Bitcoin’s growing concentration in the hands of public companies has reignited debates over scarcity, institutional power, and the best cryptocurrencies to buy now. Recent data suggests that corporate treasuries and listed firms collectively hold around 1 million BTC, valued at approximately Rs. 83.2 lakh crore ($55 billion). This accumulation not only signals mounting institutional confidence… Continue reading Public Firms Amass 1 Million BTC: What It Means for Investors Seeking the Best Crypto Buys

Author: Ron Klauss

Trump Family Amasses Rs. 10,800 Crore in Crypto Wealth Within Weeks

The Trump family has witnessed a dramatic surge in its digital asset portfolio, adding approximately Rs. 10,800 crore ($1.3 billion) in a matter of weeks. This sharp increase in wealth underscores both the volatility and the potential of the cryptocurrency market, where fortunes can shift at unprecedented speeds. For the family, which remains under constant… Continue reading Trump Family Amasses Rs. 10,800 Crore in Crypto Wealth Within Weeks

BitMine’s Expanding Ethereum Treasury: A Strategic Step Toward Digital Asset Leadership?

BitMine’s recent decision to significantly expand its Ethereum holdings has sparked debate about whether the company is positioning itself as a future leader in digital asset management. By building a larger Ethereum treasury, the firm not only strengthens its balance sheet but also signals confidence in Ethereum’s role as a foundational blockchain for decentralized finance,… Continue reading BitMine’s Expanding Ethereum Treasury: A Strategic Step Toward Digital Asset Leadership?

Why Branding, Not Blockchain, Will Shape the Future of Crypto

The future of cryptocurrency may hinge less on technological breakthroughs and more on how projects present themselves to the public. While blockchain provides the infrastructure, branding defines perception, trust, and long-term adoption. Investors and users are often influenced not by code but by narratives, reputation, and identity. From Bitcoin’s portrayal as “digital gold” to Dogecoin’s… Continue reading Why Branding, Not Blockchain, Will Shape the Future of Crypto

Dogecoin Price Poised for Potential Breakout Amid Market Speculation

Dogecoin, the meme-inspired cryptocurrency, is once again at the center of investor discussions as analysts anticipate the possibility of an unexpected price rally. Despite its lighthearted origins, Dogecoin has built a loyal community and demonstrated resilience across multiple market cycles. With renewed speculation and growing retail interest, the asset could witness a sharp surge in… Continue reading Dogecoin Price Poised for Potential Breakout Amid Market Speculation

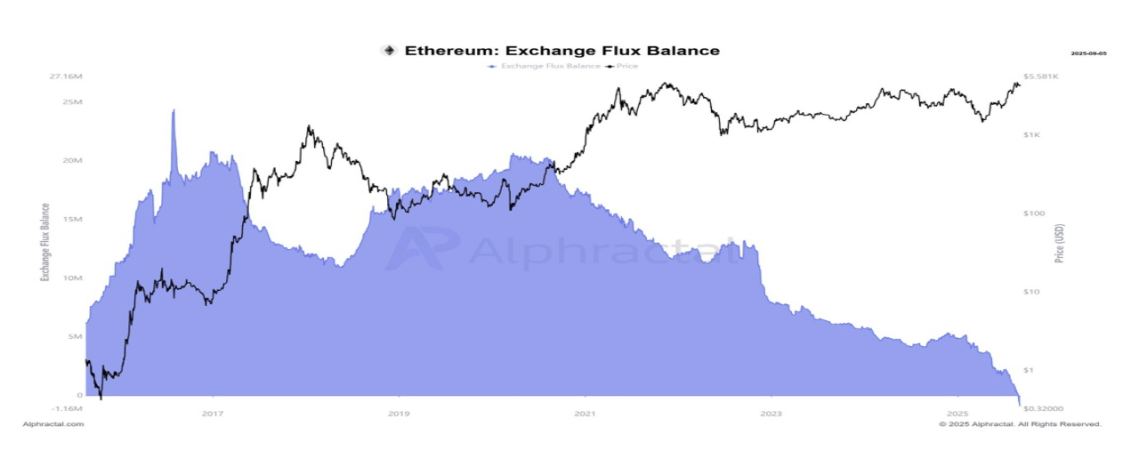

Ethereum Exchange Balances Turn Negative, Signaling Bullish Momentum

Ethereum has reached a pivotal milestone, with exchange balances turning negative for the first time, a development that is widely viewed as bullish for its price trajectory. A decline in exchange balances typically indicates that investors are withdrawing assets to private wallets, suggesting long-term holding strategies rather than short-term trading. This reduction in liquid supply,… Continue reading Ethereum Exchange Balances Turn Negative, Signaling Bullish Momentum

Ozak AI vs. Ethereum: Assessing the 2025 ROI Potential

The cryptocurrency market in 2025 is expected to be shaped by projects that combine innovation with utility. Among them, Ethereum stands as the established leader in decentralized finance and tokenization, while Ozak AI represents a newer entrant promising to integrate artificial intelligence with blockchain. Investors are increasingly weighing the return on investment (ROI) potential of… Continue reading Ozak AI vs. Ethereum: Assessing the 2025 ROI Potential

Germany’s Traditional Finance Embraces Digital Assets and Cryptocurrencies

Germany’s cryptocurrency sector has evolved into Europe’s most sophisticated and institutionally-integrated digital asset ecosystem. Anchored by clear regulatory frameworks through BaFin and enhanced by the EU’s MiCA compliance, the German market combines traditional financial expertise with innovative blockchain technology. Major banks like Deutsche Bank and Commerzbank now offer crypto services, while Berlin serves as the… Continue reading Germany’s Traditional Finance Embraces Digital Assets and Cryptocurrencies

Ondo’s Price Surge Signals Growing Confidence in Tokenized Stocks and ETFs on Ethereum

Ondo Finance has witnessed a sharp surge in its token price following the expansion of tokenized assets, particularly stocks and exchange-traded funds (ETFs), onto the Ethereum blockchain. This development reflects a broader shift in investor appetite toward real-world assets being digitized and traded through decentralized networks. The rally underscores both the rising popularity of tokenized… Continue reading Ondo’s Price Surge Signals Growing Confidence in Tokenized Stocks and ETFs on Ethereum

Tether Prepares Landmark Diversification with Gold

Tether, the world’s largest stablecoin issuer, is preparing for a historic shift by diversifying into gold-backed financial products. Known primarily for its USDT token, which is pegged to the US dollar, the company is now exploring a strategy that integrates precious metals into its reserves and offerings. This move underscores both a response to global… Continue reading Tether Prepares Landmark Diversification with Gold