Bitcoin Whale Activity Sparks Concern as BTC Stalls at Rs. 116,000

Bitcoin’s trajectory has hit a period of stagnation, with prices hovering around Rs. 116,000 as large-scale holders—commonly referred to as whales—resume heavy selling. This renewed distribution of coins by influential investors has triggered unease across the crypto market, which has otherwise been anticipating a breakout after weeks of volatility. While retail demand and institutional interest remain intact, whale-driven sell pressure has disrupted momentum, leaving Bitcoin in a fragile position. Analysts are closely monitoring the situation, as whale behavior often signals critical shifts in market cycles and influences both short-term sentiment and long-term pricing trends.

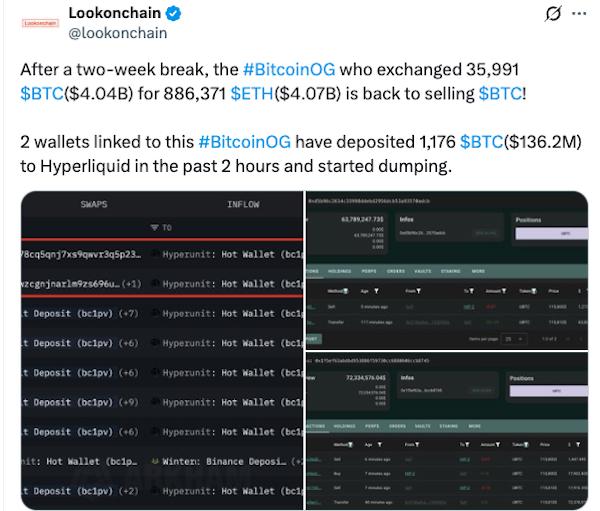

Whale Activity Resurfaces

Whales, defined as entities holding significant volumes of Bitcoin, have historically wielded outsized influence on market dynamics. Recent on-chain data suggests that a new wave of liquidations from these major holders has coincided with Bitcoin’s inability to gain upward traction.

The timing of these sales raises questions regarding investor confidence, as many traders expected stronger price appreciation after a relatively stable phase earlier this month. Instead, whale activity appears to be absorbing potential upward momentum, creating a supply overhang that prevents Bitcoin from breaking higher.

Bitcoin Flatlines at Rs. 116,000

Despite broader optimism surrounding digital assets, Bitcoin has remained range-bound near Rs. 116,000. Technical indicators reveal a lack of decisive direction, with support levels holding but no significant push toward higher resistance zones.

This stagnation underscores the delicate balance between inflows from new investors and consistent selling from whales. Market watchers believe that until this imbalance resolves, Bitcoin may struggle to achieve sustainable growth in the near term.

Implications for the Market

The implications of whale-driven distribution extend beyond short-term price action. Large-scale selling often signals a recalibration of market expectations, potentially reflecting profit-taking strategies or preparation for macroeconomic headwinds.

However, history shows that such phases can also create opportunities for smaller investors. As whales reduce holdings, the resulting redistribution can enhance long-term market resilience by spreading ownership across a broader participant base.

Looking Ahead

While Bitcoin’s flatlining price and whale activity have raised caution, the broader outlook for cryptocurrencies remains shaped by regulatory developments, institutional adoption, and macroeconomic trends. If market fundamentals strengthen and whale-driven supply eases, Bitcoin could regain its upward momentum.

For now, the market remains in a holding pattern, with traders eyeing whale wallets for signs of either continued selling or stabilization. A shift in whale behavior may well determine whether Bitcoin breaks out of its Rs. 116,000 range or remains locked in a cycle of uncertainty.

Would you like me to add expert-style commentary on potential macroeconomic triggers—such as interest rate policies, ETF inflows, or liquidity conditions—that could amplify or counteract whale influence on Bitcoin prices?