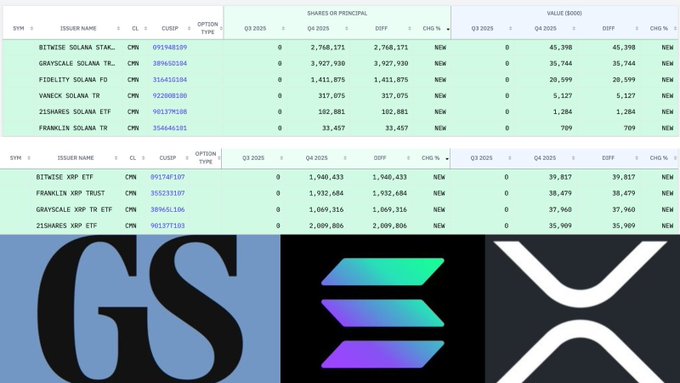

Goldman Sachs Expands Digital Asset Bet With Rs. 19,000 Crore Crypto Portfolio, Including Bitcoin and XRP

Goldman Sachs has disclosed a substantial cryptocurrency exposure valued at approximately Rs. 19,000 crore (about $2.3 billion), signaling a decisive shift in institutional engagement with digital assets. The portfolio reportedly includes significant allocations to Bitcoin and XRP, underscoring growing confidence in both established cryptocurrencies and alternative blockchain networks. The investment highlights the accelerating mainstream adoption of digital assets among global financial institutions. It also reflects broader strategic positioning as traditional banks respond to evolving regulatory frameworks, rising client demand and the increasing integration of blockchain technology into global finance.

Institutional Capital Deepens Its Crypto Commitment

Goldman Sachs’ reported $2.3 billion cryptocurrency exposure marks one of the most significant digital asset allocations among major Wall Street institutions to date. Converted at current exchange rates, the investment stands at roughly Rs. 19,000 crore, a figure that reinforces the scale of institutional capital now flowing into the sector.

The portfolio includes Bitcoin, widely regarded as digital gold, and XRP, a token associated with cross-border payment infrastructure. The inclusion of both assets suggests a dual strategy: capital appreciation through Bitcoin’s scarcity-driven model and participation in blockchain-based payment ecosystems through XRP.

For years, large financial institutions approached cryptocurrencies cautiously, citing volatility and regulatory uncertainty. This latest disclosure indicates that digital assets are increasingly viewed not as speculative outliers, but as components of diversified investment portfolios.

Strategic Rationale Behind the Allocation

From a financial strategy perspective, the move reflects multiple converging factors.

First, client demand for crypto exposure has grown steadily, particularly among high-net-worth individuals and institutional investors seeking portfolio diversification. Bitcoin’s historical performance during certain macroeconomic cycles has strengthened its appeal as a hedge against currency debasement and geopolitical risk.

Second, regulatory clarity in key jurisdictions has improved. As compliance frameworks mature, major banks are more comfortable allocating capital to digital assets while maintaining fiduciary responsibilities.

Third, blockchain technology is evolving beyond a retail-driven phenomenon. Institutional-grade custody solutions, derivatives markets and exchange-traded products have reduced operational risk and improved market infrastructure.

Goldman Sachs’ allocation may therefore represent not merely a trading position but a longer-term strategic foothold in the digital asset economy.

Bitcoin and XRP: Divergent Use Cases, Shared Momentum

Bitcoin remains the cornerstone of institutional crypto investment. Its finite supply and decentralized architecture have earned it comparisons to gold, particularly during periods of inflationary pressure.

XRP, by contrast, serves a different strategic function. It is designed to facilitate cross-border transactions with lower friction and faster settlement times than traditional banking rails. For institutions exploring the modernization of payment systems, XRP represents exposure to blockchain-based financial infrastructure rather than solely a store of value.

By combining these assets, Goldman Sachs appears to be balancing speculative upside with functional blockchain integration.

Broader Market Implications

The disclosure carries implications beyond a single balance sheet. When a globally influential investment bank publicly reveals a multibillion-dollar crypto position, it signals validation to the broader financial ecosystem.

Such moves often catalyze additional institutional participation, deepen liquidity and stabilize price discovery mechanisms. They also pressure competitors to clarify their own digital asset strategies.

Moreover, large-scale institutional involvement could contribute to reduced volatility over time, as professional capital typically operates with longer investment horizons compared to retail traders.

Risk Considerations and Regulatory Landscape

Despite growing acceptance, cryptocurrency markets remain susceptible to price swings, regulatory shifts and technological risks. Institutional players must manage counterparty exposure, cybersecurity safeguards and compliance obligations.

Regulators worldwide continue to refine frameworks governing digital asset custody, taxation and anti-money laundering protocols. Any significant regulatory change could materially impact valuations and institutional strategies.

However, Goldman Sachs’ willingness to commit approximately Rs. 19,000 crore suggests confidence that the risk-reward profile of digital assets has entered a more mature phase.

The Institutionalization of Crypto

What was once dismissed as a fringe asset class has steadily migrated into the core portfolios of global financial institutions. Goldman Sachs’ $2.3 billion crypto exposure underscores a structural transformation underway in global finance.

Digital assets are no longer confined to speculative trading desks. They are becoming integrated into mainstream capital markets, asset management strategies and payment infrastructure.

If current trends persist, the institutionalization of cryptocurrencies may mark one of the most consequential financial evolutions of the decade — not a passing experiment, but a recalibration of how value is stored, transferred and invested in the digital age.