Dogecoin’s Long Road to Rs. 83: Can the Memecoin Realistically Target Rs. 1 by 2026?

Dogecoin’s long-standing ambition to reach Rs. 1 has once again come into focus as market participants debate its prospects heading into 2026. Once dismissed as a novelty token, Dogecoin has evolved into a high-liquidity digital asset with a dedicated community and recurring cycles of speculative interest. While recent price action reflects consolidation rather than exuberance, analysts point to macro crypto trends, adoption narratives, and historical boom-bust patterns as potential catalysts. However, significant structural and market-cap challenges remain. The question facing investors is not just whether Dogecoin can rally, but whether conditions align for such an ambitious milestone.

Dogecoin’s Evolution Beyond a Meme

Originally launched as a parody, Dogecoin has outlasted many early cryptocurrencies. Over time, it has built deep liquidity, widespread brand recognition, and consistent retail participation. These factors have helped it remain relevant even during prolonged market downturns, positioning it as a recurring beneficiary during broader crypto upcycles.

What a Rs. 1 Price Really Implies

A move to Rs. 1 would represent a dramatic revaluation for Dogecoin. Such a level would require a substantial expansion in market capitalization, sustained capital inflows, and renewed speculative momentum. Unlike low-supply tokens, Dogecoin’s inflationary structure means price appreciation must be driven by continuous demand rather than scarcity alone.

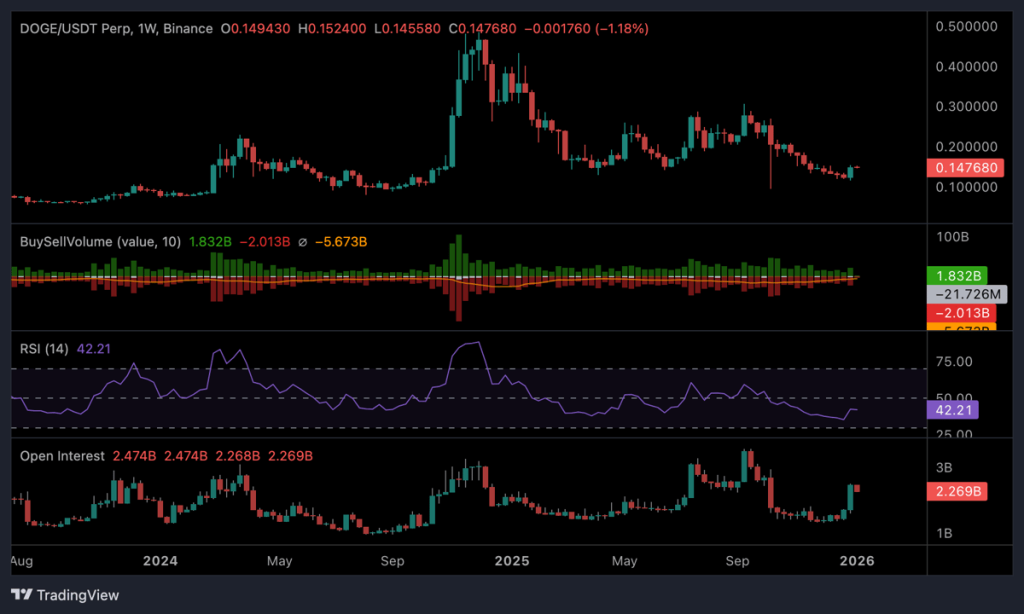

Market Cycles and Speculative Momentum

Historically, Dogecoin has performed best during periods of heightened retail enthusiasm, often coinciding with broader crypto bull markets. If digital assets enter a strong multi-year uptrend by 2026, Dogecoin could benefit disproportionately due to its accessibility and cultural resonance. That said, reliance on sentiment-driven rallies also makes it vulnerable to sharp reversals.

Adoption, Utility, and Narrative Risk

While Dogecoin has seen sporadic adoption for payments and tipping, its real-world utility remains limited compared with smart contract platforms. Without a stronger use-case narrative, its long-term valuation may continue to depend heavily on market psychology rather than fundamentals.

Analyst Perspectives Remain Divided

Optimists argue that a synchronized bull market, combined with social momentum, could push Dogecoin toward ambitious price targets. Skeptics counter that structural dilution and competition from utility-driven tokens make a sustained move to Rs. 1 difficult without extraordinary conditions.

Outlook for Investors

As 2026 approaches, Dogecoin’s Rs. 1 ambition remains speculative rather than inevitable. While not impossible, such a breakout would require exceptional market alignment, disciplined risk appetite, and renewed global enthusiasm for digital assets. For investors, Dogecoin remains a high-risk, sentiment-driven bet rather than a fundamentals-led conviction trade.