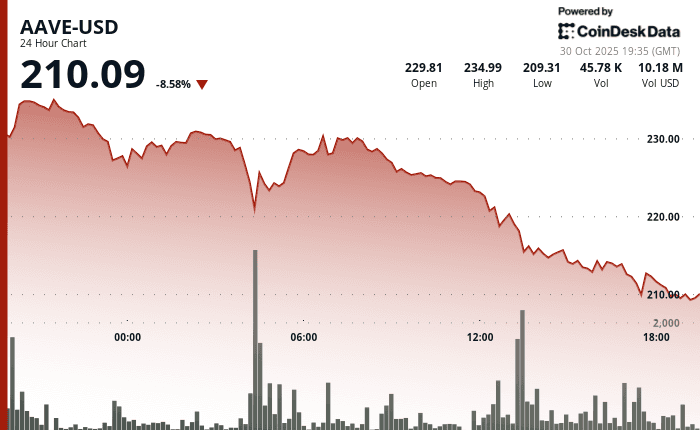

AAVE, one of the leading decentralized finance (DeFi) protocols, saw its token value fall by 8% amid a broader downturn across the cryptocurrency market. Despite maintaining strong fundamentals and growing interest in Real World Asset (RWA) integration, investor sentiment remains cautious as macroeconomic uncertainty and declining liquidity weigh on digital assets. AAVE’s recent performance highlights the delicate balance between sector innovation and overall market volatility. While institutional engagement with RWAs continues to rise, short-term price corrections underline persistent investor hesitation within the DeFi ecosystem.

AAVE Token Faces Market Pressure

AAVE’s 8% decline this week reflects broader weakness in the cryptocurrency market, where investor sentiment has been subdued by tightening global liquidity and fluctuating risk appetite. The token, which powers one of DeFi’s most prominent lending platforms, fell alongside major cryptocurrencies as traders reduced exposure to high-volatility assets.

Market analysts suggest that despite steady ecosystem development, AAVE remains susceptible to macroeconomic headwinds—particularly rising bond yields and ongoing uncertainty surrounding global monetary policy. These factors have triggered capital outflows from risk assets, including decentralized finance projects that rely heavily on on-chain liquidity.

RWA Integration Continues to Gain Traction

Interestingly, AAVE’s fundamentals tell a more optimistic story. The platform has made considerable progress in expanding its Real World Asset (RWA) initiatives, bridging traditional finance with blockchain-based lending. By enabling tokenized representations of real-world instruments—such as treasury bills, credit notes, and real estate assets—AAVE aims to attract institutional investors seeking yield efficiency through decentralized systems.

This RWA strategy has gained momentum across the DeFi sector, with major players exploring regulated frameworks for asset-backed tokenization. AAVE’s participation in this trend positions it strategically for long-term growth, even as short-term market conditions remain unfavorable.

DeFi Ecosystem Faces Mixed Sentiment

The broader DeFi landscape continues to evolve, but volatility has hindered sustained investor confidence. While total value locked (TVL) in DeFi protocols remains significant, it has experienced moderate contraction in recent weeks, partly due to lower crypto asset valuations and reduced lending activity.

AAVE’s TVL remains among the highest in the industry, underscoring its continued dominance as a liquidity provider. However, user activity has fluctuated amid shifting interest rates and competitive yields from other protocols. Industry observers note that future growth will depend on AAVE’s ability to maintain technological leadership while ensuring stable returns for both retail and institutional participants.

Institutional Interest and Regulatory Outlook

Despite short-term volatility, institutional appetite for decentralized financial infrastructure continues to expand. AAVE’s compliance-oriented approach and transparent governance framework have helped it stand out among peers navigating regulatory challenges. The company’s engagement with tokenization and permissioned liquidity pools demonstrates a willingness to adapt to evolving oversight without compromising on decentralization principles.

Analysts predict that as regulatory clarity improves—particularly around digital asset-backed lending—platforms like AAVE will benefit from renewed institutional trust and broader market participation.

Outlook: Innovation Amid Market Uncertainty

While AAVE’s token has experienced an 8% pullback, the platform’s long-term fundamentals remain strong. Its commitment to RWA integration, combined with ongoing improvements in liquidity management and risk controls, supports a cautiously optimistic outlook.

In the near term, market sentiment is expected to remain sensitive to macroeconomic data and investor risk appetite. However, if global financial conditions stabilize and DeFi continues integrating with real-world assets, AAVE could emerge as a pivotal player in the next phase of decentralized finance evolution.

For now, the token’s short-term volatility appears to mask a deeper structural transformation—one that could redefine the intersection of blockchain and traditional finance.