The White House is preparing to convene leaders from major banking institutions and cryptocurrency firms in an effort to bridge regulatory divides and shape a cohesive legislative framework for digital assets. The discussions aim to balance financial innovation with consumer protection, financial stability and anti-money laundering safeguards. As crypto adoption expands and traditional finance deepens… Continue reading White House Seeks Common Ground Between Banks and Crypto Industry on Future Regulation

Category: Crypto Exchanges

Cryptocurrency Exchanges

Cryptocurrency Investing in India: Opportunity, Volatility and the Road Ahead

Cryptocurrency investing in India has evolved from a niche interest into a mainstream financial trend, particularly among younger investors. With increasing participation from Gen Z and millennials, digital assets are becoming a notable component of diversified portfolios. While the market offers significant growth potential, round-the-clock trading and innovative earning mechanisms, it also carries substantial risks.… Continue reading Cryptocurrency Investing in India: Opportunity, Volatility and the Road Ahead

Budget 2026 May Redefine India’s Crypto Tax Landscape Amid Industry Push for Clarity

As India approaches Budget 2026, the cryptocurrency sector is intensifying its appeal for regulatory and tax clarity to foster innovation while ensuring compliance. Industry stakeholders argue that the current framework, marked by high tax rates and complex reporting rules, has constrained domestic growth and driven trading activity offshore. Policymakers now face mounting pressure to simplify… Continue reading Budget 2026 May Redefine India’s Crypto Tax Landscape Amid Industry Push for Clarity

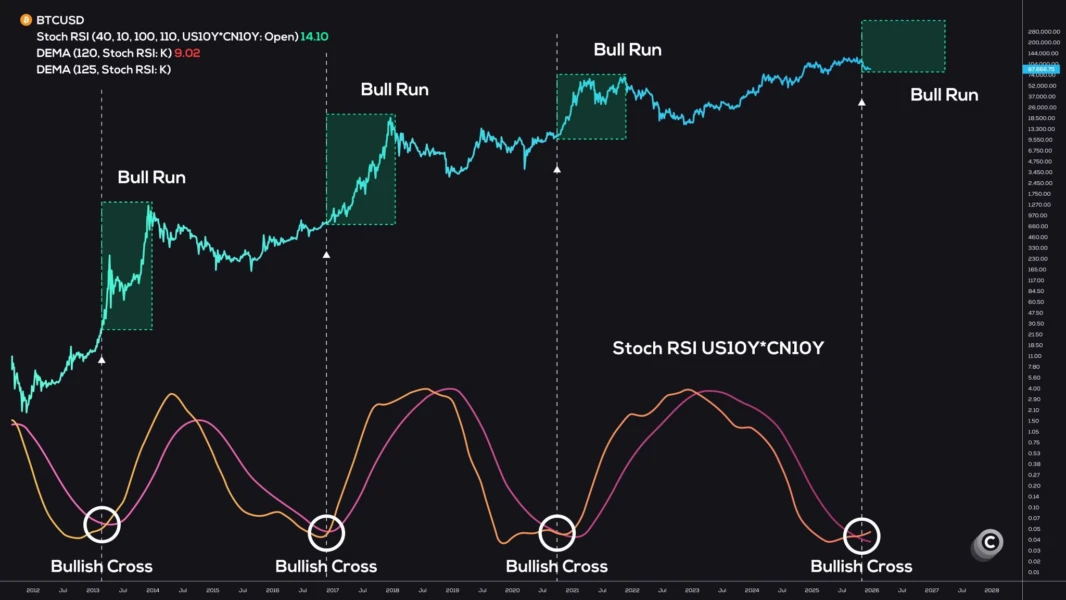

Widely Followed Bitcoin Indicator Signals Potential Price Reversal

A closely watched Bitcoin market indicator, often described by analysts as one of the most reliable long-term trend signals, is flashing early signs of a potential bullish reversal. The metric, rooted in historical price behavior and investor positioning, has previously aligned with major market bottoms and the start of sustained recovery cycles. Its reappearance comes… Continue reading Widely Followed Bitcoin Indicator Signals Potential Price Reversal

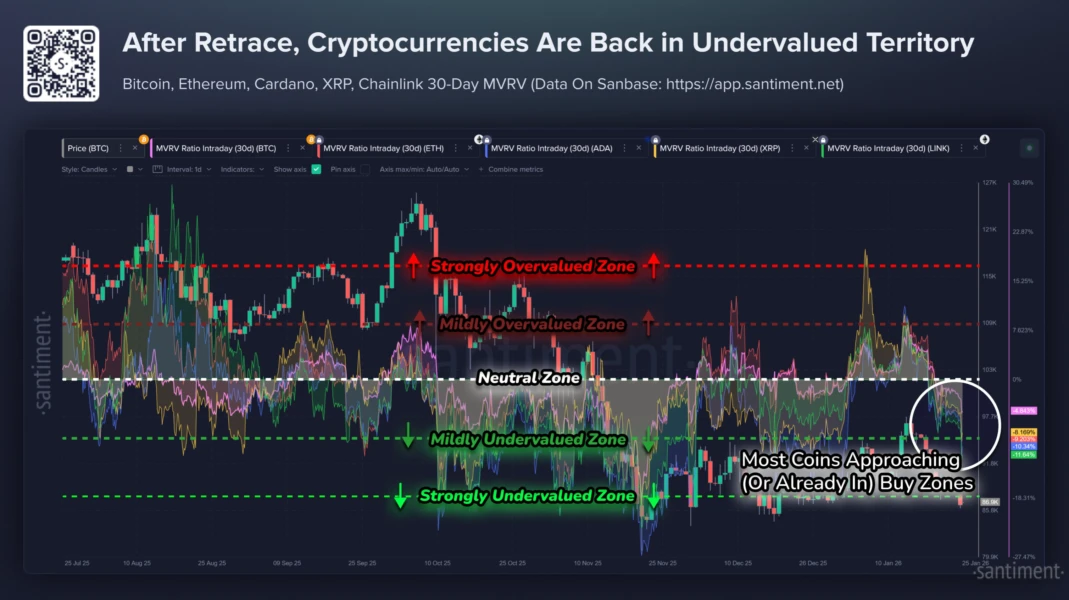

On-Chain Metrics Suggest XRP and Ethereum Enter Undervalued Territory

Fresh blockchain data indicates that XRP and Ethereum may be trading below their historical fair-value ranges, according to analysis of the Market Value to Realized Value (MVRV) metric. This on-chain indicator, widely used to gauge investor profitability and market sentiment, shows both assets hovering in zones that have previously preceded price recoveries. The development comes… Continue reading On-Chain Metrics Suggest XRP and Ethereum Enter Undervalued Territory

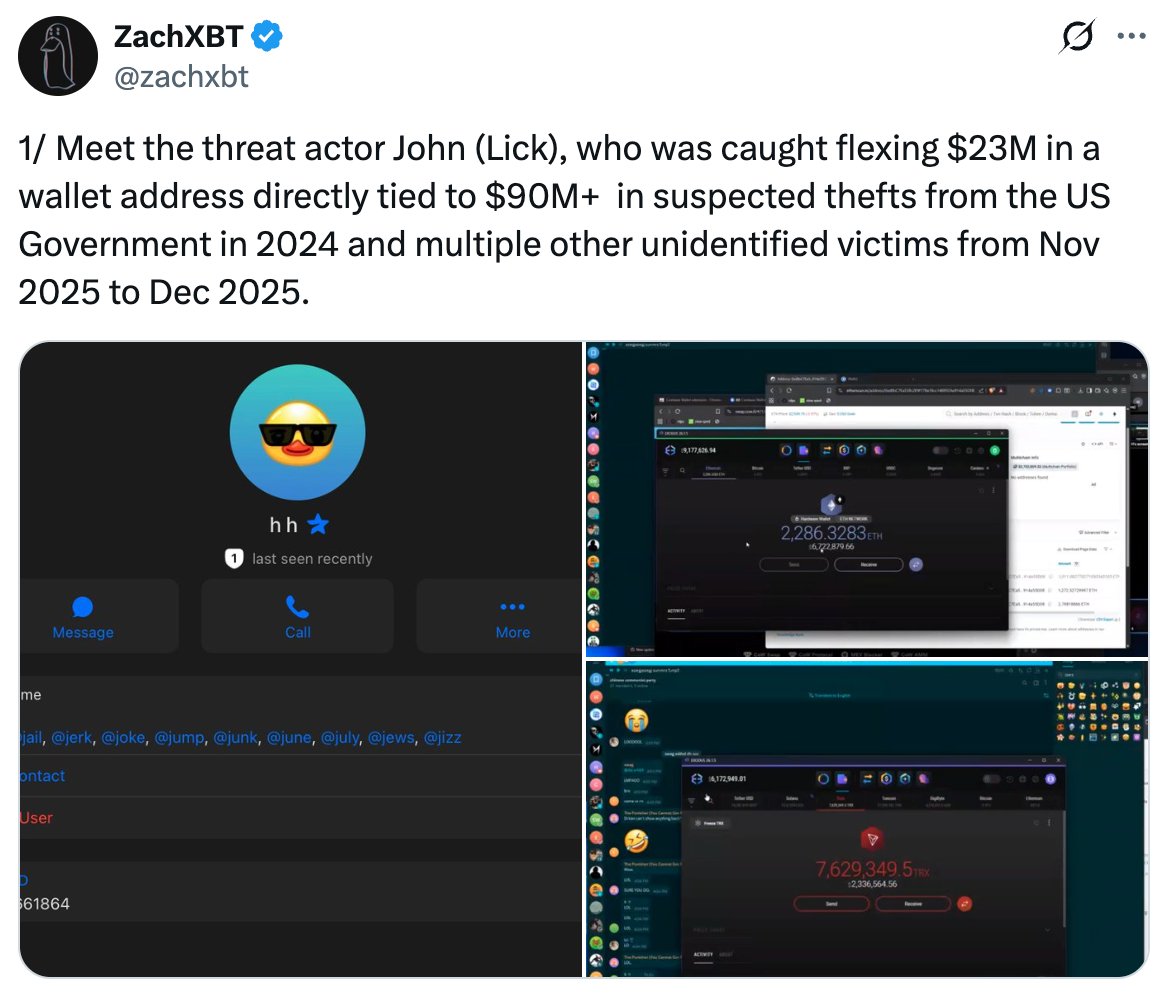

Crypto Crime Exposed: ZachXBT Uncovers Network Laundering US Government Seized Funds

Prominent blockchain analyst ZachXBT has revealed a sophisticated cryptocurrency theft network linked to funds previously seized by the U.S. government, highlighting persistent vulnerabilities in digital asset security. The investigation traces illicit transfers from multiple wallets connected to prior law enforcement seizures, suggesting a coordinated effort to launder stolen assets through mixers, decentralized exchanges, and cross-chain… Continue reading Crypto Crime Exposed: ZachXBT Uncovers Network Laundering US Government Seized Funds

Chinese-Language Networks Drive 20% of Global Crypto Money Laundering, Study Reveals

Emerging evidence shows that Chinese-language networks are now responsible for roughly 20% of global cryptocurrency money laundering, underscoring their growing role in the illicit digital asset economy. These networks exploit cross-border crypto transactions, privacy-focused tokens, and decentralized platforms to obfuscate the movement of illicit funds. Analysts warn that their activities, spanning both organized crime and… Continue reading Chinese-Language Networks Drive 20% of Global Crypto Money Laundering, Study Reveals

Cryptocurrency Adoption in Global E-Commerce Remains Below 15% Despite Market Growth

Cryptocurrencies continue to attract investors and institutional interest, yet their role in everyday online shopping remains limited. Recent market assessments indicate that fewer than 15 percent of global e-commerce merchants actively accept digital currencies as payment. While blockchain technology has matured and transaction infrastructure has improved, volatility, regulatory uncertainty, and consumer trust barriers still constrain… Continue reading Cryptocurrency Adoption in Global E-Commerce Remains Below 15% Despite Market Growth

UK Banks Impede Significant Portion of Crypto Transfers Amid Compliance Push, Report Shows

A recent industry report reveals that major UK banking institutions are blocking a substantial portion of cryptocurrency transactions, highlighting ongoing friction between traditional finance and digital asset markets. The findings indicate that banks are increasingly scrutinizing crypto-related transfers due to regulatory pressures, perceived risk of fraud, and anti-money laundering obligations. Analysts note that while these… Continue reading UK Banks Impede Significant Portion of Crypto Transfers Amid Compliance Push, Report Shows

Stablecoins at a Crossroads: Have Digital Dollars Truly Moved Beyond Experimentation?

Stablecoins, once viewed as experimental tools within the cryptocurrency ecosystem, are increasingly being positioned as foundational components of digital finance. Pegged to fiat currencies and designed to minimize volatility, these blockchain-based assets have grown in transaction volume, cross-border utility, and institutional attention. Yet questions remain about scalability, regulatory oversight, reserve transparency, and systemic risk. A… Continue reading Stablecoins at a Crossroads: Have Digital Dollars Truly Moved Beyond Experimentation?