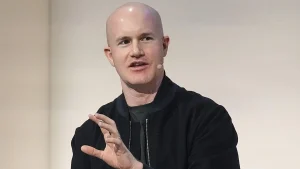

Crypto Market Rout Erodes Coinbase CEO Brian Armstrong’s Fortune

Brian Armstrong, co-founder and chief executive of Coinbase, has seen his personal fortune shrink dramatically amid a sharp downturn in cryptocurrency markets and a Wall Street downgrade of Coinbase shares. Once ranked among the world’s 500 wealthiest individuals, Armstrong has fallen off a leading global rich list after his net worth declined from approximately $17.7bn to $7.5bn. The erosion reflects Bitcoin’s slide below $70,000 and broader investor caution toward digital assets. With roughly 14% ownership in Coinbase, Armstrong’s wealth remains closely tied to the performance and valuation of the largest U.S.-based cryptocurrency exchange.

Market Correction Hits Executive Wealth

The recent contraction in digital asset prices has delivered a direct blow to the personal wealth of Coinbase’s chief executive. Brian Armstrong’s estimated net worth has dropped to around $7.5bn from roughly $17.7bn recorded last summer, marking a decline of more than 50%.

The reversal has removed Armstrong from a prominent ranking of the world’s 500 richest individuals. The shift underscores how tightly executive fortunes in the crypto industry are linked to market cycles and equity valuations.

Bitcoin’s fall below $70,000—levels last observed in late 2024—has intensified pressure across the sector. The broader correction has weighed on exchange revenues, trading volumes and investor sentiment.

Equity Exposure Amplifies Volatility

Armstrong’s wealth is largely derived from his approximate 14% ownership stake in Coinbase. As the exchange’s share price declined following weaker market conditions and a downgrade by Wall Street analysts, his personal valuation adjusted accordingly.

Publicly traded crypto firms are particularly sensitive to price swings in underlying digital assets. Lower spot prices often translate into reduced trading activity, thinner margins and declining fee income. In turn, equity markets price in slower revenue growth and heightened earnings uncertainty.

For founder-led companies, concentrated equity stakes amplify both upside and downside exposure. Armstrong’s financial trajectory illustrates this dynamic with unusual clarity.

Wall Street Reassesses Crypto Valuations

The downgrade of Coinbase stock reflects a broader reassessment of risk in the digital asset ecosystem. Analysts have cited concerns over declining retail participation, compressed transaction revenues and intensifying competition within the exchange landscape.

In addition, macroeconomic headwinds—including tighter liquidity conditions and elevated interest rates—have reduced speculative appetite across risk assets. Cryptocurrencies, often viewed as high-beta instruments, have been disproportionately affected.

The combination of market-driven volatility and equity market recalibration has compounded pressure on executive net worth tied to crypto platforms.

Bitcoin’s Slide and Sector Sentiment

Bitcoin’s retreat below $70,000 represents more than a symbolic threshold. Historically, price inflection points influence retail psychology and institutional allocation decisions alike.

The latest downturn follows a period of relative strength earlier in 2025, when digital assets benefited from improving macroeconomic conditions and sustained institutional inflows. However, renewed selling has revived concerns about the durability of the rally.

As flagship assets weaken, secondary tokens and exchange-related equities typically experience magnified declines, reinforcing cyclical volatility.

Implications for Coinbase and Industry Leadership

Despite the contraction in Armstrong’s net worth, Coinbase remains one of the most influential infrastructure providers in the global crypto economy. The company continues to operate at the intersection of regulatory compliance and digital asset innovation, positioning itself as a bridge between traditional finance and blockchain-based systems.

Still, the episode serves as a reminder of the sector’s structural volatility. Executive wealth, corporate valuations and investor confidence are closely interwoven with asset price dynamics.

For industry leaders, the current correction underscores the importance of diversified revenue models, disciplined capital management and transparent governance.

A Cyclical Reality

The decline in Armstrong’s fortune reflects a broader truth about cryptocurrency markets: rapid ascents can be followed by equally swift reversals. While wealth rankings fluctuate with asset prices, the longer-term trajectory of digital finance will depend on institutional adoption, regulatory clarity and sustainable business practices.

In the meantime, the recalibration of valuations—both personal and corporate—signals a market returning to fundamentals after a period of exuberance.