XRP Holdings on Exchanges Decline Amid Market Shifts

XRP, the prominent cryptocurrency associated with Ripple, has seen a notable decline in its supply on major exchanges, reflecting a shift in investor behavior and market dynamics. Analysts suggest that reduced exchange holdings may indicate increasing long-term confidence among holders or a strategic move toward decentralized storage. The trend also highlights evolving liquidity patterns in the crypto market, influencing trading volumes and price stability. Market observers are closely monitoring whether this contraction in exchange-based XRP supply will spur demand pressures or create price volatility, signaling broader implications for investor sentiment and Ripple’s market positioning in the coming months.

Exchange Holdings Fall: A Market Trend

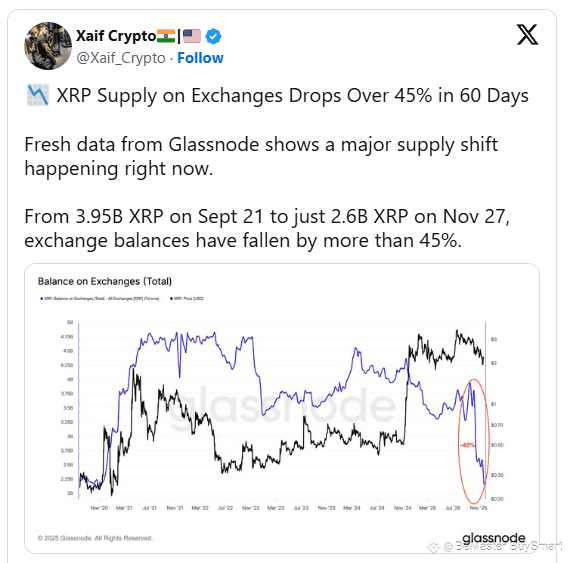

Recent data indicates a steady decline in XRP balances held on centralized cryptocurrency exchanges. This decrease suggests that investors are increasingly withdrawing assets from trading platforms, possibly to secure them in private wallets or cold storage. Reduced exchange supply often points to long-term holding strategies, signaling confidence in XRP’s future prospects, rather than short-term speculative trading. Analysts note that this pattern has parallels with other major cryptocurrencies, where shrinking exchange balances have preceded significant price movements.

Implications for Liquidity and Trading

A lower concentration of XRP on exchanges may influence liquidity, affecting daily trading volumes and potentially leading to greater price sensitivity. Traders might experience sharper price swings during periods of heightened market activity due to the limited sell-side availability. Conversely, investors holding XRP off-exchange may benefit from reduced exposure to platform risks, such as exchange outages or security breaches.

Investor Behavior and Market Sentiment

The decline in exchange-based XRP holdings could reflect growing confidence among long-term investors, who are opting to retain their assets privately rather than engage in frequent trading. Market analysts suggest that this behavior often corresponds with a bullish outlook, as stakeholders anticipate appreciation in value over time. This trend can also be indicative of broader adoption and trust in Ripple’s network infrastructure and regulatory positioning.

Outlook for XRP

While exchange balances are shrinking, XRP’s overall market capitalization and trading interest remain significant. Investors and analysts alike are observing whether the reduced supply on exchanges will generate upward price momentum or create volatility due to limited liquidity. As cryptocurrency markets mature, such shifts in asset allocation underscore the evolving strategies of both retail and institutional participants.