Power, Policy, and Pushback: Why Southeast Asia Is Reassessing Crypto Mining

Southeast Asia’s relationship with cryptocurrency mining is entering a more cautious phase as governments weigh economic benefits against rising energy costs, environmental strain, and regulatory risk. Once seen as an attractive destination due to low electricity prices and favorable climates, several countries in the region are now tightening oversight of mining operations. Concerns range from pressure on national power grids to allegations of illegal electricity use and limited local value creation. As crypto mining scales up, policymakers are signaling a shift toward stricter controls, reflecting a broader regional effort to balance innovation with sustainability and economic discipline.

From Mining Haven to Regulatory Headache

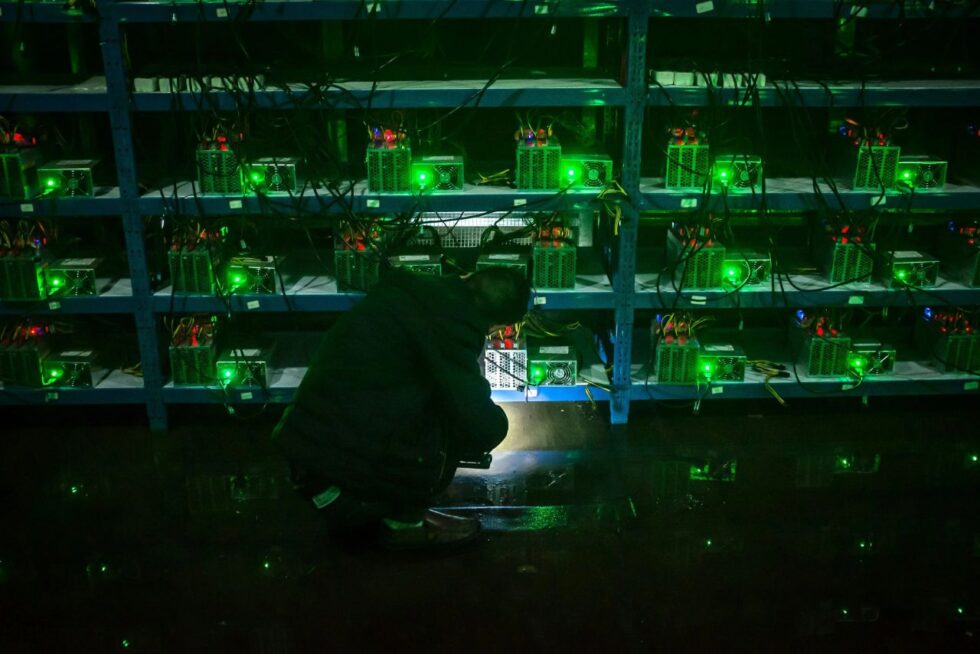

For years, parts of Southeast Asia emerged as magnets for crypto miners seeking lower operating costs after crackdowns elsewhere. Abundant energy resources, relatively relaxed regulations, and growing digital infrastructure made the region appealing. However, rapid expansion has exposed structural weaknesses, particularly in electricity distribution and regulatory enforcement.

Authorities are increasingly questioning whether the economic gains justify the long-term costs, especially when mining operations contribute little beyond short-term employment and rental income.

Energy Stress and Infrastructure Concerns

One of the central issues driving policy reassessment is energy consumption. Large-scale crypto mining requires continuous, high-intensity power usage, often rivaling that of industrial facilities. In several countries, this demand has strained aging power grids, raising fears of blackouts and higher electricity tariffs for households and small businesses.

Illegal connections and power theft linked to unauthorized mining facilities have further aggravated the situation, prompting utilities and regulators to step up inspections and penalties.

Environmental and Social Pressures Mount

Environmental considerations are also gaining prominence. As governments commit to emissions targets and renewable energy transitions, energy-intensive crypto mining sits uneasily with national climate goals. Public criticism has intensified in areas where mining clusters coexist with communities facing rising electricity costs or unreliable supply.

This social pushback is reshaping political narratives, forcing leaders to address public concerns rather than framing crypto mining solely as a technology-driven opportunity.

Regulatory Tightening Across the Region

In response, several Southeast Asian governments are moving toward clearer, stricter frameworks. Measures under consideration or implementation include licensing requirements, higher electricity tariffs for miners, limits on foreign-owned operations, and closer monitoring of energy usage.

Rather than outright bans, most policymakers appear focused on control and accountability—ensuring mining activity aligns with national priorities and does not undermine financial or energy stability.

A Maturing Approach to Digital Assets

The growing wariness toward crypto mining reflects a broader maturation of digital asset policy in Southeast Asia. Governments are no longer viewing the sector through a purely growth-oriented lens. Instead, they are integrating considerations of sustainability, infrastructure resilience, and economic value creation.

For miners, the message is clear: the era of regulatory ambiguity is closing. For the region, the challenge lies in fostering innovation without allowing speculative industries to overwhelm critical resources.