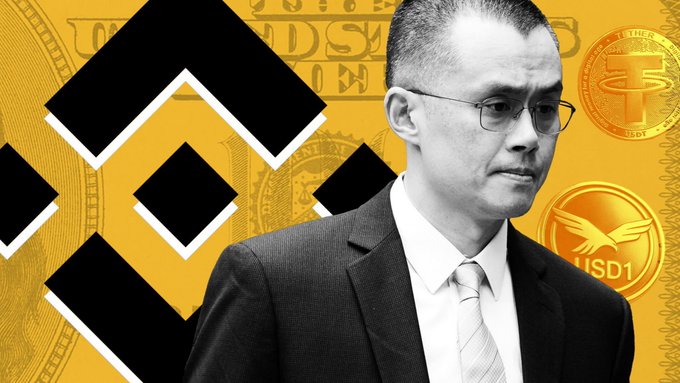

Scrutiny Returns to Binance as Reports Allege Terror-Linked Fund Flows Despite Costly Settlements

Fresh allegations have reignited global scrutiny of Binance, the world’s largest cryptocurrency exchange, with reports claiming that as much as Rs.14 trillion ($1.7 billion) moved through accounts allegedly linked to terrorist financing networks—even after the company had paid billions of dollars in regulatory settlements. The claims raise serious questions about the effectiveness of compliance reforms, the challenges of policing cross-border digital finance, and the broader risks embedded in the crypto ecosystem. As regulators intensify oversight, the episode underscores a central dilemma: whether enforcement actions are truly reshaping behavior or merely becoming a cost of doing business for global crypto giants.

Renewed Allegations Cast a Long Shadow

Binance has once again found itself at the center of controversy following reports that significant sums flowed through accounts allegedly connected to terror-linked entities. The reported amount—approximately Rs.14 trillion—has drawn particular attention because it allegedly moved through the exchange even after Binance had already agreed to multibillion-dollar settlements with authorities over past compliance failures.

While the company has repeatedly stated that it has strengthened its internal controls, the allegations suggest lingering vulnerabilities in monitoring illicit financial activity within high-volume crypto platforms.

Compliance Reforms Under Question

In recent years, Binance has publicly committed to overhauling its compliance framework, investing heavily in know-your-customer (KYC) protocols, transaction monitoring systems, and cooperation with law enforcement agencies. These efforts followed intense regulatory pressure and costly penalties aimed at correcting historical lapses.

However, the latest claims raise doubts about whether these measures are sufficient in practice. Critics argue that the sheer scale and speed of crypto transactions continue to outpace enforcement tools, allowing bad actors to exploit gaps even within reformed systems.

The Challenge of Policing Global Crypto Flows

Unlike traditional banking, cryptocurrency operates across borders with limited central oversight, complicating efforts to track and freeze suspicious funds. Terror financing networks, like other illicit actors, are often adept at exploiting jurisdictional differences and technological complexity.

For exchanges operating at Binance’s scale, the challenge is magnified. Processing billions of transactions daily increases exposure to risk, making absolute prevention of illicit flows difficult. Regulators, however, maintain that systemic weaknesses cannot be excused by scale alone.

Regulatory and Market Implications

The renewed scrutiny could have far-reaching consequences, not only for Binance but for the broader crypto industry. Regulators may respond with stricter licensing requirements, heavier reporting obligations, and more aggressive enforcement actions. For investors and institutional partners, repeated allegations—regardless of legal outcomes—can erode trust and raise concerns about governance standards.

At a market level, such developments reinforce the argument that crypto platforms are moving closer to the regulatory expectations long applied to traditional financial institutions.

A Test of Credibility for the Crypto Sector

Ultimately, the controversy highlights a defining moment for the digital asset industry. If major exchanges are seen as unable to fully prevent misuse despite hefty penalties and public commitments, regulators may conclude that stronger external controls are necessary.

For Binance, the path forward hinges on transparency and demonstrable results. For the crypto sector as a whole, the episode serves as a reminder that legitimacy in global finance depends not on innovation alone, but on credibility, accountability, and trust.