XRP Shows Strongest Market Signals Since 2022, On-Chain Indicators Suggest

XRP has reached its most favorable technical and on-chain position since 2022, according to recent market indicators tracking price structure, liquidity flows, and investor behavior. The improvement reflects a combination of renewed trading interest, tighter supply dynamics, and growing confidence among long-term holders. While broader digital asset markets remain sensitive to macroeconomic cues, XRP’s underlying metrics point to strengthening fundamentals rather than short-lived speculation. Analysts note that such conditions often emerge during early phases of trend recovery, positioning the asset for sustained momentum if supportive market conditions continue.

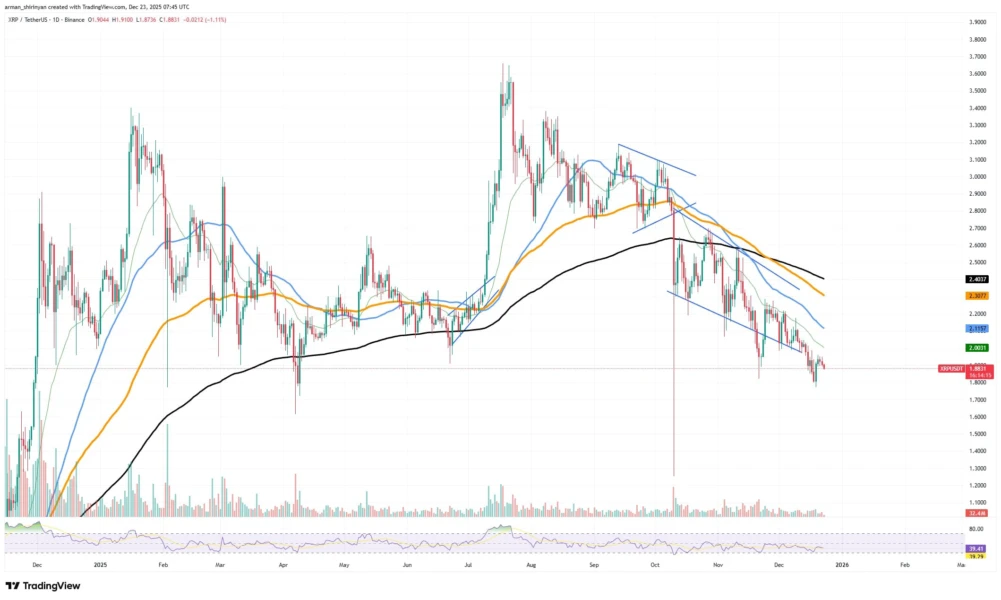

Indicator Signals a Structural Shift

Recent analytical indicators suggest that XRP is exhibiting its strongest market structure in nearly three years. These signals are based on a convergence of factors, including improved price stability, rising transaction efficiency, and reduced selling pressure from long-term holders. Together, they indicate a potential shift from consolidation toward accumulation.

On-Chain Activity and Liquidity Trends

On-chain data shows a gradual increase in active addresses and consistent transaction throughput, pointing to renewed network engagement. Liquidity conditions have also improved, with deeper order books and lower volatility compared with prior cycles. This combination typically reflects healthier market participation rather than short-term speculative spikes.

Investor Positioning and Sentiment

Wallet-level analysis indicates that a larger share of XRP supply is now held by participants with longer investment horizons. Such behavior often coincides with growing confidence in an asset’s medium- to long-term prospects. At the same time, short-term trading activity has become more balanced, reducing the likelihood of abrupt price dislocations.

Broader Market Context

XRP’s improving indicators come amid a broader reassessment of digital assets, as investors place greater emphasis on fundamentals, regulatory clarity, and real-world utility. In this environment, assets demonstrating network stability and consistent usage tend to attract incremental capital.

Implications for Market Participants

For traders and investors, the current signals suggest a more constructive risk-reward profile than in previous periods of uncertainty. While price movements remain subject to broader market sentiment, the underlying metrics provide a stronger foundation than seen since 2022.

Outlook Ahead

If current trends in on-chain activity and investor behavior persist, XRP could maintain its relative strength in the months ahead. Sustained momentum, however, will depend on broader market stability and continued confidence in the asset’s long-term utility and ecosystem development.