Cryptocurrency ATMs across the United States are confronting growing regulatory pressure as authorities intensify efforts to curb fraud, money laundering, and consumer abuse. Once hailed as a convenient on-ramp to digital assets, these machines are increasingly viewed as weak links in compliance and consumer protection frameworks. Lawmakers and enforcement agencies are scrutinizing high fees, limited… Continue reading Crypto ATMs Face an Uncertain Future as U.S. Regulators Tighten Oversight

Category: Regions

Nasdaq and CME Group Strengthen Alliance, Signaling a New Phase for Institutional Crypto Investing

Nasdaq and CME Group have expanded their strategic collaboration in a move that underscores the accelerating institutionalization of crypto markets. The deeper partnership aims to enhance market infrastructure, improve transparency, and support the growing demand for regulated digital asset products. As institutional investors seek secure and compliant access to crypto exposure, the involvement of two… Continue reading Nasdaq and CME Group Strengthen Alliance, Signaling a New Phase for Institutional Crypto Investing

Trump Media Plans Shareholder Crypto Distribution, Signaling a Strategic Pivot Toward Digital Assets

Trump Media has announced plans to distribute a newly developed cryptocurrency to its shareholders, marking a notable shift in its corporate and financial strategy. The move positions the company at the intersection of media, capital markets, and blockchain technology, reflecting a broader trend of corporations exploring token-based incentives. While details on timing and valuation remain… Continue reading Trump Media Plans Shareholder Crypto Distribution, Signaling a Strategic Pivot Toward Digital Assets

U.S. Crypto Market Structure Reform Faces a Long Road, with 2029 Emerging as a Realistic Timeline

Despite growing political attention and repeated calls for regulatory clarity, comprehensive U.S. crypto market structure legislation is unlikely to materialize before the end of this decade. Structural complexity, jurisdictional overlap among regulators, and an increasingly polarized political environment continue to slow progress. While incremental measures and enforcement-led oversight are shaping the market in the interim,… Continue reading U.S. Crypto Market Structure Reform Faces a Long Road, with 2029 Emerging as a Realistic Timeline

U.S. Bitcoin Mining Giants Shift Strategy as AI Computing Emerges as the Next Growth Engine

America’s largest Bitcoin mining companies are increasingly pivoting toward artificial intelligence, signaling a strategic shift in response to evolving market dynamics. After navigating volatile cryptocurrency cycles and margin pressure, miners are repurposing infrastructure, capital, and technical expertise to tap into the rapidly expanding demand for AI computing. High-performance data centers, access to low-cost power, and… Continue reading U.S. Bitcoin Mining Giants Shift Strategy as AI Computing Emerges as the Next Growth Engine

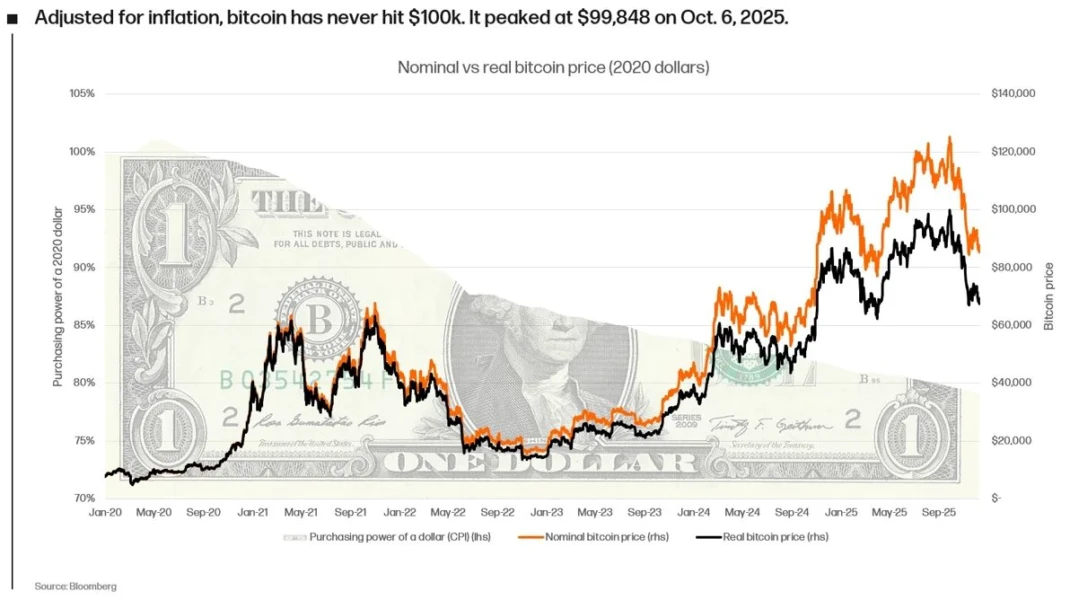

Dollar Stability Under Scrutiny as Analysts Weigh 2026 Outlook for Gold, Silver, and Bitcoin

Renewed warnings about a potential crisis in the U.S. dollar have intensified debate across global financial markets, with analysts increasingly focusing on the implications for gold, silver, and digital assets. While predictions of a dollar “collapse” remain contentious, concerns over rising debt, persistent deficits, and shifting monetary policy expectations are reshaping investor behavior. Precious metals… Continue reading Dollar Stability Under Scrutiny as Analysts Weigh 2026 Outlook for Gold, Silver, and Bitcoin

U.S. Crypto Regulation Heads for a Defining Year in 2026 as Federal Policy and State Innovation Converge

The United States is moving toward a pivotal moment in cryptocurrency regulation, with 2026 shaping up as a year of structural clarity and political decision-making. Proposed Senate legislation, emerging stablecoin frameworks, and state-level Bitcoin initiatives are collectively redefining how digital assets are governed. After years of regulatory ambiguity, policymakers are shifting from enforcement-driven responses toward… Continue reading U.S. Crypto Regulation Heads for a Defining Year in 2026 as Federal Policy and State Innovation Converge

Rs. 513 Million Bitcoin Enigma Jolts U.S. Crypto Markets, Raises Questions on Exchange Transparency

A mysterious Bitcoin transaction valued at more than Rs. 513 million has sent ripples through the U.S. cryptocurrency market, drawing attention to one of the country’s largest digital asset exchanges. The unexpected movement of funds, executed without an immediately identifiable trigger, has fueled speculation among analysts and traders about its origin and intent. While large… Continue reading Rs. 513 Million Bitcoin Enigma Jolts U.S. Crypto Markets, Raises Questions on Exchange Transparency

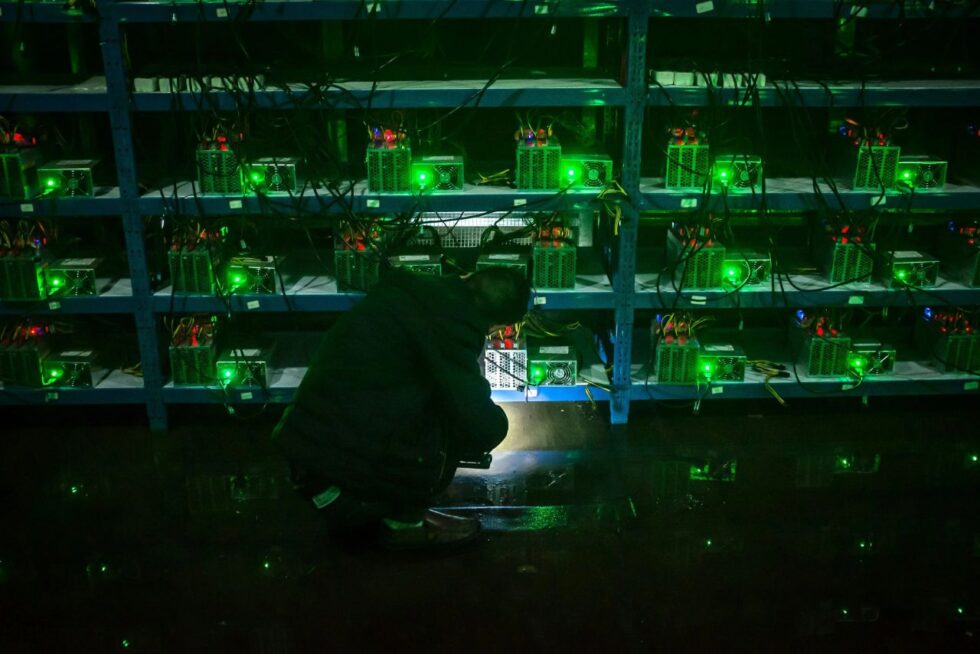

Why China’s Bitcoin Mining Crackdown Failed to Halt Crypto Production

China’s efforts to suppress Bitcoin mining, once the global epicenter of cryptocurrency production, have largely failed to eliminate activity, highlighting structural and economic realities of the industry. Despite regulatory bans and enforced shutdowns, miners have relocated to other jurisdictions, while underground operations persist domestically. Factors such as decentralized mining infrastructure, profitable energy arbitrage, and international… Continue reading Why China’s Bitcoin Mining Crackdown Failed to Halt Crypto Production

Bitcoin Rebounds as Japan’s Rate Hike Stirs Currency Volatility and Dollar Bets Intensify

Bitcoin staged a notable rebound following Japan’s decision to raise interest rates, a move that injected fresh volatility into global currency markets and reignited debate over the yen’s long-term trajectory. As investors recalibrated positions, prominent market voices pointed to structural pressures that could still weaken the Japanese currency, even in a higher-rate environment. Among them,… Continue reading Bitcoin Rebounds as Japan’s Rate Hike Stirs Currency Volatility and Dollar Bets Intensify