Bitcoin entered a corrective phase this week as it slipped below multiple technical support zones, signaling mounting pressure across the broader crypto market. Traders observed heightened volatility, accelerated liquidations, and a disappearance of bullish momentum that had previously supported prices. The breakdown of key price floors has raised concerns about whether Bitcoin can sustain medium-term strength or if deeper retracements are imminent. Market analysts now point to macroeconomic uncertainty, declining liquidity, and reduced risk appetite as primary contributors. This article examines the factors behind the pullback, outlines potential scenarios for recovery, and evaluates what investors should watch in the days ahead.

A Sharp Decline Shakes Market Confidence

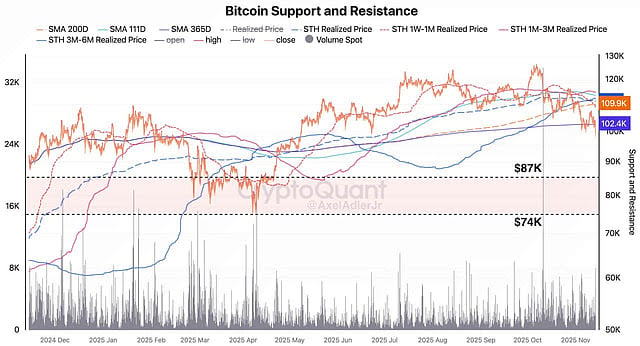

Bitcoin’s recent downturn has disrupted the relatively stable trading pattern seen over the previous weeks. The asset fell below prominent support zones that had acted as strong floors for much of the quarter. This breach signaled an imbalance between buying strength and selling pressure, triggering broader caution within the market.

Analysts note that such levels often serve as psychological anchors for traders. Once broken, the probability of deeper corrective moves increases, especially when momentum indicators fail to show signs of reversal.

Technical Levels Under Scrutiny

The decline intensified after Bitcoin slipped beneath a cluster of support ranging from short-term moving averages to trendline structures that had formed throughout recent rally phases. With these zones compromised, traders are now observing new potential support areas forming at lower price tiers.

Momentum oscillators point toward fading demand, while volume metrics suggest that sellers held a decisive advantage during the drop. The absence of strong buy-side reaction adds to the belief that Bitcoin may remain vulnerable until more stable liquidity conditions emerge.

Macroeconomic and Liquidity Pressures

The pullback comes at a time when global risk assets are facing renewed macroeconomic uncertainty. Shifts in monetary policy expectations, uneven equity performance, and fluctuations in commodity markets have led to increased caution among institutional traders.

In addition, liquidity conditions in crypto markets have remained tight, with reduced participation from major market makers. This thinning of order books can magnify price movements, increasing the likelihood of sudden declines when technical structures fail.

Investor Sentiment Turns Cautious

As support levels fell, leveraged positions were liquidated across major exchanges, further accelerating downward momentum. This process often triggers cascades, especially when markets are already leaning bearish. Social sentiment analysis suggests rising fear and reduced conviction among short-term investors.

However, long-term holders appear less reactive, maintaining steady accumulation patterns despite short-term volatility. This divergence reflects differing investment horizons and risk tolerances.

Potential Scenarios for Recovery

Although the recent break in support has stirred unease, recovery remains possible if Bitcoin can reclaim lost levels or establish stability above newly identified floors. Analysts outline several conditions that could aid a turnaround:

- A rebound in trading volume supporting upward momentum

- Improved liquidity conditions across spot and derivatives markets

- Reduced macroeconomic stress, particularly in interest-rate expectations

- Stronger institutional positioning, often seen during oversold phases

If these factors align, Bitcoin may regain footing and resume its broader trend.

Outlook: Navigating a Critical Phase

Bitcoin now enters a pivotal moment where traders must balance caution with strategic assessment. The break of major support zones underscores the fragility of the current market environment, but it also presents an opportunity for recalibration. Whether the asset stabilizes or continues its descent hinges on upcoming liquidity flows, macroeconomic signals, and the ability of buyers to reassert control.

For now, the market remains watchful, recognizing that Bitcoin often tests conviction before establishing its next sustained move.