Why China’s Bitcoin Mining Crackdown Failed to Halt Crypto Production

China’s efforts to suppress Bitcoin mining, once the global epicenter of cryptocurrency production, have largely failed to eliminate activity, highlighting structural and economic realities of the industry. Despite regulatory bans and enforced shutdowns, miners have relocated to other jurisdictions, while underground operations persist domestically. Factors such as decentralized mining infrastructure, profitable energy arbitrage, and international demand for Bitcoin have limited the effectiveness of the crackdown. The episode illustrates the challenges of enforcing restrictive policies on decentralized technologies and underscores the resilience and adaptability of the crypto mining sector amid regulatory pressure, offering critical lessons for policymakers and investors alike.

Historical Context of the Crackdown

China dominated global Bitcoin mining for years, controlling over 60% of network hash rate at its peak. In 2021, authorities imposed strict bans, citing environmental concerns, financial risk, and capital outflow. These measures included power restrictions, facility closures, and penalties for operators. The goal was to curtail Bitcoin production and protect domestic financial stability.

However, the dispersed and digital nature of mining, combined with global connectivity, made enforcement inherently difficult. Miners could switch locations or adapt operations rapidly, challenging traditional regulatory approaches.

Relocation and Global Redistribution

A significant consequence of the crackdown was the international migration of mining operations. Countries with lower energy costs, stable regulations, and supportive infrastructure, such as the United States, Kazakhstan, and Russia, became attractive destinations. This redistribution reshaped the global hash rate, reducing China’s dominance but not eliminating Bitcoin production.

The global network benefited from this migration, as decentralization increased resilience and security while demonstrating the industry’s ability to respond dynamically to geopolitical pressures.

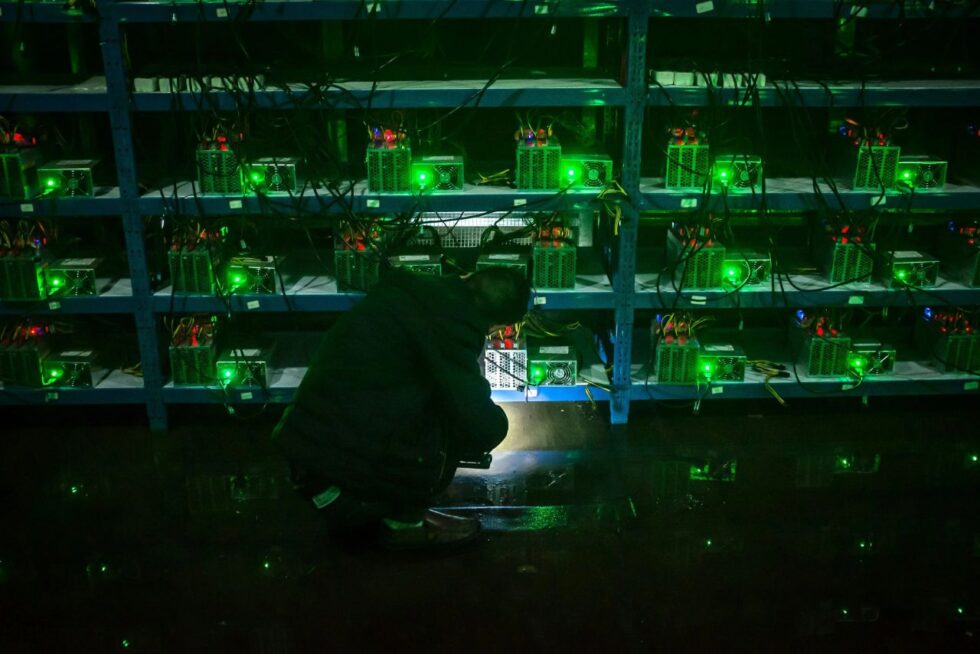

Underground Mining and Domestic Adaptation

Despite official bans, reports indicate that clandestine mining continues in parts of China, often leveraging off-grid energy sources or operating under limited visibility. Some operators utilize renewable energy or small-scale facilities to minimize detection while continuing profitability.

These adaptive strategies reflect miners’ incentive-driven approach: Bitcoin mining remains lucrative as long as electricity costs are manageable and market prices justify operational expenditure.

Economic and Structural Drivers

Several economic factors underlie the crackdown’s limited success. Bitcoin mining is inherently location-agnostic but highly sensitive to energy costs. High domestic energy availability, combined with global Bitcoin demand, makes continued operations—either relocated or clandestine—financially attractive.

The decentralized and borderless characteristics of blockchain networks further diminish the efficacy of state-level prohibitions, demonstrating a structural tension between centralized regulation and distributed technology.

Implications for Policy and Industry

China’s experience highlights the limitations of national interventions in decentralized ecosystems. While domestic bans reduced environmental strain locally and encouraged global redistribution, they did not halt production or diminish Bitcoin’s broader adoption.

For investors and policymakers, the key takeaway is that decentralized networks exhibit significant adaptability, requiring nuanced regulatory frameworks that balance oversight, innovation, and economic realities.

Outlook

The failed crackdown underscores the resilience of the crypto mining industry and its capacity to operate across borders. Moving forward, regulators may need to focus on cooperative international standards, energy efficiency incentives, and market transparency rather than solely pursuing prohibitive measures. For the global crypto ecosystem, the episode reinforces Bitcoin’s decentralized, adaptive, and robust nature in the face of concentrated regulatory pressure.