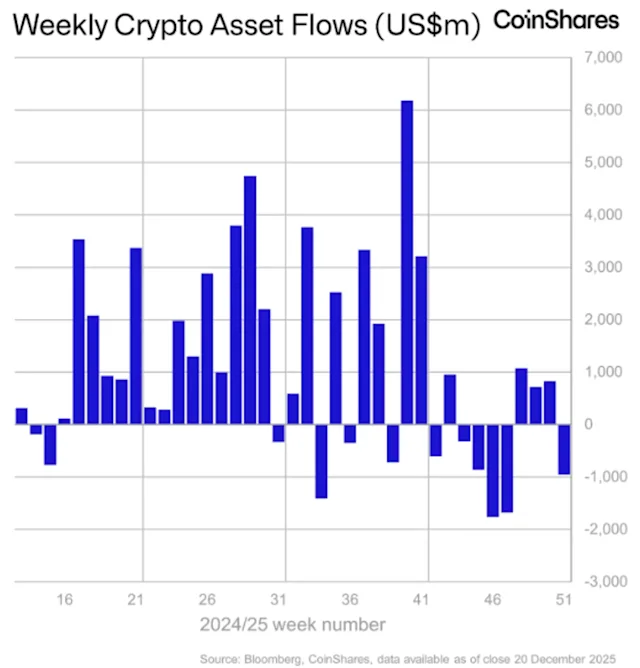

Congress Delay on Crypto Legislation Spurs $1 Billion Capital Outflow

A delay in crypto-related legislation in the U.S. Congress has triggered an estimated $1 billion outflow from digital asset markets, highlighting investor sensitivity to regulatory clarity. Market participants cite uncertainty over taxation, custody rules, and potential trading restrictions as key factors driving withdrawals. The pause has affected both institutional and retail investors, impacting liquidity and market confidence. Analysts note that regulatory predictability is critical for capital allocation in the crypto ecosystem, and prolonged indecision could slow adoption, hinder innovation, and exacerbate volatility. The development underscores the high stakes of legislative timelines on global digital asset flows.

Regulatory Uncertainty Drives Market Response

The postponement of deliberations on proposed cryptocurrency legislation has created immediate uncertainty in the market. Investors, wary of potential regulatory shifts, have moved capital into safer or more liquid instruments. This reaction illustrates the heightened sensitivity of crypto markets to legislative timelines, where even short delays can provoke substantial financial movement.

Impact on Institutional and Retail Investors

Both institutional funds and retail participants contributed to the $1 billion outflow.

Institutional investors, managing large portfolios, have adjusted exposure to avoid potential compliance risks, while retail investors have reduced positions amid fears of stricter rules. This dual impact amplifies volatility and affects market depth.

Liquidity and Market Implications

The sudden capital outflow has pressured liquidity, widening bid-ask spreads and affecting the efficiency of trading operations. Exchanges report temporary reductions in order book depth, highlighting how policy uncertainty can directly influence market functioning and investor confidence.

Importance of Legislative Clarity

Analysts emphasize that clear regulatory guidance is essential to sustain investment inflows. Defined rules on taxation, custody, and permissible trading structures reduce uncertainty and encourage longer-term capital allocation in the sector. Without timely legislative action, adoption and innovation may slow, and market participants may seek alternative jurisdictions.

Broader Implications for the Crypto Ecosystem

The outflow serves as a reminder that digital asset markets remain highly sensitive to policy developments. Effective legislation could stabilize capital movement, reinforce investor confidence, and support broader integration of crypto assets into mainstream finance. Conversely, delays may reinforce risk aversion and exacerbate volatility.

Outlook Ahead

Market watchers are closely monitoring Congressional developments, noting that even incremental progress toward clear regulation could reverse outflows and restore confidence. The current episode highlights the critical influence of timely legislative action on global crypto liquidity and the strategic decisions of market participants.