Japan’s Bond Market Jolt Sends Ripples Through Global Crypto Sentiment

Japan’s long-dormant bond market is stirring, and the shift is unsettling Bitcoin traders worldwide. As government bond yields climb to levels not seen in years, investors are reassessing risk across asset classes. Higher yields in one of the world’s most influential capital markets challenge the assumptions that have long supported speculative assets, including cryptocurrencies. For Bitcoin, which has thrived in an era of ultra-loose monetary policy, the change raises concerns about capital flows, leverage, and global liquidity. The unease reflects a broader recalibration as markets confront the possibility of a less forgiving financial environment.

Japan’s Yield Awakening Breaks a Long Silence

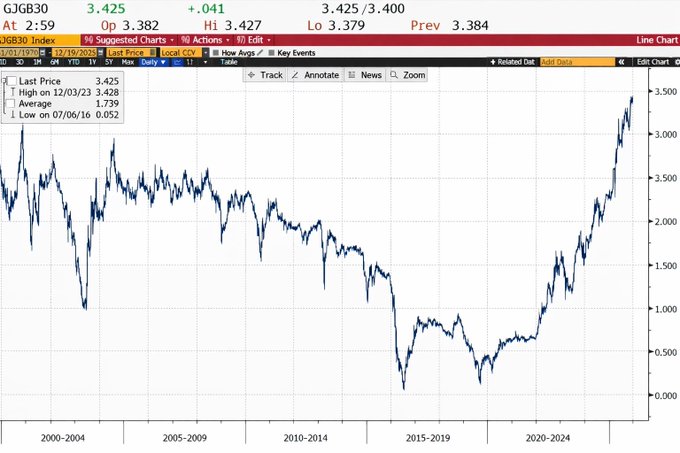

For decades, Japan stood apart as a symbol of low yields and aggressive monetary accommodation. That era is now showing visible cracks. Recent increases in Japanese government bond yields signal a potential shift in policy direction, driven by persistent inflationary pressures and mounting concerns over currency stability.

Although yields remain modest by global standards, even small upward moves in Japan carry outsized implications. The country’s bond market is among the largest in the world, and its pricing influences capital allocation far beyond its borders.

Why Bitcoin Traders Are Paying Attention

Bitcoin has historically benefited from excess liquidity and low interest rates, conditions that encourage risk-taking and speculative investment. Rising bond yields, however, offer investors a safer alternative with improving returns. As yields climb, the opportunity cost of holding non-yielding assets like Bitcoin increases.

For leveraged traders in particular, the shift is uncomfortable. Higher global yields can tighten financial conditions, reduce borrowing appetite, and trigger sharper price swings in volatile assets such as cryptocurrencies.

The Yen, Capital Flows, and Global Risk Appetite

Japan’s bond yields are closely tied to movements in the yen and cross-border capital flows. A sustained rise in yields could strengthen the currency, prompting Japanese investors to repatriate funds previously deployed in higher-risk or overseas assets.

Such a reversal would matter for crypto markets, which rely heavily on global liquidity. Any broad pullback from risk assets could amplify volatility and challenge bullish narratives built on abundant capital and monetary easing.

A Broader Signal, Not an Isolated Event

Market analysts caution that the concern is less about Japan alone and more about what it represents. If one of the last bastions of ultra-loose monetary policy begins to normalize, it may mark a turning point in the global financial cycle.

For Bitcoin traders, the message is clear: macroeconomic forces are reasserting themselves. Digital assets are no longer insulated from shifts in traditional markets, particularly when those shifts affect liquidity and investor psychology.