Bitcoin is reinforcing its status as a digital store of value as global monetary uncertainty intensifies. With fixed supply mechanics and decentralized governance, the asset continues to attract institutional and retail investors seeking hedges against inflation and currency debasement. Recent capital inflows into regulated investment vehicles have increased liquidity and broadened participation. While price volatility… Continue reading Bitcoin Strengthens Position as Digital Store of Value Amid Monetary Uncertainty

Category: Crypto Exchanges

Cryptocurrency Exchanges

Global Cryptocurrency Market Enters Strategic Consolidation Phase Amid Regulatory Maturation

The global cryptocurrency market is transitioning from speculative expansion to strategic consolidation, shaped by regulatory advancements, institutional participation and evolving macroeconomic conditions. After years of volatility-driven cycles, digital assets are increasingly viewed through the lens of portfolio diversification, financial infrastructure innovation and cross-border settlement efficiency. Governments are refining oversight frameworks, while asset managers integrate crypto… Continue reading Global Cryptocurrency Market Enters Strategic Consolidation Phase Amid Regulatory Maturation

Ethereum’s Evolution: From Smart Contracts Pioneer to Institutional Blockchain Infrastructure

Ethereum continues to redefine its position within the digital asset ecosystem as it evolves from a pioneering smart contract platform into a foundational layer for decentralized finance, tokenization and enterprise blockchain integration. The network’s transition to a proof-of-stake consensus mechanism significantly reduced energy consumption while improving scalability potential. Institutional adoption is accelerating as tokenized assets,… Continue reading Ethereum’s Evolution: From Smart Contracts Pioneer to Institutional Blockchain Infrastructure

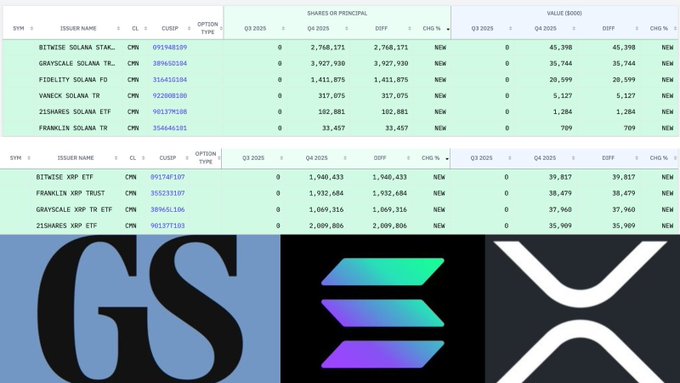

Goldman Sachs Expands Digital Asset Bet With Rs. 19,000 Crore Crypto Portfolio, Including Bitcoin and XRP

Goldman Sachs has disclosed a substantial cryptocurrency exposure valued at approximately Rs. 19,000 crore (about $2.3 billion), signaling a decisive shift in institutional engagement with digital assets. The portfolio reportedly includes significant allocations to Bitcoin and XRP, underscoring growing confidence in both established cryptocurrencies and alternative blockchain networks. The investment highlights the accelerating mainstream adoption… Continue reading Goldman Sachs Expands Digital Asset Bet With Rs. 19,000 Crore Crypto Portfolio, Including Bitcoin and XRP

Crypto Market Rout Erodes Coinbase CEO Brian Armstrong’s Fortune

Brian Armstrong, co-founder and chief executive of Coinbase, has seen his personal fortune shrink dramatically amid a sharp downturn in cryptocurrency markets and a Wall Street downgrade of Coinbase shares. Once ranked among the world’s 500 wealthiest individuals, Armstrong has fallen off a leading global rich list after his net worth declined from approximately $17.7bn… Continue reading Crypto Market Rout Erodes Coinbase CEO Brian Armstrong’s Fortune

Institutional Crypto Lender BlockFills Freezes Withdrawals Amid Market Turbulence

BlockFills, a Chicago-based cryptocurrency trading and lending firm serving institutional investors, has temporarily suspended client withdrawals and deposits following heightened volatility in digital asset markets. The decision came after Bitcoin briefly declined to around $60,000 before stabilizing. Backed by Susquehanna Private Equity Investments and the venture arm of CME Group, the firm described the move… Continue reading Institutional Crypto Lender BlockFills Freezes Withdrawals Amid Market Turbulence

Kazakhstan’s Crypto Reset: From Shadow Market to Regulated Digital Hub

Kazakhstan is undertaking an ambitious overhaul of its cryptocurrency sector after authorities revealed that nearly 95% of digital asset turnover in 2024 occurred outside the legal framework. With illegal trading volumes exceeding €13 billion, policymakers have shifted from passive oversight to structured regulation. The government has formally recognized digital assets as part of the national… Continue reading Kazakhstan’s Crypto Reset: From Shadow Market to Regulated Digital Hub

Crypto Market Leaders in Focus: Top 10 Digital Assets by Market Capitalization in February 2026

The cryptocurrency market entered February 2026 with cautious optimism, supported by improving macroeconomic indicators and sustained institutional participation. While volatility remains an inherent feature of digital assets, leading tokens by market capitalization continue to demonstrate relative resilience and liquidity depth. Bitcoin is consolidating within a broad range, Ethereum is attempting structural recovery, and stablecoins maintain… Continue reading Crypto Market Leaders in Focus: Top 10 Digital Assets by Market Capitalization in February 2026

European Union Moves to Prohibit All Russian Cryptocurrency Transactions in Expanded Sanctions Push

The European Union is advancing a sweeping proposal to prohibit all cryptocurrency transactions involving Russian entities and individuals, marking a significant escalation in its sanctions framework. The move aims to close potential loopholes that could allow digital assets to circumvent financial restrictions imposed after the Ukraine conflict. By targeting crypto flows, EU policymakers intend to… Continue reading European Union Moves to Prohibit All Russian Cryptocurrency Transactions in Expanded Sanctions Push

Susquehanna-Backed Crypto Lender BlockFills Suspends Client Withdrawals Amid Liquidity Concerns

BlockFills, a digital asset trading and lending firm supported by Susquehanna’s investment arm, has halted client withdrawals, intensifying concerns about liquidity pressures in the cryptocurrency credit market. The move follows mountingacross digital asset platforms as volatile price swings and tighter funding conditions strain balance sheets. While the firm has not disclosed the full extent of… Continue reading Susquehanna-Backed Crypto Lender BlockFills Suspends Client Withdrawals Amid Liquidity Concerns