long held a revered place in financial systems, functioning as both an inflation hedge and a global reserve of trust. Despite lacking yield, it carries an intrinsic allure—rooted in centuries of human belief and tangible scarcity.

Vembu’s endorsement of gold comes at a time when global uncertainty has renewed investor interest in physical assets. With inflationary pressures, geopolitical instability, and rising debt burdens, the demand for traditional safe havens has surged. While crypto advocates often position digital assets as “digital gold,” their extreme volatility and periodic collapses have eroded public confidence.

According to economists, gold’s value lies not just in its market price but in the psychological security it provides—a guarantee that transcends technology and government policy.

Crypto: A Technology Still Seeking Trust

Vembu’s cautious stance on crypto underscores a central dilemma for the digital asset ecosystem—trust remains elusive. While blockchain technology has revolutionized financial infrastructure, the industry has struggled to separate innovation from speculation.

Over the past few years, cryptocurrency markets have been rocked by scandals, bankruptcies, and regulatory crackdowns. From exchange failures to stablecoin collapses, these crises have exposed the fragility of a system that often prioritizes speed and hype over security and governance.

Vembu’s skepticism mirrors that of traditional investors who view cryptocurrencies not as stores of value but as high-risk instruments detached from tangible productivity. His preference for gold signals an adherence to foundational financial principles—those that prioritize preservation over performance, and reliability over novelty.

A Broader Economic Perspective

Beyond personal investment preferences, Vembu’s comments may also be seen as a commentary on economic fundamentals. As the founder of one of India’s most successful software firms, his worldview merges technological optimism with grounded realism.

In multiple public appearances, Vembu has advocated for decentralization in economic and social systems—not through unregulated digital currencies, but through locally sustainable enterprises. His choice of gold over crypto, therefore, aligns with his belief in enduring, community-based forms of value rather than speculative, transnational finance.

By emphasizing tangible assets, Vembu implicitly critiques the “financialization” of technology—where digital tools serve more to gamble than to build.

The Bottom Line: Tangibility Triumphs Over Trend

Vembu’s faith in gold serves as a reminder that in finance, longevity often outweighs novelty. While crypto enthusiasts continue to tout decentralization as the future of money, trust remains the currency that truly sustains economies.

For long-term investors and cautious wealth managers, his stance reinforces a timeless lesson: value is not defined by code or hype, but by endurance, credibility, and universal acceptance. In a financial landscape increasingly shaped by volatility, Sridhar Vembu’s preference for gold reflects not nostalgia—but prudence.

As markets oscillate between innovation and instability, his message resonates clearly: in the pursuit of wealth, it is wiser to stand on ground that has never moved.