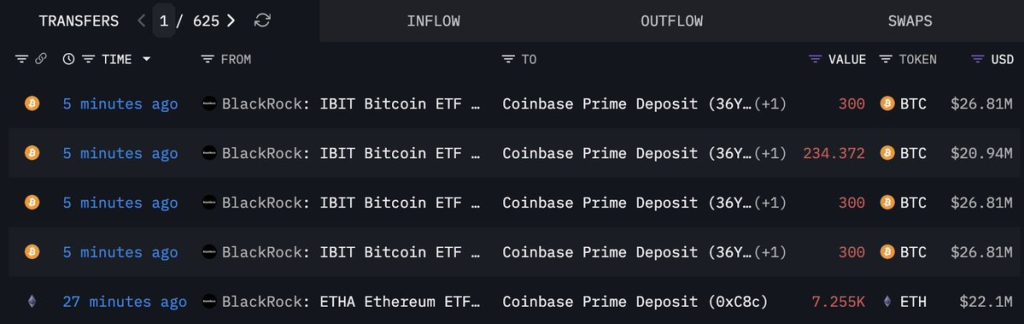

BlackRock Initiates 2026 With First-Ever Bitcoin and Ethereum Asset Sale

Global asset management giant BlackRock has made its first sale of Bitcoin and Ethereum holdings in 2026, marking a notable moment for institutional participation in digital assets. The transaction signals a shift from pure accumulation toward active portfolio management amid evolving market conditions. While the scale of the sale remains measured, it reflects a maturing approach to crypto exposure by large financial institutions. Analysts view the move as a strategic rebalancing rather than a retreat, underscoring how cryptocurrencies are increasingly being treated as mainstream financial instruments within diversified investment portfolios.

A Strategic Move by the World’s Largest Asset Manager

BlackRock’s decision to sell portions of its Bitcoin and Ethereum holdings represents a calculated portfolio adjustment rather than a fundamental change in stance. As digital assets continue to integrate into global capital markets, institutional investors are increasingly applying traditional asset management principles—profit-taking, risk management, and reallocation—to crypto investments.

Market participants say the move highlights how cryptocurrencies are no longer viewed solely as speculative assets but as components of structured, long-term investment strategies.

Market Context Behind the Sale

The sale comes against a backdrop of heightened volatility in digital asset markets, driven by shifting monetary expectations, regulatory developments, and profit-booking after recent price rallies. Bitcoin and Ethereum have both experienced sharp swings, prompting institutional investors to reassess exposure levels.

By trimming positions early in the year, BlackRock appears to be responding to market dynamics while preserving flexibility for future re-entry or reallocation.

Implications for Institutional Crypto Adoption

BlackRock’s actions are closely watched due to its influence on global investment trends. The sale reinforces the idea that institutional participation in crypto markets is entering a more mature phase, characterized by disciplined capital management rather than directional bets.

Industry experts note that such activity can improve market stability over time, as large players introduce liquidity and more predictable trading behavior.

Investor Sentiment and Market Reaction

While retail investors often interpret large institutional sales as bearish signals, analysts caution against such conclusions. The transaction size, relative to BlackRock’s total assets under management, remains modest and does not indicate a loss of confidence in blockchain-based assets.

Instead, the move reflects normalization—cryptocurrencies are being traded, hedged, and optimized like equities, bonds, or commodities.

Regulatory and Risk Considerations

Ongoing regulatory clarity around digital assets has encouraged institutions to adopt more active management approaches. Clearer compliance frameworks allow firms to adjust positions without signaling uncertainty about the asset class itself.

Risk management considerations, including liquidity needs and macroeconomic exposure, are also likely factors influencing the timing of the sale.

What Lies Ahead

BlackRock’s first Bitcoin and Ethereum sale of 2026 may set the tone for how institutional investors engage with crypto markets in the coming year. Rather than dramatic exits or aggressive accumulation, the focus appears to be on balance, discipline, and long-term value creation.

For the broader market, the message is clear: digital assets have entered a phase where strategic management—not speculation—defines institutional participation.