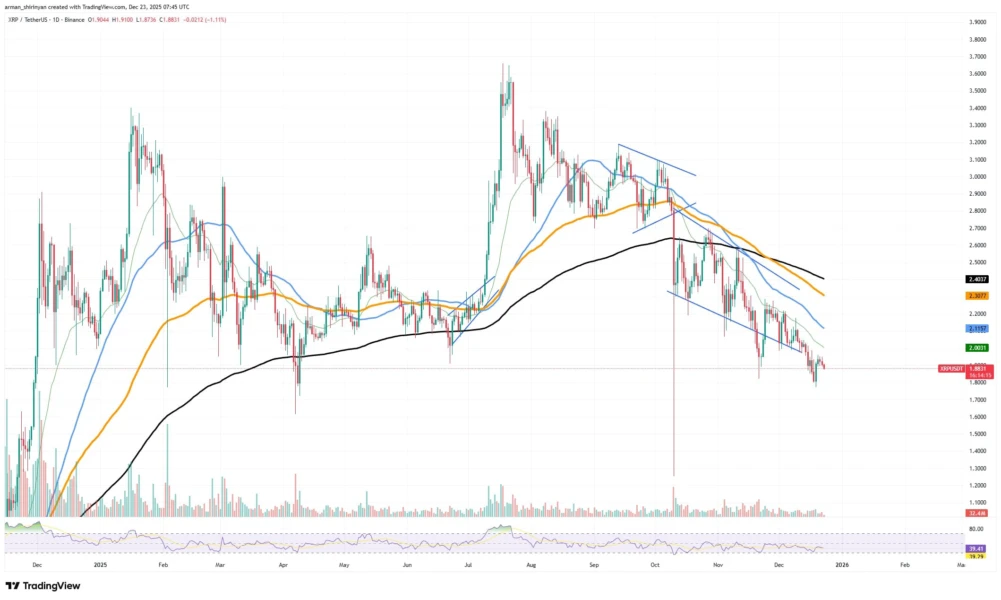

XRP has reached its most favorable technical and on-chain position since 2022, according to recent market indicators tracking price structure, liquidity flows, and investor behavior. The improvement reflects a combination of renewed trading interest, tighter supply dynamics, and growing confidence among long-term holders. While broader digital asset markets remain sensitive to macroeconomic cues, XRP’s underlying… Continue reading XRP Displays Its Most Resilient Market Structure Since 2022, Data Signals

Year: 2025

Binance Introduces Time-Bound Alpha Rewards Initiative to Boost Platform Engagement

Binance has announced a limited-period Alpha initiative designed to increase user engagement through a task-based rewards mechanism. Under the program, participants can earn Alpha Points by completing specified on-platform activities within a defined timeframe. The move reflects a broader industry trend of incentivizing participation as digital asset platforms compete for user attention amid fluctuating market… Continue reading Binance Introduces Time-Bound Alpha Rewards Initiative to Boost Platform Engagement

VanEck’s Mid-December 2025 Bitcoin ChainCheck Signals Shifting On-Chain Dynamics

VanEck’s mid-December 2025 Bitcoin ChainCheck highlights notable changes in on-chain activity, offering insights into investor behavior and market structure as the digital asset matures. The assessment points to evolving holding patterns, measured network usage, and capital flows that suggest a transition from speculative trading toward longer-term positioning. While price volatility remains a defining feature, underlying… Continue reading VanEck’s Mid-December 2025 Bitcoin ChainCheck Signals Shifting On-Chain Dynamics

Ghana Embraces Digital Assets With Crypto Legalization and Gold-Backed Stablecoin Plans

Ghana has formally legalized cryptocurrency trading through new legislation, marking a significant shift in its financial and regulatory landscape. The move aims to bring oversight, consumer protection, and transparency to a sector that has operated largely outside formal regulation. Alongside legalization, authorities have signaled plans to explore gold-backed stablecoins, leveraging the country’s mineral resources to… Continue reading Ghana Embraces Digital Assets With Crypto Legalization and Gold-Backed Stablecoin Plans

XRP Shows Strongest Market Signals Since 2022, On-Chain Indicators Suggest

XRP has reached its most favorable technical and on-chain position since 2022, according to recent market indicators tracking price structure, liquidity flows, and investor behavior. The improvement reflects a combination of renewed trading interest, tighter supply dynamics, and growing confidence among long-term holders. While broader digital asset markets remain sensitive to macroeconomic cues, XRP’s underlying… Continue reading XRP Shows Strongest Market Signals Since 2022, On-Chain Indicators Suggest

XRP Gains Momentum Amid Renewed Market Interest and Strategic Developments

XRP, one of the leading digital assets in the cryptocurrency market, has recently drawn heightened attention due to a combination of market movements, regulatory progress, and strategic partnerships. The token has experienced notable price fluctuations as traders respond to macroeconomic trends and developments within Ripple Labs’ ecosystem. Additionally, XRP’s increasing adoption in cross-border payments and… Continue reading XRP Gains Momentum Amid Renewed Market Interest and Strategic Developments

Fundstrat’s Bitcoin Playbook: Tom Lee Clarifies Strategy Amid Market Crosscurrents

Bitcoin’s evolving market narrative took center stage after Fundstrat co-founder Tom Lee outlined the firm’s outlook during a recent investor discussion, shedding light on how institutional strategists are positioning themselves amid heightened volatility. Lee’s commentary focused on long-term adoption trends, macroeconomic signals, and capital rotation within digital assets, rather than short-term price speculation. As Bitcoin… Continue reading Fundstrat’s Bitcoin Playbook: Tom Lee Clarifies Strategy Amid Market Crosscurrents

Litecoin Rides Bitcoin’s Rally, Faces Crucial Test Near Rs.79.60 Resistance

Litecoin has mirrored Bitcoin’s recent upward momentum, benefiting from renewed optimism across the broader cryptocurrency market. As capital flows back into large-cap digital assets, Litecoin has staged a steady recovery, supported by improving sentiment and higher trading volumes. However, technical indicators suggest the rally may be approaching a critical inflection point. Market participants are closely… Continue reading Litecoin Rides Bitcoin’s Rally, Faces Crucial Test Near Rs.79.60 Resistance

Contrarian Conviction: Cathie Wood Increases Stake in Slumping Crypto-Linked Equity

Cathie Wood has made a decisive contrarian move, investing Rs. equivalent of $26.1 million in a crypto-linked stock that has been under sustained market pressure. The purchase comes amid heightened volatility across digital asset markets, where falling prices, regulatory uncertainty, and investor caution have weighed heavily on valuations. Wood’s action signals confidence in the long-term… Continue reading Contrarian Conviction: Cathie Wood Increases Stake in Slumping Crypto-Linked Equity

Bitcoin at Rs. 72 Lakh: Opportunity or Overreach for Indian Investors?

Bitcoin trading near USD 87,000 has reignited debate among Indian investors weighing opportunity against risk. The surge reflects strong institutional demand, tightening supply dynamics, and growing acceptance of digital assets globally. However, elevated prices also amplify volatility, regulatory uncertainty, and tax exposure, particularly under India’s strict crypto taxation framework. For investors, the decision to buy… Continue reading Bitcoin at Rs. 72 Lakh: Opportunity or Overreach for Indian Investors?